U.S. Ethanol Exports Remain Strong as Markets Diversify in 2015

Contact:

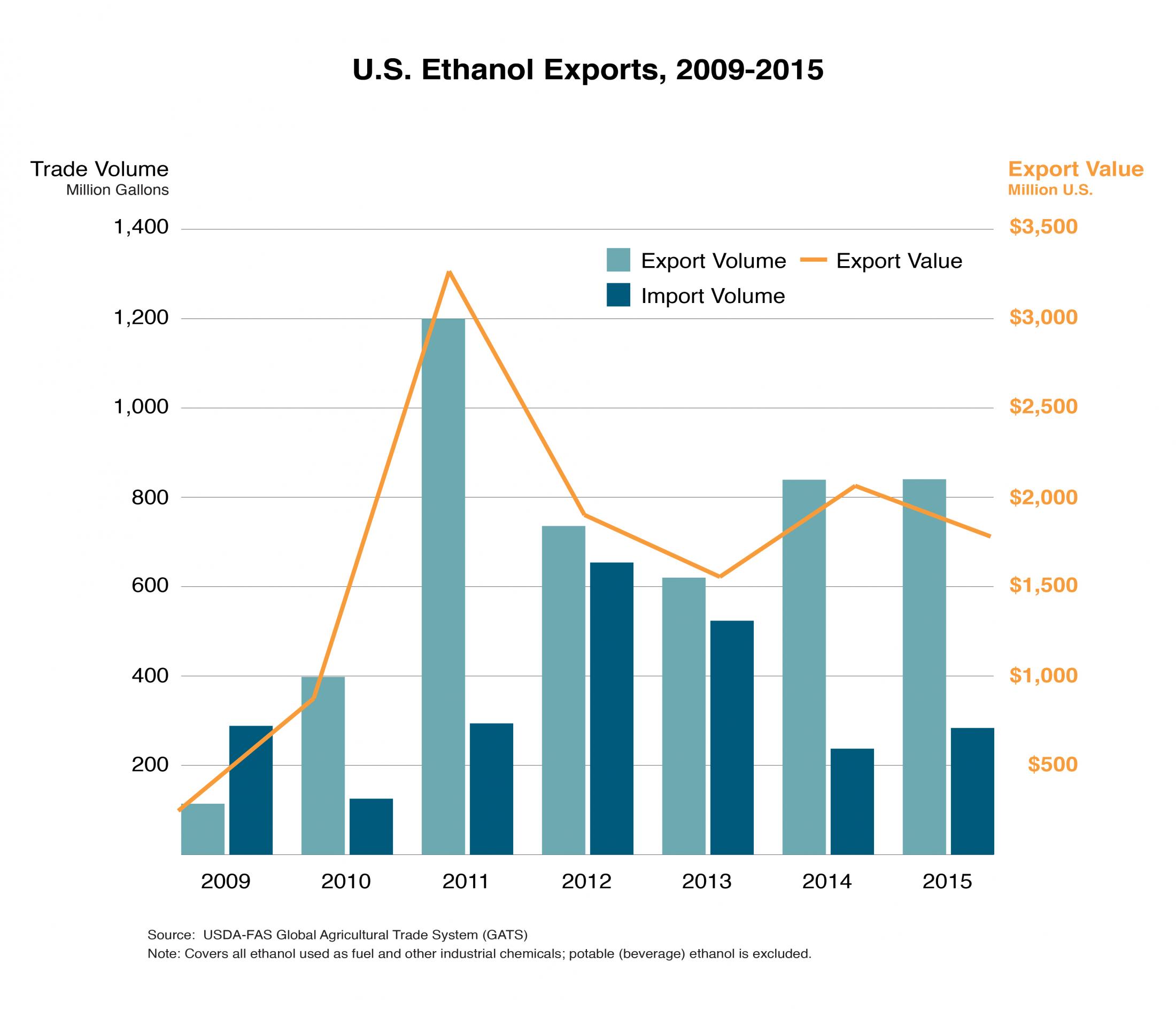

The United States exported 836 million gallons of non-beverage ethanol in 2015, nearly all of which was used for fuel. This volume was unchanged from the previous year and remained the second highest volume on record. Despite a two-year decline in U.S. ethanol exports following the record 1.2 billion gallons in 2011, overall exports have trended upward since 2009.

The value of U.S. ethanol exports was $1.8 billion in 2015, down 14 percent from $2 billion in 2014, due to lower prices. Over the past two years, lower ethanol prices and more diverse export destinations helped sustain higher export volumes despite collapsing oil prices and a stronger U.S. dollar. The advantage of increased market diversity was demonstrated in 2015 when record sales to China, Korea and India more than offset a sales downturn to Canada, the United States’ top market.

The U.S. share of global non-beverage ethanol exports remained at 50 percent in 2015. The United States’ export reliance (the percent of production exported) and the portion of the U.S. corn crop supporting ethanol exports both remained largely unchanged over the past two years.

Record Surge in 2011

U.S. ethanol exports have trended upward since 2009, with the notable spike in 2011, when sales jumped to a record 1.2 billion gallons. This record was the result of three events that caused U.S. exports to surge above trend, adding as much as 720 million gallons to export sales.

First, Brazil’s drought in 2010/11 resulted in a poor sugarcane crop and a swing toward more cane crushed for sugar in response to higher sugar prices. This supply shock reduced Brazil’s domestic and exportable supplies of ethanol. The result was a 360-million-gallon increase in U.S. ethanol exports to Brazil and other foreign markets to replace Brazilian shipments.

The second event in 2011 was Canada’s demand for fuel ethanol, driven by provincial mandates and growing gasoline use, which exceeded its production capacity for the first time. This led to a 54-percent increase in U.S. ethanol exports to Canada, primarily to supply Canada’s demand for fuel ethanol not met by domestic supplies.

Third, the European Union (EU) began importing lower priced U.S. ethanol and blending it into E90 (a 90-percent blend of ethanol in gasoline) to meet its own increasing domestic mandates and to substitute higher priced Brazilian supplies. The EU imported 296 million gallons of ethanol from the United States, a 54-percent increase from 2010.

Following the 2011 record export year, U.S. sales to Brazil immediately returned to trend in 2012 as the Brazilian sugarcane industry recovered from drought. At the same time, and extending through 2013, U.S. exports to the EU collapsed from a record 296 million gallons in 2011 to a mere 27 million gallons. This was largely the result of higher import tariffs following the EU’s reclassification of E90 in 2012, and the application of anti-dumping duties on U.S. ethanol in 2013. Helping mitigate an even larger collapse in U.S. ethanol exports from 2011 to 2013, U.S. sales rose to other markets, most notably to the Philippines, Peru and India.

Falling Oil Prices, Stronger Dollar Pose Challenges

Despite falling oil prices and a stronger dollar, U.S. ethanol export volumes remained at the second-highest level on record in 2014 and 2015 and one-third above 2013 shipments. Since 2013 a decline in U.S. ethanol prices helped maintain volume sales. But U.S. exporters also benefited from a more diverse export portfolio with sales gains to previously less-important markets and a surge in import demand from China.

Since 2013, more than 96 percent of U.S. ethanol exports have been for fuel use, with the favorable price spread between U.S. fuel ethanol and wholesale gasoline prices in overseas markets having an impact on foreign demand for U.S. ethanol. The Brent price for crude oil fell from $100-125 a barrel in 2011-2013 to less than $40 a barrel by late 2015. U.S. ethanol prices also fell due to declining feedstock prices, but not nearly as much as oil prices. Varying country tax policies for gasoline and fuel ethanol make complete price comparisons difficult, but the blending economics in many markets have turned against ethanol suppliers because of diminishing demand for discretionary blending (blending that is driven by economics above mandated levels).

Exchange rates also worked against U.S. ethanol exporters over the past two years, but the only significant foreign market that suffered an overall decline in U.S. shipments was Canada. Exports to Canada, the United States’ largest market, rose slightly in 2014, as discretionary sales above minimum mandate use continued despite an eight-percent increase in the U.S. dollar. Then, in 2015, U.S. exports to Canada fell 25 percent with a further 20-percent appreciation in the U.S. dollar.

By contrast, U.S. ethanol exports rose to most other markets during the past two years, while the U.S. dollar appreciated 7-13 percent against those currencies. Lower product prices helped offset this adverse exchange rate adjustment. During the 2014-15 timeframe, the average export unit value of U.S. ethanol fell 15 percent to $2.13 per gallon.

Market Diversification Kept Sales Strong in 2014-2015

The market for U.S. ethanol exports has become more diversified over the past two years. Following the decline of sales to Brazil and the EU, the portion of total exports shipped to the top five markets fell from 79 percent in 2013 to 68 percent in 2015. Canada, Brazil and the Philippines remained top destinations from 2013 to 2015, but smaller markets, especially South Korea and India, became more important. In addition, the United States exported significant quantities of ethanol to China for the first time in 2015, making it the fourth-largest market for the year.

| U.S. Ethanol Export Destinations | ||

| | 2013 | 2015 |

| Canada | 52% | 30% |

| Brazil | 7% | 14% |

| Philippines | 9% | 9% |

| China* | - | 8% |

| South Korea | - | 7% |

| India | - | 6% |

| Mexico | 5% | 4% |

| Oman | - | 4% |

| Peru | 5% | 3% |

| UAE | 6% | - |

| Rest of World | 16% | 15% |

| | | |

| Total Gallons | 617 million | 836 million |

| Source: FAS Global Agricultural Trade System (GATS) *First-ever U.S. ethanol exports to China in 2015 | ||