Opportunities for U.S. Agricultural Products in Vietnam and Thailand

Contact:

Link to report:

Executive Summary

Vietnam offers abundant opportunities for exporting consumer-oriented products, despite the challenges of recovering from the COVID-19 pandemic and dealing with high inflation. The Vietnamese economy is poised for significant expansion in the coming decades. With a burgeoning population and a growing middle class, Vietnamese consumers are becoming more discerning about the origin and composition of their food. As suppliers of safe and high-quality agricultural products, U.S. agricultural exporters are in a good position to bolster sales in the Vietnamese market. Vietnam also has growing sectors able to absorb high-value U.S. products such as retail, tourism, and food processing, and consumers are increasingly focused on health and wellness. For similar reasons, notably a growing middle class and strong domestic industries, there are also opportunities in Thailand for consumer-oriented agricultural products from the United States.

Macroeconomic Perspective of Vietnam

Vietnam, a country of 105 million people, is among the fastest growing economies in the world. In 2024, the real gross domestic product (GDP) growth of Vietnam is expected to stabilize - at 6.0 percent after reaching 8.1 percent in 2022.1 This growth is supported by the vast expansion in the services and industrial sectors and the continued recovery of tourism following the COVID-19 pandemic. The GDP per capita in 2023 was $4,284, an increase of $160 from 2022. According to the World Bank, interest rates in Vietnam remain steady due to domestic monetary policy actions. Vietnam is strategically located in Southeast Asia maintaining influentially positive regional ties. Overall, Vietnam is a dynamic market with a rapidly growing middle class and young population influenced by global consumer patterns, rising per capita income, and an expanding economy in key sectors such as retail, tourism, and food processing.

Vietnam Agricultural Trade Overview

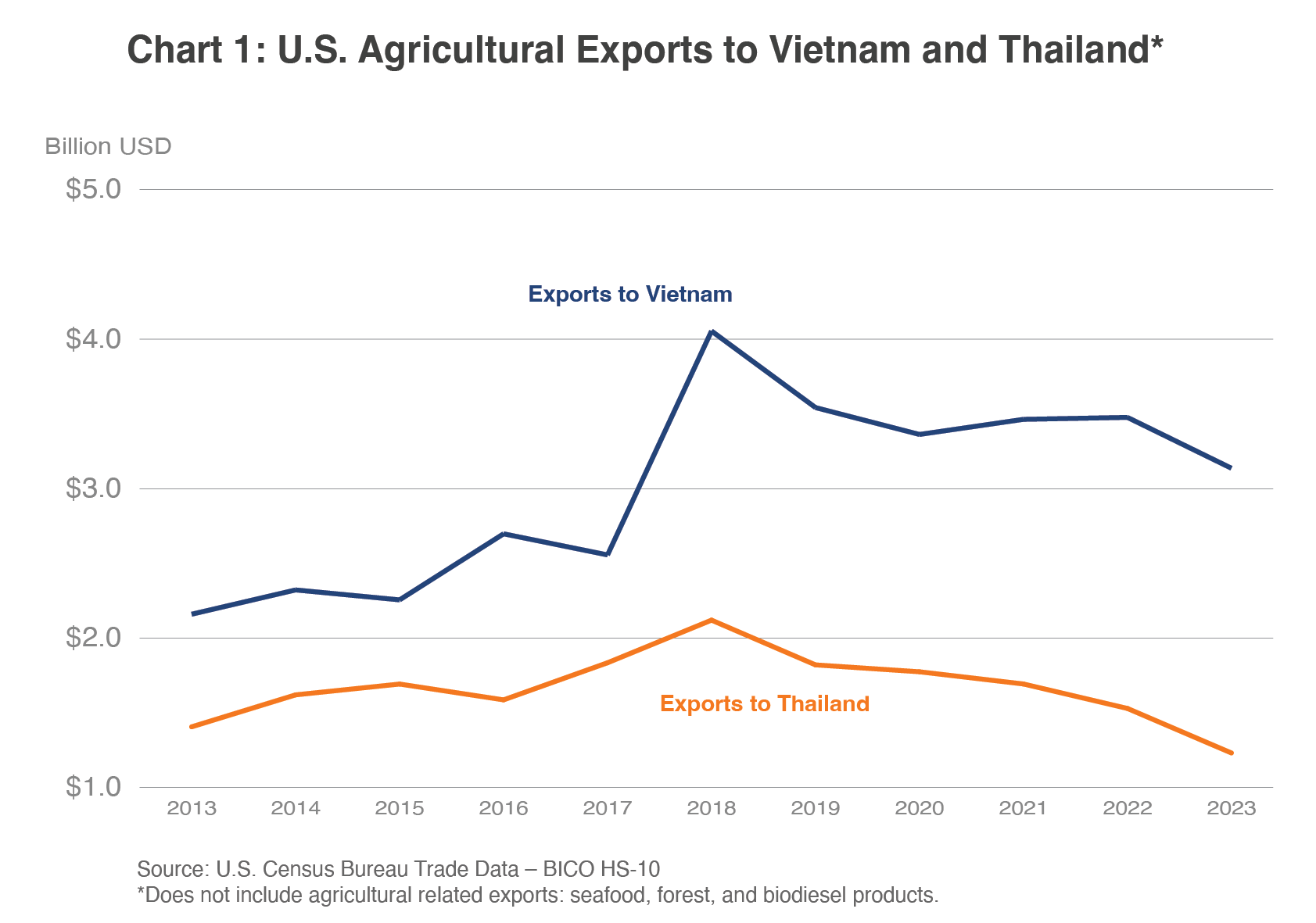

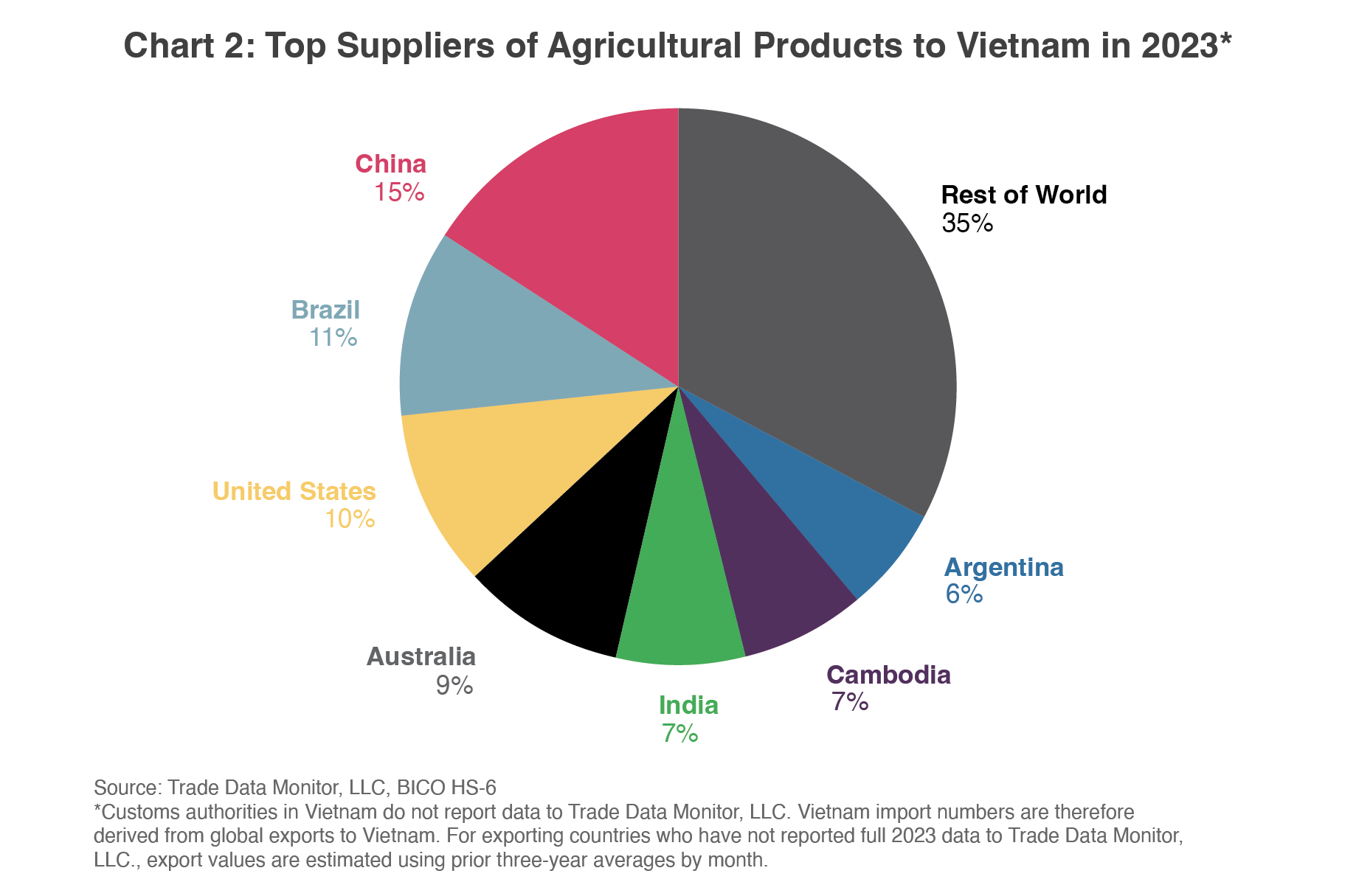

In 2023, Vietnam imported $32 billion of agricultural products from the world. Imports have increased over the past three years as Vietnam recovered from COVID-19 related trade and travel disruptions. In 2023, the top suppliers of agricultural products to Vietnam were China, Brazil, and the United States, followed by Australia, India, and Cambodia. Over the last thirty years, Vietnam has ratified several regional and bilateral Free Trade Agreements (FTAs) with major trading partners. Where trading partners do not have an FTA in place, Most Favored Nation tariff levels apply.

Opportunities for U.S. Exports to Vietnam

Robust opportunities exist for U.S. agricultural products thanks to projected overall market growth and strong preference for high-quality, safe U.S. goods. The United States exported $3.1 billion in agricultural products to Vietnam in 2023, the third largest agricultural product exporter to Vietnam behind China and Brazil. Top exports were in bulk commodities related to feed and manufacturing. While these products make up a large portion of the U.S. market share, many consumer-oriented goods are also among top products exported and represent exciting growth opportunities. Despite a rapidly growing middle class and preference for U.S. high-quality products, Vietnam is a price sensitive market.

Table 1: Top U.S. Agricultural Product Exports to Vietnam; Million USD

| Product | 2019 | 2020 | 2021 | 2022 | 2023 |

| Cotton | 1428 | 1162 | 1028 | 1069 | 750 |

| Soybeans | 273 | 425 | 393 | 390 | 378 |

| Distillers Grains | 257 | 284 | 371 | 387 | 342 |

| Soybean Meal | 184 | 70 | 174 | 164 | 244 |

| Tree Nuts | 121 | 140 | 167 | 173 | 238 |

| Other Feeds, Meals & Fodders | 114 | 155 | 156 | 174 | 188 |

| Dairy Products | 170 | 185 | 276 | 224 | 146 |

| Wheat | 72 | 136 | 56 | 108 | 145 |

| Poultry Meat & Products* | 140 | 128 | 100 | 130 | 122 |

| Fresh Fruit | 139 | 135 | 100 | 121 | 105 |

| All Other Agricultural Products | 645 | 543 | 645 | 537 | 480 |

| Total Agricultural Exports | 3543 | 3363 | 3464 | 3477 | 3137 |

Note: Column totals may not add up exactly due to rounding.

* Excluding eggs

Source: U.S. Census Trade Data, BICO HS-10

Demand for high-value consumer-oriented products

Vietnamese consumers demand high-quality and safe products. U.S. exporters of consumer-oriented products are well poised to fill this demand as both the population and the middle class continue to grow. U.S. products are sold at various levels – retail, hotel, and food processing– all growing industries in Vietnam. In 2022, Vietnam’s retail sales increased by 13 percent, the hotel, restaurant, and institutional (HRI) market grew by 51 percent, and the food processing and manufacturing sector grew by 9 percent. According to Euromonitor International, Vietnam’s HRI sector is comprised of over 330,000 outlets in the following subsectors: restaurants, bakeries, cafés and bars, street stalls, hotels, and institutional catering services. Consumer-oriented U.S. products are also further used as ingredients in Vietnam’s food processing sector. Food processing ingredients include dairy products, other edible bovine products, processed fruits, tree nuts, peanuts, and potatoes.

Dairy Products

In 2023, U.S. exports of dairy products to Vietnam were $146 million. Non-fat dried milk powder and fresh cheese represent high value prospects for U.S. exporters. While cheese is typically not consumed as part of the traditional diet, food service establishments and the exposure of younger generations to global diets continue to drive the demand for both hard and soft cheeses. According to Euromonitor International, an increasing consumer focus on healthy living is also bolstering the demand for higher protein and calcium cheeses like packaged hard cheese but may present challenges for cheeses with higher sodium and saturated fat contents. Non-fat dried milk powder for use in nutritional drinks and reconstituted milk are also popular in Vietnam and offer a safe and shelf-stable alternative to fresh milk. Other dairy products with good export potential include lactose and whey, which currently constitute 17 percent and 10 percent of U.S. dairy exports to Vietnam respectively.

Fresh Fruits

Vietnam holds high market potential for increased exports of fresh fruits from the United States. Exports of U.S. fresh fruits in 2023 reached $105 million (a 13-percent decrease from 2022 due, in part, to domestic inflation) and consisted mainly of apples, cherries, and grapes. USDA worked with other USG agencies to gain market access for U.S. grapefruit in February 2023. In total, Vietnam has granted access for seven fresh fruits of U.S.-origin: apples, cherries, grapes, pears, blueberries, oranges, and grapefruit. Imported fruits will become increasingly popular as their affordability improves because of economic growth and as Vietnamese consumers adopt healthier diets.

Meat Products

As the economy and international tourism continue to rebound, consumption of imported meat is expected to grow in both value and volume in the coming years. According to Euromonitor International, the increased focus on health and fitness is also fueling a shift towards leaner proteins such as chicken, although demand for red meat remains strong. High-prospect meat products include frozen/chilled beef (boneless and bone-in), frozen chicken (leg quarters, legs, and paws), and turkey. Price competitive imported frozen products do well over local chilled options.

Processed Products

In 2023, Vietnam was the United States’ 11th largest market for processed agricultural products. Fifteen years ago, it was the 24th largest market. Products with high growth over the period include processed egg products, chocolate and confectionary, non-alcoholic beverages, pet food, condiments and sauces, processed vegetables, and snack foods. According to the FAS Exporter Guide for Vietnam (VM2023-0074), the COVID-19 pandemic resulted in many shifts in the shopping habits of Vietnamese consumers. One such shift is the increased purchase of shelf-stable foods using online shopping and door-to-door delivery services, with e-commerce sales increasing 26 percent in 2022.

Condiments and sauces: According to Euromonitor International, pickled, and low-salt products have high potential in the Vietnamese market. Overall, the country is becoming more health conscious, and the government is trying to reduce the incidence of noncommunicable disease. These goals have shifted demand to lower sodium condiments and sauces, as well as plant-based products, dairy-free products, sugar-free products, and products with fewer ingredients.

Dried dog and cat food: Pet food, in particular dog and cat food, presents growth opportunities in Vietnam as interest in dogs and cats as pets is increasing along with the rise of disposable incomes. In 2023, retail sales of dog and cat food both grew by over 15 percent and over the last five years, the dog and cat populations have grown by 30 and 20 percent respectively. Purchasers of pet food are less sensitive to price inflation, according to Euromonitor International. As pet populations have grown, a slow shift is beginning to take place away from non-prepared food (i.e., scraps) to prepared dog and cat food (i.e., wet food, dry food, treats). Currently, U.S. exporters are only eligible to export dried pet food to Vietnam. There are also opportunities for pet food ingredients and additives.

Processed fruits and vegetables: Dried and processed fruits are used domestically as ingredients and for snacking. Increasing demand for healthy foods will continue driving consumption as local production is unable to keep up with domestic demand. While Vietnam is a large producer of vegetables, food manufacturers in Vietnam use a mix of locally produced raw materials and imported food ingredients in their operations. The top selling U.S. products in this category are raisins and frozen potatoes.

Tree Nuts

Tree nuts are the fifth largest U.S. agricultural export to Vietnam. In 2023, U.S. tree nut exports reached $238 million, a 37-percent increase over 2022. Major U.S. exports include pistachios, almonds, walnuts, cashews, and pecans. Recovery of the manufacturing and tourism sectors has increased demand for U.S. tree nuts. While demand remains strong, when imported for local consumption, tree nuts are subject to import tariffs from 8 to 30 percent. However, most U.S. tree nuts imported into Vietnam are further processed and re-exported to third countries and are therefore exempted from import tariffs.

Opportunities for U.S. Consumer-Oriented Goods in Thailand

Many opportunities for U.S. consumer-oriented good exports also exist in Thailand, which boasts the fourth highest per capita income in the Association of Southeast Asian Nations after Singapore, Brunei, and Malaysia. With a population of 70 million and real GDP growth of 3.0 percent forecast in 2024 compared to 2.5 percent in 2022, private consumption is expected to grow with the expansion of the middle class. GDP growth is forecast to reach 3.5 percent by 2027.2 As much of the Thai economy relies on tourism, post-pandemic recovery is paramount for continued economic growth. After a period of high consumer price inflation in 2022, prices have stabilized while inflation is expected to remain below 2 percent in the near term. According to the World Bank, per capita GDP in 2022 was $6,910, $150 lower than in 2021. Strong fiscal and monetary policy in Thailand have resulted in growing investment in the country. As a result, the prospects for Thai economic growth are promising.

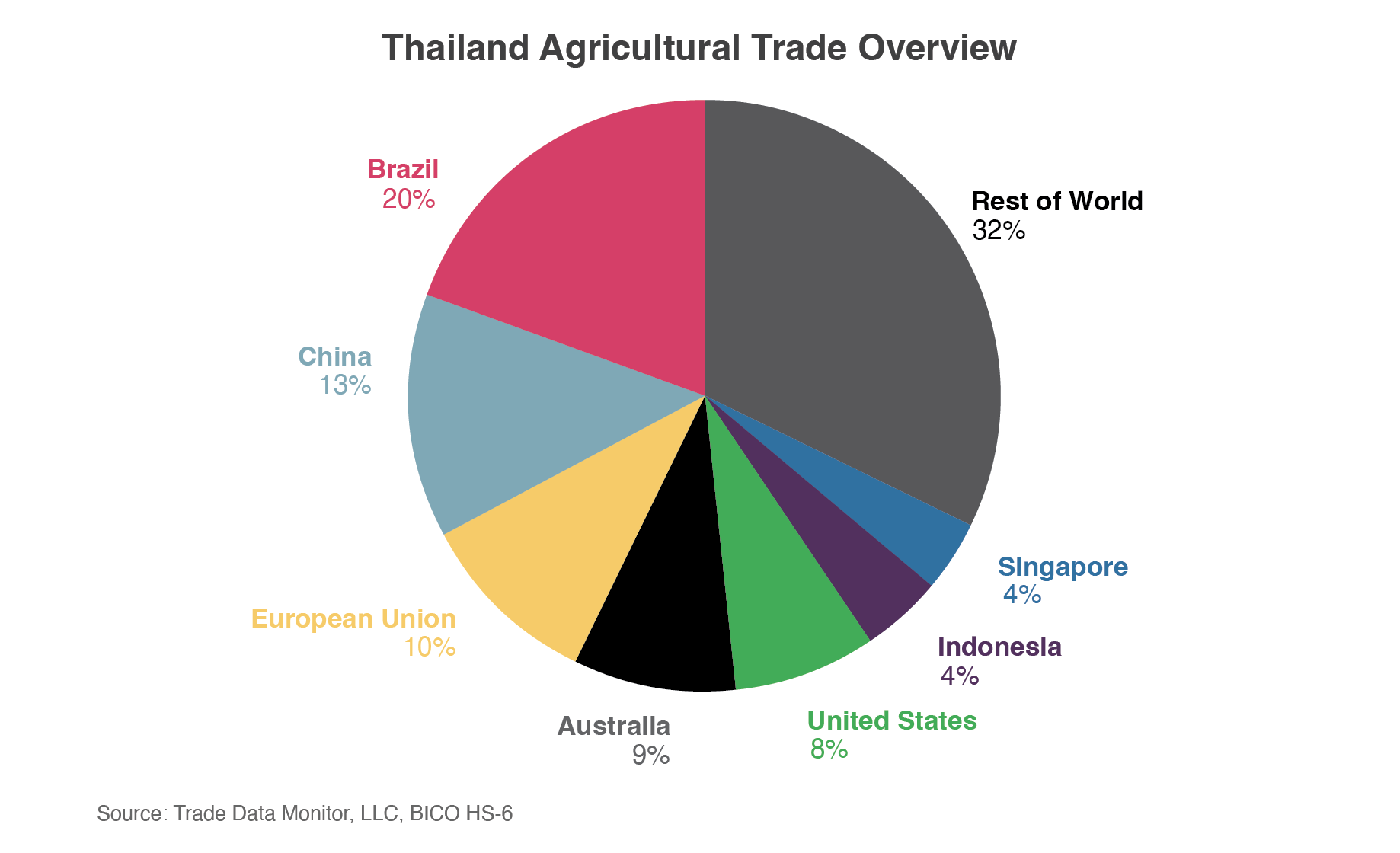

Thailand Agricultural Trade Overview

In 2023, Thailand imported $17 billion of agricultural products, the top suppliers of which were Brazil, China, and the European Union. The United States was the fifth largest supplier of agricultural products to Thailand with $1.2 billion in exports. Top U.S. agricultural exports to Thailand were in bulk commodities related to feed and manufacturing, but strong opportunities exist for U.S. consumer-oriented products as well. Like Vietnam, Thailand also has large retail, tourism, and food processing sectors that rely on U.S. agricultural products. According to the FAS Exporter Guide for Thailand (TH2022-0083), demand for high-convenience processed foods as well as ready-to-eat meals, healthy food products, and food delivery are rising among Thai consumers. Plant-based and free-from products are also growing in popularity. Over the last twenty years, Thailand has ratified several regional and bilateral FTAs with major trading partners. Where trading partners do not have an FTA in place, Most Favored Nation tariff levels apply.

Table 2: Top U.S. Consumer-Oriented Product Exports to Thailand; Million USD

| Product | 2019 | 2020 | 2021 | 2022 | 2023 |

| Dairy Products | 56 | 75 | 90 | 113 | 98 |

| Food Preparations | 130 | 123 | 130 | 121 | 79 |

| Tree Nuts | 42 | 37 | 32 | 60 | 59 |

| Fresh Fruit | 45 | 35 | 22 | 26 | 36 |

| Non-Alcoholic Beverages* | 18 | 18 | 19 | 18 | 17 |

| Chocolate & Cocoa Products | 20 | 20 | 24 | 23 | 16 |

| Processed Vegetables | 22 | 17 | 15 | 20 | 14 |

| Processed Fruit | 12 | 13 | 11 | 12 | 11 |

| Other Consumer Oriented | 9 | 8 | 10 | 7 | 9 |

| Wine & Related Products | 4 | 7 | 6 | 8 | 8 |

| All Other Consumer-Oriented Products | 52 | 46 | 37 | 47 | 35 |

| Total Consumer-Oriented Exports | 411 | 399 | 396 | 453 | 383 |

Note: Column totals may not add up exactly due to rounding.

* Excluding juice

Source: U.S. Census Trade Data, BICO HS-10

Products with growth potential include:

- Beef Products: U.S. exports of beef and beef products to Thailand have more than doubled in the last ten years, driven by exports of boneless frozen beef. Demand for imported beef is increasing because of urbanization, rising incomes, tourism, and the slow recovery of the domestic livestock sector following severe pandemic-related disruptions.

- Dairy Products: Consumption of cheese and non-fat dried milk powders for nutritional drinks is expected to grow in Thailand. As in Vietnam, consumers are increasingly influenced by western-style diets, which incorporate cheese products into healthy lifestyle messaging.

- Dog and Cat Food: The dog and particularly cat pet populations in Thailand are expanding, as highlighted in FAS reporting (TH2021-0063). As consumers shift to healthier lifestyles themselves, they have increased purchases of premium packaged pet food products like treats and pet foods labeled as natural and healthy. Thailand allows dry and wet pet food imports from the United States.

- Fresh Fruits: The United States consistently ranks as a top five supplier of fresh fruit to Thailand. Top exports include fresh apples and cherries, both of which grew in 2023, increasing 35 percent and 83 percent by value. Fresh fruit imports are challenged by fluctuations in the Thai baht, but demand for imported fresh fruit remains strong.

- Wine: In February 2024, Thailand removed its high import tariff and reduced the excise tax on wine to promote tourism and increase spending by foreign and domestic tourists.3 These measures are expected to improve the competitiveness of U.S. wines. Wine consumption is increasing among Thai consumers due to the growing middle class, large tourism industry, and expansion of “wine culture” in hotels, restaurants, and bars. U.S. exports of wine and related products grew by both value (6 percent) and volume (18 percent) in 2023.

Conclusion

With projected population and economic growth, Vietnam will remain a market with high growth potential for U.S. agricultural exports. Consumer-oriented products present particularly good opportunities, as Vietnamese consumers increasingly demand high-quality, safe, and nutritious products. Dairy products (cheese, non-fat dried milk powder), fresh fruits (apples, cherries), meat products (beef, poultry), processed products (condiments, pet food), and tree nuts (pistachios, almonds) are all exciting growth areas for U.S. exports. Thailand also presents opportunities for premium consumer-oriented products for many of the same reasons as Vietnam: a growing population and middle class, increased preference for healthy and nutritional products, and strong sectors able to absorb high-value U.S. products. In both countries, there is strong and growing consumer preference for U.S. branded products and exporters of U.S. agricultural products are sure to find exciting prospects in these markets.

1 S&P Global Market Intelligence

2 S&P Global Market Intelligence

3 For more information, see FAS Report TH2024-0014.