Southeast Asia: A Fast-Growing Market for U.S. Agricultural Products

Contact:

Printer-friendly PDF (155.3 KB)

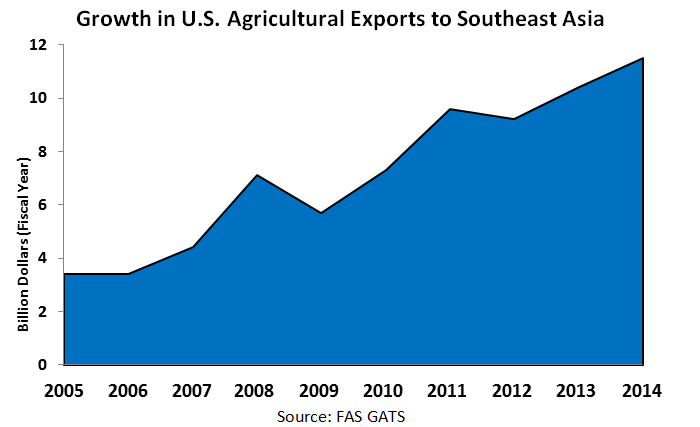

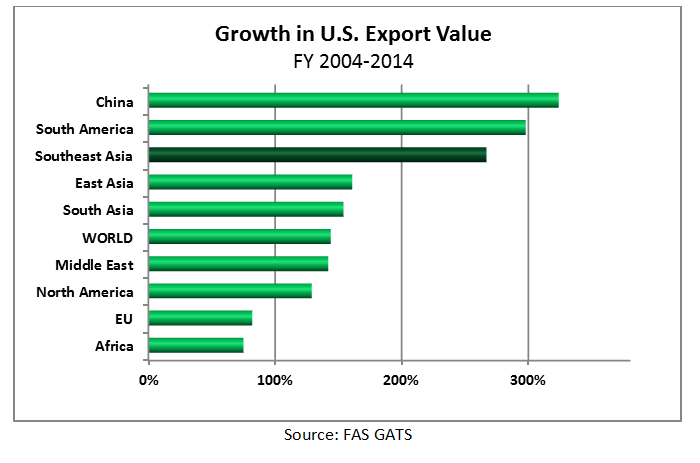

U.S. agricultural exports to Southeast Asia have experienced extremely rapid growth in recent years and, in FY 2014, they climbed to a record $11.5 billion – up 11 percent from FY 2013. In the past decade, Southeast Asia has had the fastest growth in U.S. agricultural sales of any region except South America (see charts below). Strong economic growth and increasing demand for high-value products have been major drivers of this increase, and these trends are expected to continue to make Southeast Asia an attractive destination for U.S. exports in the future.

Strong Export Growth for Wide Variety of Products

While overall U.S. agricultural exports have experienced a sharp rise in recent years, the growth of sales to Southeast Asia has outpaced the general trend. This has been true for a wide range of agricultural products, and especially for high-value products.

Bulk products: Soybeans, wheat, and cotton are the largest bulk U.S. exports to Southeast Asia. While overall U.S. bulk product exports have increased 43 percent in value over the past five years, sales to Southeast Asia have increased 71 percent. Greater exports of soybeans have been driven by rapidly expanding poultry and aquaculture industries in the region. In the case of Indonesia, where nearly all of the soybean imports are for human consumption, growing food demand is also driving imports. Indonesia was the fourth-largest market for U.S. soybeans globally last year. The Philippines continues to be a major market for U.S. wheat, and was the fifth-largest market last year. For cotton, 20 percent of U.S. exports went to Southeast Asia in FY 2014, as textile production and exports have continued to expand throughout the region.

Intermediate products: While bulk export growth has been impressive, shipments of higher-value products U.S. products to Southeast Asia have increased even more dramatically. For “intermediate products” such as feeds and semi-processed products, U.S. exports globally have increased 62 percent in the past five years, while sales to Southeast Asia have risen 110 percent. This is largely being driven by increased purchases of U.S. feeds to meet the demand of the expanding livestock, poultry, and aquaculture industries. Strong economic growth and higher income levels in the region are driving demand for meat protein, leading to expanded domestic production of meat, especially poultry. In fact, poultry production in Southeast Asia has increased at a rate of six percent per year, faster than any region other than the Former Soviet Union and South Asia. To keep up with growing demand, Southeast Asian poultry producers are turning to modernized production practices and facilities. This has helped boost demand for U.S. soybean meal. The region has also become an important buyer of other U.S. feeds such corn gluten meal and distillers dried grains.

Export Increases for U.S. Agricultural Products to Southeast Asia

Product | FY 2009 Export Value ($Mil) | FY 2014 Export Value ($Mil) | Increase |

| Bulk Total | $2,532 | $4,342 | 71% |

| Soybeans | $911 | $1,819 | 100% |

| Wheat | $730 | $1,283 | 76% |

| Cotton | $688 | $908 | 32% |

| Other Bulk | $204 | $332 | 63% |

| Intermediate Total | $1,419 | $2,986 | 110% |

| Soybean Meal | $357 | $1,122 | 214% |

| Other Feeds | $331 | $547 | 65% |

| DDGs | $156 | $359 | 130% |

| Other Intermediate | $575 | $958 | 67% |

| Consumer-Oriented Total | $1,730 | $4,140 | 139% |

| Dairy | $322 | $1,412 | 338% |

| Prepared Food | $219 | $492 | 125% |

| Fresh Fruit | $231 | $439 | 90% |

| Other Consumer | $958 | $1,797 | 88% |

| Total | $5,681 | $11,468 | 102% |

Consumer-oriented: U.S. exports of consumer-oriented products to Southeast Asia have experienced the strongest growth. While U.S. exports of these products globally have risen 71 percent in the past five years, growth to Southeast Asia is nearly double that at 139 percent. Dairy is the product that has seen the sharpest increase in U.S. exports. Rising incomes and greater demand for high-protein products, combined with sluggish growth in domestic dairy production in much of the region, have boosted import demand for these products. Nearly 20 percent of U.S. dairy exports went to Southeast Asia in FY 2014, and four of the top 10 U.S. markets for dairy products were in this region (Philippines, Vietnam, Indonesia and Malaysia). Other key consumer-oriented exports included prepared food, fresh fruit, and tree nuts. Strong growth in retail food sales is expected to support continued growth in consumer-oriented product exports.

Agricultural related products: In addition to agricultural products, Southeast Asian countries have also become key buyers of “agricultural related” products such as wood products and biofuels. Vietnam was the sixth-largest market for U.S. wood products in FY 2014, primarily logs and lumber to use for further processing and export. The Philippines was the fourth-largest market for U.S. ethanol, as imports increased in order to meet mandated blending levels in gasoline.

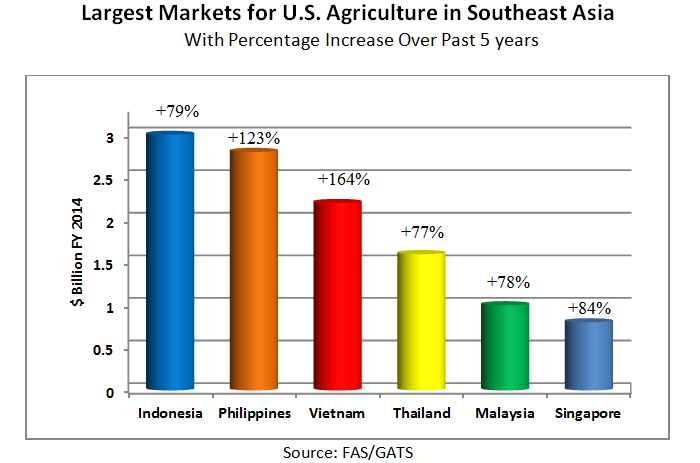

Exports Have Risen to All Key Southeast Asian Markets

Indonesia is the most populous Southeast Asian country by far and is the largest market in the region for U.S. agricultural exports, which totaled $3 billion in FY 2014. The Philippines and Vietnam, however, have been the fastest-growing markets for the United States in recent years. The United States is the largest food supplier to the Philippines, providing about one-quarter of total food imports. Meanwhile, U.S. exports to Vietnam have increased tenfold in the last decade. Overall U.S. market share in the region has remained relatively steady in recent years, with most of the growth in U.S. exports coming as a result of the entire Southeast Asia market expanding.

U.S. Market Share

| Market | Total Ag Imports in CY 2013 | U.S. Market Share | Largest Supplier |

| Indonesia | $18.2 billion | 16% | Australia (16%) |

| Malaysia | $17.3 billion | 6% | Thailand (14%) |

| Thailand | $11.0 billion | 16% | United States |

| Vietnam* | $10.4 billion | 12% | United States |

| Singapore | $10.4 billion | 9% | Malaysia (21%) |

| Philippines | $6.8 billion | 26% | United States |

Strong Economic Growth Makes Southeast Asia Attractive for U.S. Exports

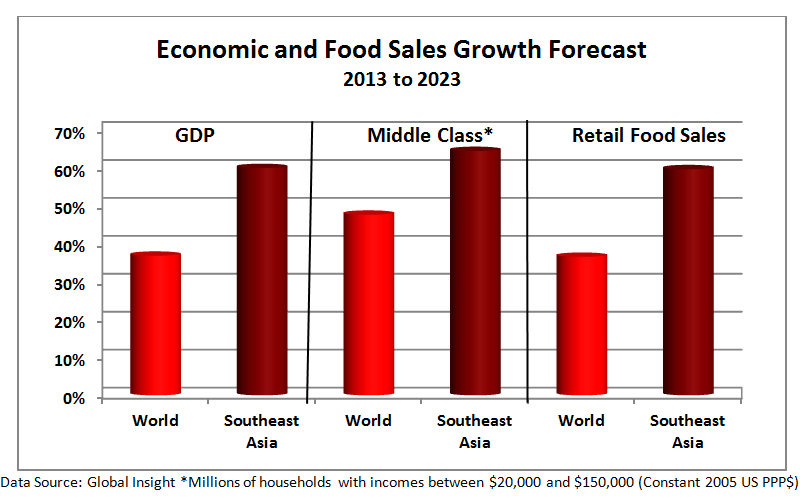

Southeast Asia is expected to remain an attractive market for U.S. agricultural exports due to a number of factors. One is the huge consumer base of the region, with more than 620 million people – almost double the population of the United States. In addition, rapid economic growth is enabling more of these consumers to purchase a wider range of agricultural products. As consumer demand shifts to higher-value products, this will continue to create strong demand from the region for animal feed ingredients, as well as more consumer-oriented imports. During the next decade, Southeast Asia is forecast to experience much stronger economic growth than the global average, as well as sharply higher growth in the middle class (see chart below). In addition, urbanization is expected to continue at a very rapid rate. These factors are expected to result in rising retail food sales, with 60-percent growth expected in the next decade, compared to just 37 percent globally.