United States Agricultural Exports to Taiwan Remain Promising

Contact:

Link to report:

Executive Summary

Taiwan is the seventh-largest market for U.S. agricultural exports. Taiwan has vibrant urban communities and a highly developed e-commerce industry that provides convenience for customers, all which support Taiwan’s continued demand for safe and high-quality food products. In addition, evolving consumption trends suggest customers are increasingly looking for western-style food options that cannot be locally sourced. Since domestic food production alone cannot match increased food demand, agricultural imports will continue to play an important role in Taiwan’s retail food economy. While trade barriers exist and competition intensifies, opportunities to increase U.S. agricultural exports remain promising.

Macroeconomic Perspective

Taiwan is a wealthy Asian economy and an industry leader in semiconductor and information technology. Taiwan’s economy grew both in 2020 and 2021 despite the COVID-19 pandemic as technology exports remained strong. Taiwan’s economic resilience during the last two years is notable considering that many countries, even comparatively developed ones, have not been immune to significant economic headwinds and have continued to struggle through their recoveries. According to the latest International Monetary Fund (IMF) forecast, Taiwan is expected to see a 3.2 percent real gross domestic product (GDP) growth in 2022 after a strong growth of 6.3 percent in 2021.

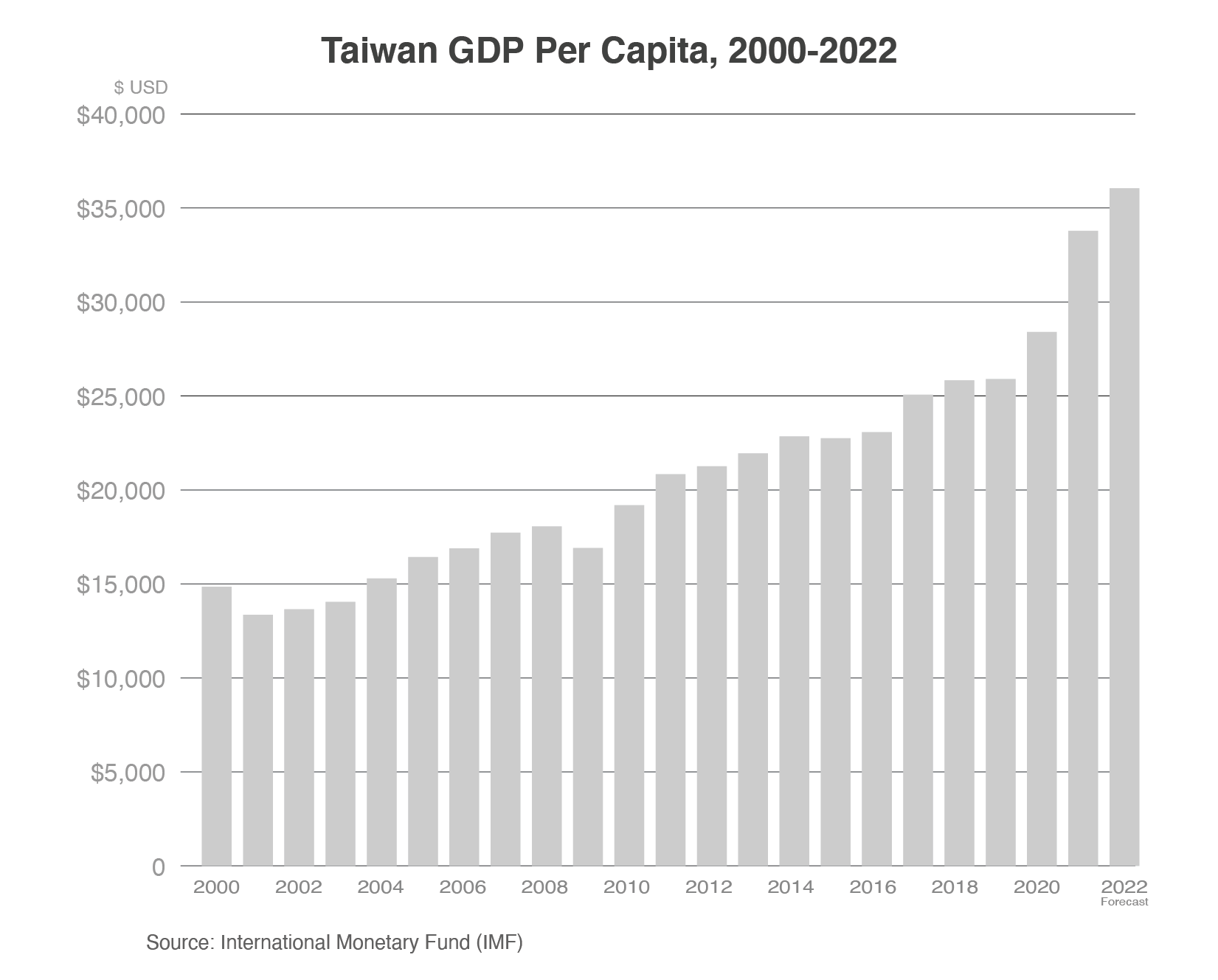

Reflecting its robust economy, Taiwan has a high per capita income. Based on IMF data, Taiwan’s GDP per capita surpassed $25,000 in 2017 and is forecast to surpass $35,000 in 2022. If adjusted based on purchasing power, Taiwan’s GDP per capita is one of the highest in the world. The strong consumer base supports Taiwan’s highly urbanized economy, where consumers have access to modern food retail options that highlight international food products. Taiwan is also a vibrant international tourist destination, with the tourism industry meeting demands to offer both Taiwanese and international cuisine options. Although Taiwan’s strict border control measures during COVID-19 have affected the tourism industry, Taiwan is in the process of reopening to foreign visitors.

Consumption Trends and Agricultural Trade

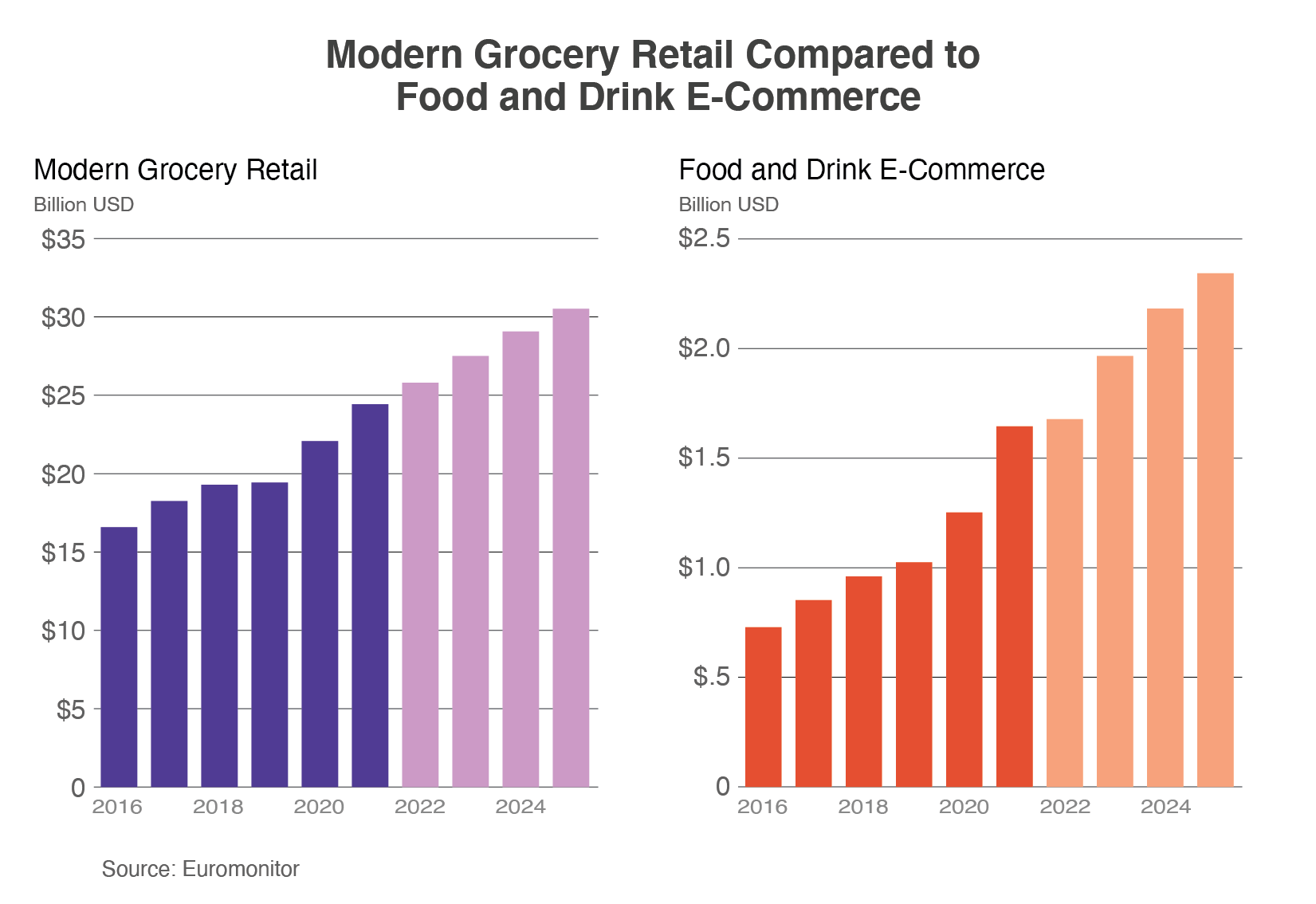

Taiwan’s consumer foodservice and retail industries were hit hard during the height of the COVID-19 pandemic, especially in 2021 when preventive measures to combat the pandemic curbed dine-in food services and in-store operations. To meet the demands of the increased “at home economy,” including home cooking, working from home, and home entertainment, service providers pivoted to expand delivery and take-out services, prioritizing convenience and flexibility. Contactless transactions and ready-to-cook meal packages made significant gains, and convenience stores such as 7-Eleven and Family Mart promoted their e-commerce platforms, allowing consumers to shop online for fresh groceries and prepared foods, and pick up the goods at the nearest store. Although consumers made fewer trips to markets for grocery needs, they increased their basket sizes, stocking both food and essential items throughout the pandemic. Coupled with rising e-commerce sales and home delivery services, modern grocery retail sales grew during the pandemic and are forecast to continue their growth trajectory, exceeding $30.5 billion in 2025, a 57.1 percent increase from their pre-COVID sales level in 2019, according to Euromonitor data.

Resilient grocery and consumer foodservice sales are further supported by agricultural trade data. Despite the pandemic, Taiwan’s agricultural imports were not significantly impacted, highlighting the importance of imports to satisfy domestic food demand, whether through modern grocery retailers and restaurants, or increasingly through online digital platforms. In 2020, Taiwan imported $12.4 billion of agricultural products, a 1.9 percent decrease from 2019. In 2021, however, Taiwan strongly rebounded, importing a record-high $14.8 billion of agricultural products, a 16.3 percent increase compared to the previous record year’s figure (2018, $12.7 billion). Top agricultural suppliers to Taiwan include the United States, the European Union, Brazil, New Zealand, Japan, and the People’s Republic of China.

U.S. Agricultural Exports to Taiwan

As the seventh-largest export market for U.S. agricultural products, Taiwan has been one of the most reliable trading partners. In 2021, the United States exported $3.8 billion of agricultural products to Taiwan, a 17.5 percent increase from 2020 ($3.3 billion). As the lead supplier in many product categories, the United States exports a diverse set of agricultural ingredients to support Taiwan’s domestic food processing industry as well as to supply high-value, ready-for-consumption agricultural products. A decade ago, consumer-oriented products made up 29.9 percent of overall U.S. agricultural exports to Taiwan. In 2021, that share increased to 48.8 percent, suggesting that U.S. exporters have further diversified their product mix and that Taiwan is a developed market primed for higher-valued consumer goods.

| Selected Top U.S. Agricultural Exports to Taiwan (Calendar Year, $ Million) | ||||||

| Product Group | 2017 | 2018 | 2019 | 2020 | 2021 | 2021 U.S. Market Share |

| Soybeans | 585.8 | 854.3 | 691.5 | 602.0 | 732.2 | 47.1% |

| Beef & Beef Products | 408.6 | 551.6 | 568.4 | 551.6 | 662.7 | 51.7% |

| Corn | 394.9 | 603.2 | 232.0 | 177.4 | 416.8 | 35.0% |

| Wheat | 295.0 | 267.4 | 319.3 | 300.9 | 305.8 | 79.5% |

| Fresh Fruit | 218.0 | 198.7 | 252.3 | 195.3 | 206.5 | 29.7% |

| Poultry Meat & Products1 | 152.2 | 189.3 | 186.6 | 222.9 | 164.8 | 89.0% |

| Dairy Products | 83.4 | 93.2 | 109.4 | 121.2 | 137.6 | 12.3% |

| Total U.S. Ag. Exports | 3,331.7 | 3,963.6 | 3,573.0 | 3,260.4 | 3,831.1 | 26.1% |

| Source: U.S. Census Bureau Trade Data, BICO HS-10; Trade Data Monitor LLC, BICO HS-6 for market share 1Excluding eggs |

||||||

While the United States is the leading agricultural supplier to Taiwan (26.1 percent market share in 2021), competition in a few top products has intensified. Brazil and Argentina, with their competitively priced bulk products, have contributed to fluctuations in demand for U.S. commodities and market share in soybeans and corn during the last decade. The United States continues to dominate the wheat market, competition from Australia notwithstanding, and although uncertainties from the Russian invasion of Ukraine continue to put pressure on prices, neither has been a key wheat supplier to Taiwan.

Key Opportunities in Consumer-Oriented Products

Beef and Beef Products

In 2021, Taiwan imported a record-high $1.2 billion of beef and beef products. As the sixth-largest export market for U.S. beef and beef products, the United States exported a record $662.7 million to Taiwan. Known for its quality, U.S. beef products are well positioned to maintain competitiveness. In 2022, U.S. beef exports may see another record-breaking year. From January - May 2022, exports to Taiwan increased 72.8 percent in value, reaching $378.3 million, and 36.3 percent in quantity. To stabilize food prices, the Taiwanese government temporarily reduced beef tariffs in 2021-22, allowing U.S. exporters to take advantage of lowered duties. While temporary, such trade policy indicates that imports play an important part in providing a stable, year-round supply of beef products for Taiwan’s consumers.

Poultry Products

Although Taiwan’s domestic poultry production has met most of its poultry demand, imports play a vital role. According to USDA Production, Supply, and Distribution data, 21 percent of domestic consumption for chicken meat was fulfilled by imports in 2021. As a result, demand for imports to complement domestic production will create U.S. poultry export opportunities. Taiwan primarily imports leg quarters, whole legs, and drumsticks, all of which the United States is the leading supplier with an import market share around 90 percent during the past several years. Although there have been recent bans due to detection of highly pathogenic avian influenza in the United States, Taiwan has temporarily modified its restrictions on poultry imports (see GAIN report TW2022-0024 for more information) to protect import supply. Analysis from the Agricultural Trade Office in Taipei, Taiwan has also highlighted egg products for export opportunities. In 2021, Taiwan imported $17. 6 million of eggs and products. As with poultry meat, Taiwan’s egg production is mostly for domestic consumption. However, in recent months, limited egg supplies from seasonal avian influenza virus infections and production lag after decreased demand from the COVID-19 pandemic contributed to price hikes, opening opportunities for fresh table egg imports to support price and supply stabilization. According to a recent GAIN report, the United States has full market access to Taiwan for all eggs and egg products (see GAIN report TW2022-0027 and the USDA Animal and Plant Health Inspection Service website for more information).

Pet Food

According to Euromonitor, the Taiwan pet food market is forecast to exceed $1.0 billion in 2022, a 63.8 percent increase from 2017 ($613.0 million). Demand for high-quality pet foods is rising, especially among younger generations in urban areas. Pet owners increasingly follow and adopt the trend of premiumization of pet foods, replacing table scraps with commercial pet food and purchasing pet food that oftentimes uses human-grade, premium ingredients. Dog and cat food imports have shot up during the past decade, growing from $100.3 million in 2011 to $226.4 million in 2021, an average annual growth rate of 8.5 percent. Considering that “at home economy,” including remote work and studying, is likely to be a long-term trend, pet ownership, particularly cats and small dogs to accommodate urban lifestyles, and the demand for commercial pet food are expected to remain robust.

Wine

Despite limited foodservice and cancelled or postponed celebratory events due to the pandemic, wine imports in 2021 were at an all-time high, suggesting resilient wine demand from evolving consumer preferences and a robust middle class. Taiwan imported $285.3 million of wine and related products, a 21.3 percent increase from 2020. The United States is the second-largest wine supplier to Taiwan, exporting a record $17.9 million in 2021. Competition remains fierce: Old World wines from Europe are generally more well known, while New World wines such as Chilean and Australian are price competitive. However, U.S. wine is increasingly recognized for its quality and value. As many new wine consumers do not have fixed preferences, accessibility and marketing efforts are important.

Trade Policy Perspective

Global trade is important to Taiwan as its export-driven trade policy has been the main engine behind its economic growth. Taiwan is a member of the World Trade Organization and Asia-Pacific Economic Cooperation, as well as an observer at the Organization for Economic Co-operation and Development. One of Taiwan’s most comprehensive trade agreements is the Agreement between New Zealand and the Separate Customs Territory of Taiwan, Penghu, Kinmen, and Matsu on Economic Cooperation. The agreement allows agricultural products from New Zealand to enter Taiwan with reduced tariffs, providing a tariff advantage over U.S. exporters.

As with other economies, the COVID-19 pandemic and the ensuing supply chain disruptions have put economic resilience and market diversification at the forefront of Taiwan’s trade policy. Taiwan applied to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in 2021 to combat inflationary pressures and to further integrate with the global economies. It remains to be seen whether Taiwan will be admitted to the CPTPP; however, the application suggests that Taiwan is pursuing regional and global trade engagement to build economic resilience. Another example of Taiwan’s trade engagement is the recently launched U.S.-Taiwan Initiative on 21st-Century Trade, to further develop economic ties and facilitate trade. According to the Office of the United States Trade Representative, the initiative will explore ways to deepen the bilateral trade relationship, including agricultural trade.