Opportunities for U.S. Food Processing Ingredient Exports to Malaysia

Contact:

Link to report:

Executive Summary

Malaysia was the 26th-largest export destination for U.S. agricultural products in 2022, totaling nearly $1.1 billion in value, and is a top prospect for exports of food and beverage ingredients because of its large and growing food processing industry. Food and beverages manufactured in Malaysia not only serve domestic consumers but are also exported to many neighboring countries. U.S. exports of dairy products, fresh and processed potatoes, food-grade soy, processed fruit and juices, tree nuts, and more have many opportunities to supply the Malaysian food processing sector, which depends on imports for key ingredients and inputs, and in doing so reach consumers across Malaysia and throughout Southeast Asia.

Macroeconomic Perspective

Malaysia has a diverse and open economy with a gross domestic product (GDP) per capita that is among the highest in Southeast Asia at $12,360 in 2022.1 Malaysia is currently considered an upper-middle income country by the World Bank (countries with gross national income per capita between $4,466 and $13,845) but is expected to become a high-income country within the next few years. According to the International Monetary Fund, Malaysia’s real GDP growth has been mostly between 4 and 5 percent in recent years, apart from major shifts between 2020 and 2022 due to the COVID-19 pandemic. With an estimated population of 34 million in 2022, Malaysia is the 43rd-most-populous country in the world and the 6th-most-populous member state of the Association of Southeast Asian Nations (ASEAN).2

Agricultural Trade and the Food Processing Industry

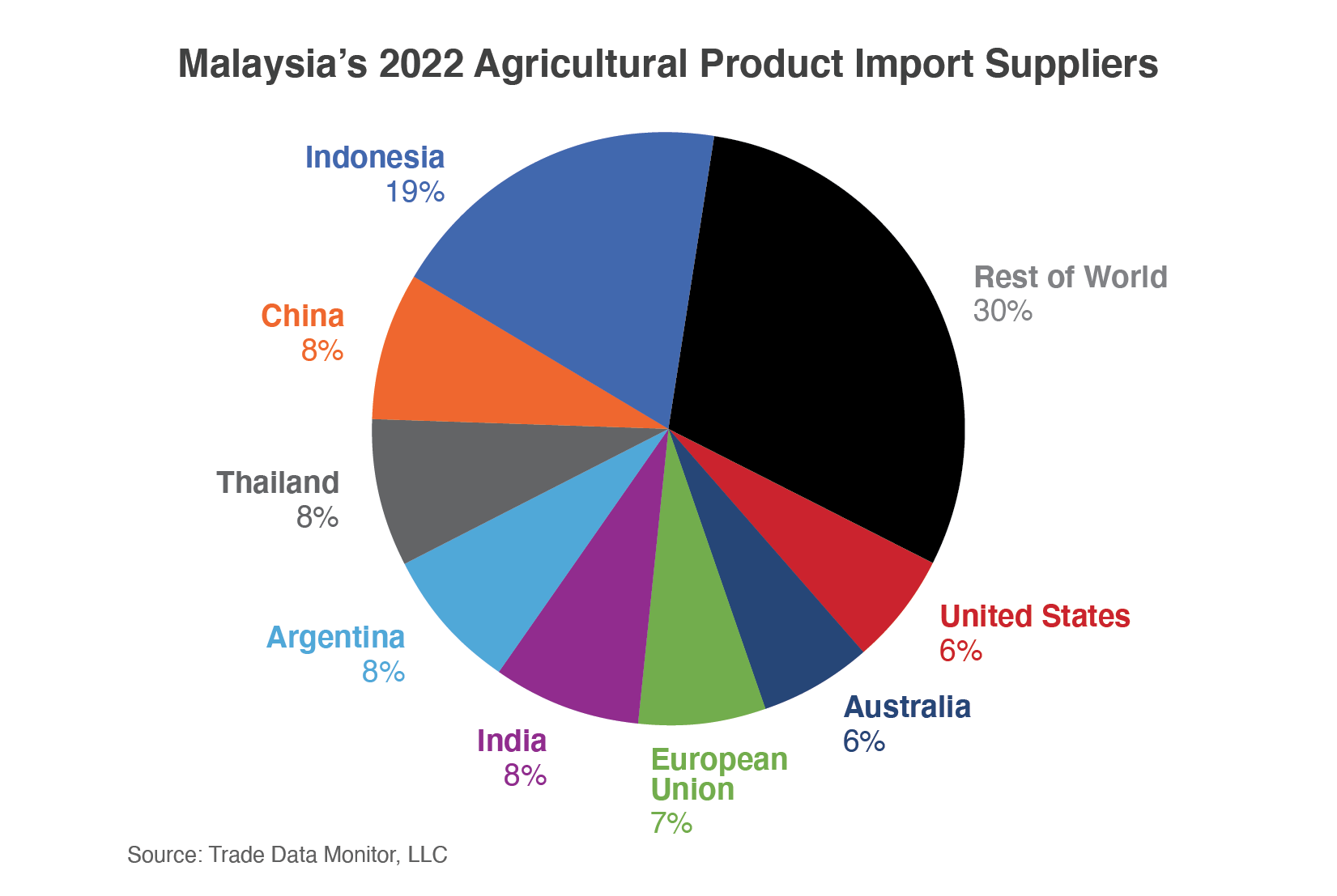

Malaysia is the 26th-largest export destination for U.S. agricultural products, with exports valued at nearly $1.1 billion in 2022. The United States was Malaysia’s eighth-largest supplier, accounting for 5.6 percent of total agricultural imports. The mix of U.S. products is diverse, ranging from bulk products such as soybeans, wheat, and cotton to consumer-oriented products such as dairy, tree nuts, fruits, and vegetables.

U.S. Agricultural Exports to Malaysia

Value in Millions, U.S. Dollars

| Product | 2018 | 2019 | 2020 | 2021 | 2022 |

| Soybeans | 230.3 | 237.5 | 240.2 | 257.9 | 268.1 |

| Dairy Products | 101.1 | 108.6 | 156.9 | 158.3 | 218.7 |

| Food Preparations | 85.3 | 107.1 | 109.4 | 171.8 | 119.3 |

| Processed Vegetables | 58.1 | 70.7 | 52.0 | 60.7 | 74.0 |

| Cotton | 105.7 | 118.2 | 79.2 | 63.8 | 64.6 |

| Tree Nuts | 35.2 | 36.7 | 37.5 | 35.4 | 32.4 |

| Wheat | 48.7 | 130.5 | 72.7 | 72.4 | 28.1 |

| Misc. Feeds, Meals & Fodders | 37.5 | 39.1 | 41.8 | 37.5 | 27.2 |

| Essential Oils | 18.2 | 18.2 | 22.3 | 46.7 | 24.5 |

| Fresh Fruit | 45.3 | 33.3 | 34.5 | 31.9 | 24.0 |

| All Others | 293.3 | 252.4 | 215.5 | 248.5 | 208.5 |

| Total Exported | 1,058.7 | 1,152.3 | 1,062.0 | 1,184.9 | 1,089.4 |

Source: US Census Bureau Trade Data - BICO HS-10

The Malaysian food processing sector accounts for around 10 percent of total domestic manufacturing output and supplies in both the internal and export markets.3 To serve its consumers domestically and abroad, the Malaysian food processing industry depends on imported ingredients. The manufacturing of dairy products, wheat flour-based products, processed fruit and vegetables, and various specialty foods and beverages rely heavily on imports. The United States is an important supplier of many of these ingredients, and prospects are strong because of the size and growth of Malaysian food processing. Because Malaysia is a regional supplier of processed foods, U.S. food and beverage processing ingredients can reach consumers in Malaysia, throughout Southeast Asia, and beyond.

The U.S. agricultural products that have high potential to expand in the Malaysian market for use in food processing include: (1) dairy products; (2) fresh and processed potatoes; (3) food-grade soy products; (4) processed fruit and juices; and (5) tree nuts.

Dairy Products

Malaysia imported $2 billion of dairy products from all suppliers in 2022, up from $1.7 billion in 2021 and above the 5-year average of $1.6 billion. The United States exported $218.7 million to Malaysia in 2022, holding nearly 12 percent of the market share, according to Trade Data Monitor (TDM). Nearly three-quarters ($162 million) of U.S. dairy exports to Malaysia are of nonfat dry milk, a product commonly used in commercial bakeries that is also Malaysia’s top dairy product import. Other major dairy suppliers outside the United States include New Zealand (31 percent market share), the European Union (23 percent market share), and Thailand (10 percent market share). Malaysia’s other top dairy imports include infant formula, malt extract and products with milk and cocoa content, whey, cheese (including cheddar and Colby), ice cream, and butter, all of which the United States currently exports to Malaysia to some degree (though it is only competitive in cheese, whey, and ice cream currently).

Fresh and Processed Potatoes

Malaysia imported around $288 million of fresh and processed potatoes from all suppliers in 2022, up from nearly $174 million in 2018. According to TDM, Malaysia reported importing $60.6 million in frozen potatoes (including french fries) from the United States in 2022; at 41 percent market share, the United States is Malaysia’s largest supplier of frozen potatoes ahead of the European Union. While frozen potatoes and french fries constitute most U.S. potato product exports, other categories include fresh potatoes and processed potato products such as potato chips. Malaysian retail sales of frozen processed potatoes experienced high growth in 2021 and 2022, as their versatility and shelf life were ideal for at-home cooking during the peak of the COVID-19 pandemic. Frozen processed potato sales are expected to continue growing due to the introduction of new potato products that include seasonings, spices, and herbs, as well as the growth of e-commerce retail channels that facilitate at-home consumption.4 As the largest supplier overall of fresh and processed potato products to Malaysia, the United States is well-positioned to meet increased demand in the future despite consistent competition from the European Union (frozen potatoes) and China (the largest fresh potato supplier to Malaysia).

Food-Grade Soy Products

The United States is one of the largest exporters of soybeans in the world and is the largest supplier of soybeans to Malaysia, with nearly 54 percent market share in 2022. However, most U.S. soybeans produced and exported are for feed use rather than food use. While the value of soybeans traded specifically for human consumption is difficult to measure, the U.S. Soybean Export Council estimates that the Malaysian market for food soy in 2021 was around 175,000 tons, with 70,000 tons coming from the United States. The United States exported $6.1 million of textured soy protein concentrate, a product used by food manufacturers to make many products that resemble meat, to Malaysia in 2022. According to Euromonitor International, tofu and similar soy products are ideal for Malaysian consumers looking to prepare meals without meat as they are easy to cook, widely available, and high in protein.

Processed Fruit Products

Malaysia imported $276 million of processed fruit from all suppliers in 2022, with $20.6 million coming from the United States, which was the third-largest supplier behind China and Thailand. The United States exports a diverse set of processed fruits and related products, with dried fruits and juice mixtures making up the largest proportion. Raisins were the top product at $6.5 million exported, followed by processed cranberries (which include dried, sweetened cranberries) at $5.4 million and dried prunes at $4.7 million. Shelf stability has driven increased demand for processed fruit products in recent years. Imported fruit products fill demand for variety and provide alternatives to products grown locally, and processed fruits and juices are generally more easily transported for long distances.

Tree Nuts

Malaysia imported $196 million of tree nuts from all suppliers in 2022, down from $204 million in 2021. The United States exported $32.4 million to Malaysia in 2022 and was the second-largest supplier behind Indonesia, holding 19 percent market share. Shelled almonds made up 68 percent of U.S. tree nut exports to Malaysia, with $22.2 million exported there in 2022. Other top products include in-shell pistachios ($3.5 million), shelled walnuts ($3.4 million), and in-shell almonds ($1.6 million). The United States holds a very high market share in Malaysia for imported shelled almonds, at nearly 85 percent, and a high market share for shelled walnuts (64 percent) and in-shell pistachios (48 percent). According to Euromonitor International, sales of nuts, seeds, and trail mixes in Malaysia have increased 4.5 percent annually, on average, since 2018, and this growth rate is forecast to increase during the next 5 years. Almonds, pistachios, and walnuts are common ingredients in nut mixes, and U.S. exports have good prospects because of the current market share for these tree nuts.

Trade Policy

Malaysia is a member of ASEAN and is thus part of the ASEAN Free Trade Area along with its neighbors Brunei, Cambodia, Indonesia, Laos, Burma, Singapore, Thailand, and Vietnam. As part of ASEAN, it has free trade agreements (FTAs) with Australia, the People’s Republic of China (PRC), India, Japan, New Zealand, and the Republic of Korea (South Korea). Malaysia is a party to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Regional Comprehensive Economic Partnership. Malaysia also has seven bilateral FTAs with countries including Australia, the PRC, India, Japan, New Zealand, Pakistan, and Türkiye. For information on trade policy and regulations relevant to the export of food processing ingredients to Malaysia, see FAS’s most recent Malaysia: Food Processing Ingredients GAIN report.

Conclusion

Due to its expanding food processing industry, Malaysia is a major prospect for the export of food and beverage ingredients and is a significant export destination for U.S. agricultural products. The Malaysian food processing sector, which depends on imports for essential ingredients and inputs, has many opportunities to benefit from U.S. exports of dairy products, fresh and processed potatoes, food-grade soy, processed fruit and juices, tree nuts, processed food and beverages, snacks, and more. Food and beverages manufactured in Malaysia not only serve domestic consumers but are also exported to many neighboring countries. Given that Malaysia is a key regional supplier of processed foods, U.S. food and beverage ingredients can effectively reach consumers not only within Malaysia but also throughout Southeast Asia and beyond.

1 International Monetary Fund

2 CIA World Factbook

3 Malaysian Investment Development Authority

4 Euromonitor International Ltd.