Opportunities for Expanding U.S. Pet Food Exports to Canada

Contact:

Link to report:

Executive Summary

Canada is the United States’ largest export market for pet food, specifically dog and cat food, and the third-largest export destination for all U.S. agricultural products. Canada is also the largest U.S. export market for high-value consumer-oriented products due to proximity, refined transportation logistics, a free trade agreement, and a science-based regulatory environment. In 2021, Canada was the destination for nearly half of all U.S. pet food exports. Canada’s geographical proximity, large disposable income, high pet ownership rate, health consciousness, and preference for e-commerce make it an excellent market opportunity for U.S. pet food exporters.

Macroeconomic Perspective

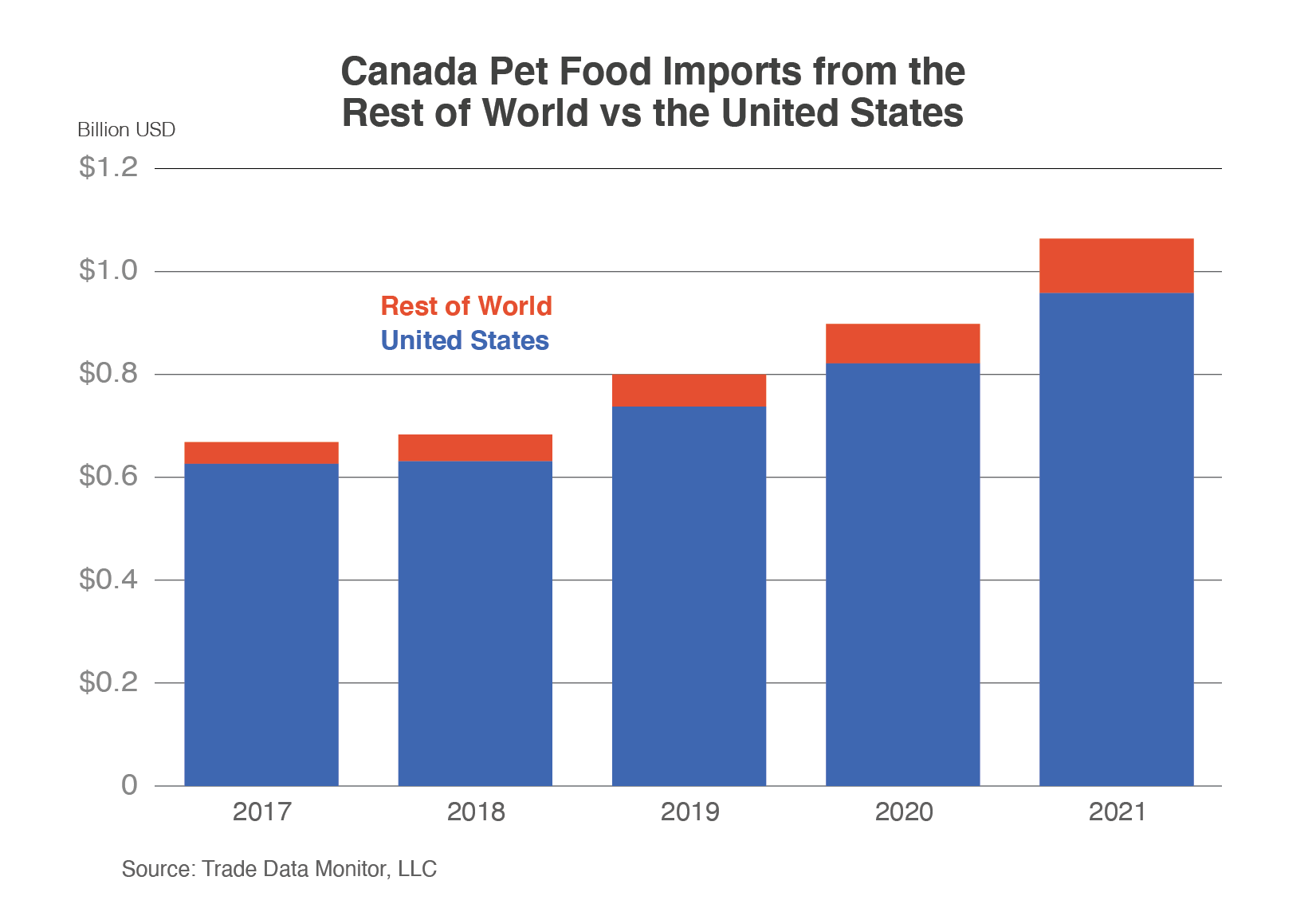

Canada is the largest export market for U.S. high-value consumer-oriented agricultural products, at more than $18 billion in 2021.1 The United States holds a 55-percent market share of consumer-oriented agricultural products due in part to comparable production quality and standards. Canadians have a high disposable income. In 2021, Canada’s real gross domestic product (GDP) per capita surpassed $52,000 U.S. dollars (USD).2 Additionally, 90 percent of Canadians (34.2 million people) live within 100 miles of the U.S. border.3 The United States is the top supplier of pet food to Canada with 90 percent of the import market, followed by Thailand holding 4 percent, and China and the European Union both holding 2 percent of the Canadian pet food import market.

Consumption Trends and Market Drivers

As of 2022, pet food became one of Canada’s fastest growing imported consumer-oriented product categories. According to Euromonitor, the retail value of pet food in Canada is expected to exceed $6.7 billion USD by 2027. In 2021, Canada imported $958 million worth of pet food from the United States, despite supply chain challenges resulting from the COVID-19 restrictions and slowed production of pet food by manufacturers facing labor shortages. During the first 8 months of 2022, the value of pet food imports by Canada from the United States increased by 19.6 percent compared to the same period in 2021.4

According to Euromonitor, 56 percent of Canadians have at least one pet in their household. During the COVID-19 pandemic, an additional million Canadians became pet owners. The current increased demand for pet food can be partially attributed to Canadians purchasing dogs and cats during the COVID-19 lockdown as people were spending more time at home. Pets have become increasingly important members of the family, and their owners are spending more on organic pet foods, including plant-based natural ingredients and products sold with sustainable packaging. Canadian pet food buyers value a clean label (i.e., a label listing known ingredients).

Prospects for U.S. Pet Food Exports

Dog Food

Dry dog food is one of the fastest growing consumer products in Canada, beating out other pet care products, packaged foods, and even soft drinks sales.5 In 2021, premium dry dog food sales were 14 times higher than premium wet dog food sales and, according to Euromonitor, are projected to increase to $1.9 billion USD by 2027. As COVID-19 restrictions are lifted, Canadians are returning to in-store shopping, but online sales for dog food are still increasing.

There is a growing opportunity for U.S. dog food products to enter the Canadian market through improved quality, diverse products, and eco-friendly ingredients. The rising trend of humanizing pets has led to an increased preference for premium dog food made with high-quality ingredients. Humanization is where pet owners want increased nutrition and overall wellbeing for their pets. It is important for top U.S. dog food companies to adapt and maintain organic and sustainable practices to retain customers and access expanding markets in Canada.

Cat Food

There are more cats in Canada than dogs, but, according to Euromonitor, more cats are returning to shelters due to Canadians leaving home as COVID-19 restrictions are lifted. Cat food products follow similar trends and prospects as dog food products. According to a 2021 cat food sales analysis, retail value sales are expected to exceed $1.7 billion USD by 2027, and premium dry cat food is the preferred product. Although store-based retailers remained the dominant retail channel for pet food from 2019 to 2021, cat food sales decreased in grocery stores by 15.9 percent while e-commerce sales increased by 92.3 percent. Cat food sales from grocery stores in 2021 were valued at $582 million, while e-commerce sales were valued at $262 million.6 As of 2022, cat food sales in grocery stores are slowly decreasing, but online sales are steadily increasing. Cat owners are also increasingly favoring fresh, quality ingredients with eco-friendly packaging.

Trade Policy

Although agricultural products going across the border are duty-free per the 2020 U.S.-Mexico-Canada Agreement, the Canada Border Services Agency requires U.S. products to have a certification of origin. Organic food products, including organic pet food, must be approved by the U.S. Department of Agriculture’s (USDA) National Organic Program or by the Canadian Organic Standards to be sold as organic in both the United States and Canada. The labels must be in English and French.

As of April 2021, the Canadian Food Inspection Agency (CFIA) no longer requires import permits for processed, shelf-stable pet foods, treats, or compound chews (except for heat-treated foods). However, import conditions still include a zoosanitary certificate and an importer’s statement of compliance. Raw pet food is required to be inspected by the Animal and Plant Health Inspection Service (APHIS) and exported with a veterinary sanitary certificate. The products must also come from an approved APHIS/veterinary services facility with a year-long validation. CFIA and the Public Health Agency of Canada implemented new microbial requirements for pet chews in April 2022 with a 1-year transition period. For additional regulatory import requirements, please consult the most recent Food and Agricultural Import Regulations and Standards Country Report for Canada by USDA’s Foreign Agricultural Service.

Conclusion

Opportunities for U.S. pet food in Canada are promising and continue to expand. Potential exporters need to consider food trends, demographics, and the importance of e-commerce when marketing to the Canadian consumer. Canadian pet owners are placing increasing importance on their animals and want the highest quality ingredients afforded by their high disposable incomes. These factors, including Canada’s proximity and similar health standards, make Canada an excellent market for U.S. pet food exports.

1 Global Agricultural Trade System (GATS)

2 The World Bank (GDP per capita in current USD)

3 Global Agricultural Information Network, Canada Exporter Guide

4 Trade Data Monitor, LLC

5 Euromonitor, Dry Dog Food in Canada

6 Euromonitor, Dry Cat Food in Canada