Mixed Prospects for U.S. Agricultural Exports to Turkey

Summary

The United States is a principal supplier of raw materials for Turkey’s expanding role as a highvalue exporter and regional trade hub. Turkey was the 11th-largest export market for U.S. agricultural products in calendar year 2011. Despite record shipments last year, U.S. exports to Turkey face significant challenges going forward. Although demand for agricultural products in Turkey is thriving, regulatory barriers and competition from regional suppliers pose risks to the U.S. export outlook.

Strong Demand Outlook as Regional Trade Hub

Turkey’s agricultural import demand is being driven by economic growth, increasing affluence in the middle class, investment in processing facilities, and regional trade. Turkey’s real gross domestic product grew more than eight percent last year, contrasting sharply with the rest of Europe. More than 60 percent of the population is under 35 years of age, and 4 million households will transition to middle-class incomes over the next decade, a 30 percent expansion. Domestic food and beverage sales are projected to grow 40 percent over the next five years, increasing by $58 billion. Finally, poultry exports and aquaculture production are both projected to double in the next five years.

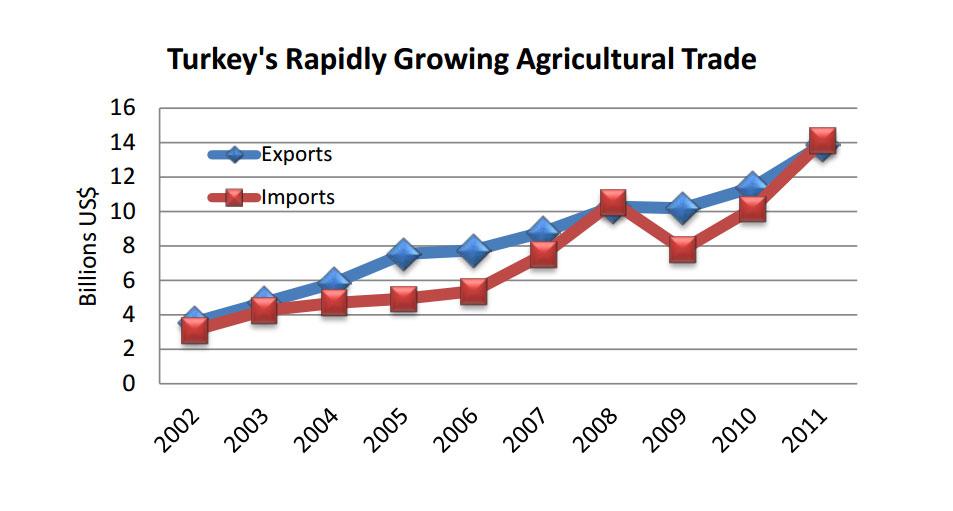

Historically, Turkey has been a net exporter of agricultural products but the country relies increasingly on imports for its food and fiber processing industries. The chart below shows that imports actually eclipsed exports in 2008 and again in 2011. More than half of Turkey’s exports are destined for European markets, including Russia, but exports to the Middle East have been increasing sharply. The United States is Turkey’s second-largest supplier of agricultural products after the European Union. U.S. market share was 18 percent in 2011.

U.S. Principal Supplier of Raw Materials

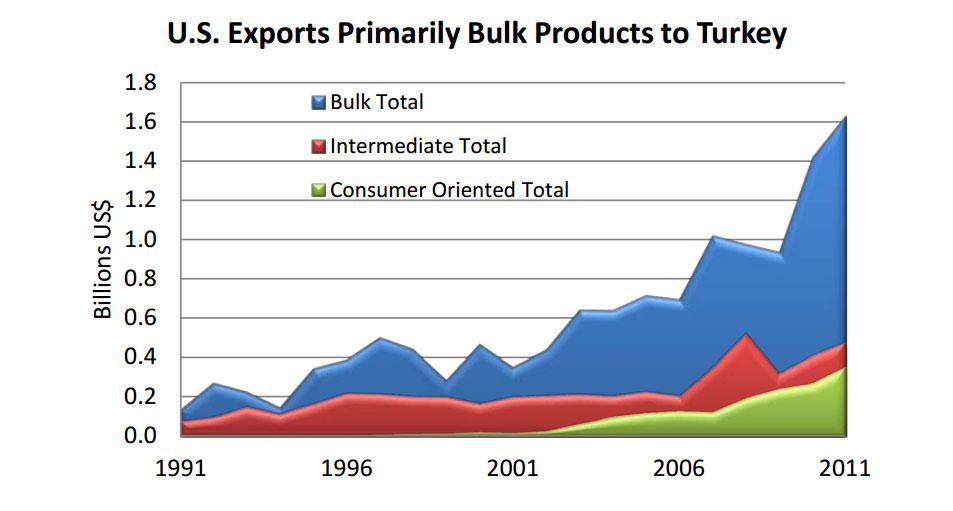

The United States is a net exporter of agricultural products to Turkey, shipping $2.5 billion in 2011. Most major exports to Turkey, including cotton, soybeans, wheat, live animals and tree nuts, undergo further processing before reaching consumers. Turkey is the second-largest market for U.S. cotton exports after China, with U.S. shipments reaching $1.2 billion in 2011. Turkey is also the largest market for U.S. exports of live animals, importing $209 million in 2011.

Import demand for animal feed is projected to increase sharply as Turkey continues to expand livestock, poultry and aquaculture production. Turkey is turning more to Russia and Ukraine for wheat- and sunflower-based feed ingredients, although U.S. soybeans are still an important source for feed millers. The chart below highlights growth in bulk shipments over the past 20 years, with cotton consistently accounting for more than half of the bulk total, followed by soybeans.

Biosafety Law Hinders Demand for U.S. Bulk Products

In 2010, Turkey’s government enacted a biosafety law that bans the cultivation and import of biotech crops for food and feed use unless the event is approved by Turkey’s Ministry of Agriculture. Although the ministry has approved several mainstream corn and soybean events for feed use, it recently rejected six corn events already approved in the European Union. This decision sets a precedent that diverges further from science-based regulatory standards and creates significant challenges for U.S. corn and soybean exports.

U.S. corn and corn gluten feed exports to Turkey fell to zero in 2011 from $190 million in 2008. Due to co-mingling of different corn varieties in U.S. distribution channels, identity-preserved varieties are not a scalable alternative for export markets. Soybean exports declined more than 60 percent from the 2009 record, although the United States continues to maintain some market share. The Turkish biosafety law limits access to high-quality, cost-effective animal feed supplies without presenting real health benefits for consumers. Furthermore, switching feed ingredients is inefficient and costly for producers, and processors have reported lack of availability of some derivate products like corn oil. Assuming no policy change, U.S. bulk shipments to Turkey face regulatory headwinds that limit growth potential.

Three Factors Favor Black Sea Suppliers (Russia and Ukraine)

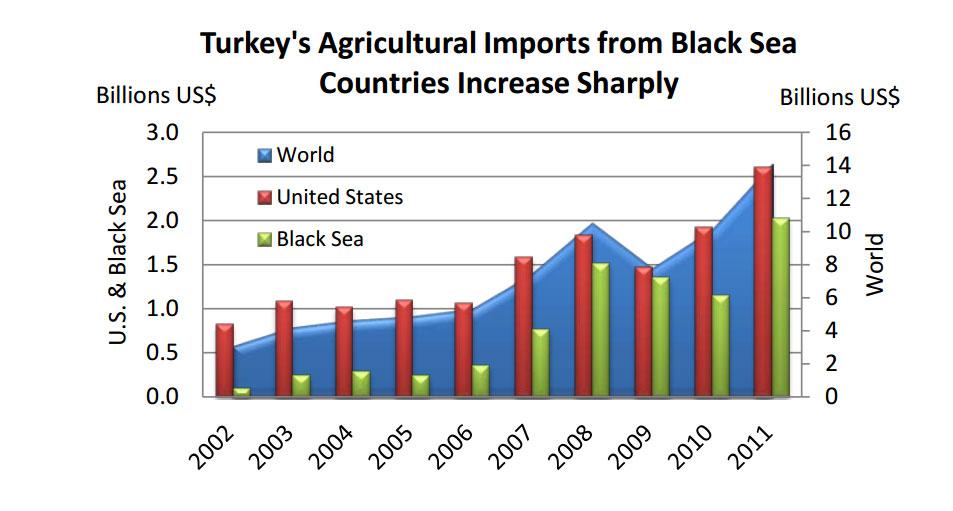

Russia and Ukraine, across from Turkey on the Black Sea, are well-positioned as low-cost suppliers of bulk commodities. Proximity, conventional production methods, and currency valuation all favor Black Sea suppliers relative to U.S. exporters. While Turkey’s biosafety law adversely affects U.S. shipments of bulk commodities and animal feed shipments such as corn and soybeans, it favors conventionally-produced commodities originating in Russia and Ukraine, specifically wheat and sunflower products. The chart below reflects the recent surge in Black Sea exports to Turkey from 2007 to 2011.

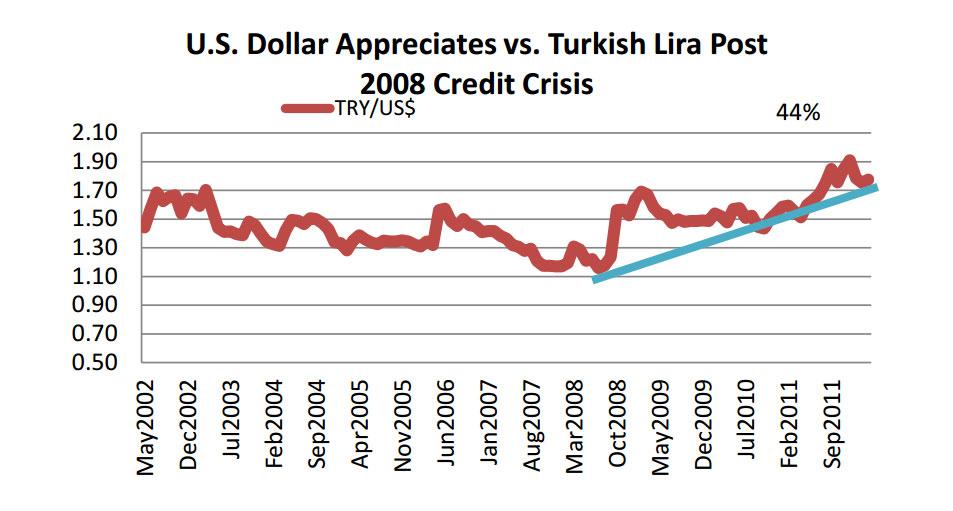

Currency valuation is another factor that favors Black Sea suppliers. Since the onset of the credit crunch in September 2008, the U.S. dollar has appreciated 44 percent vis-à-vis the Turkish lira. Over the same period, the Turkish lira has appreciated more than 10 percent relative to the Russian ruble, making commodities denominated in rubles more price competitive for Turkish importers.