Rice Export Prices Highest in More Than a Decade as India Restricts Trade

India, the world’s largest rice exporter, disrupted global rice markets by banning white rice exports in July 2023, before placing an export tax on parboiled rice exports in August 2023. Accounting for roughly 40 percent of global rice trade in 2022, India exported more than the next four exporters combined. India has consistently been the lowest-priced white rice supplier since 2020, and the sharp increase in rice prices is expected to disproportionately impact countries in import-dependent Sub-Saharan Africa. Three of the top five Indian export markets are in Sub-Saharan Africa – Benin, Senegal, and Côte d’Ivoire – with each receiving more than 1 million tons of Indian rice in 2022. India is by far the largest supplier to these countries and many others in the region.

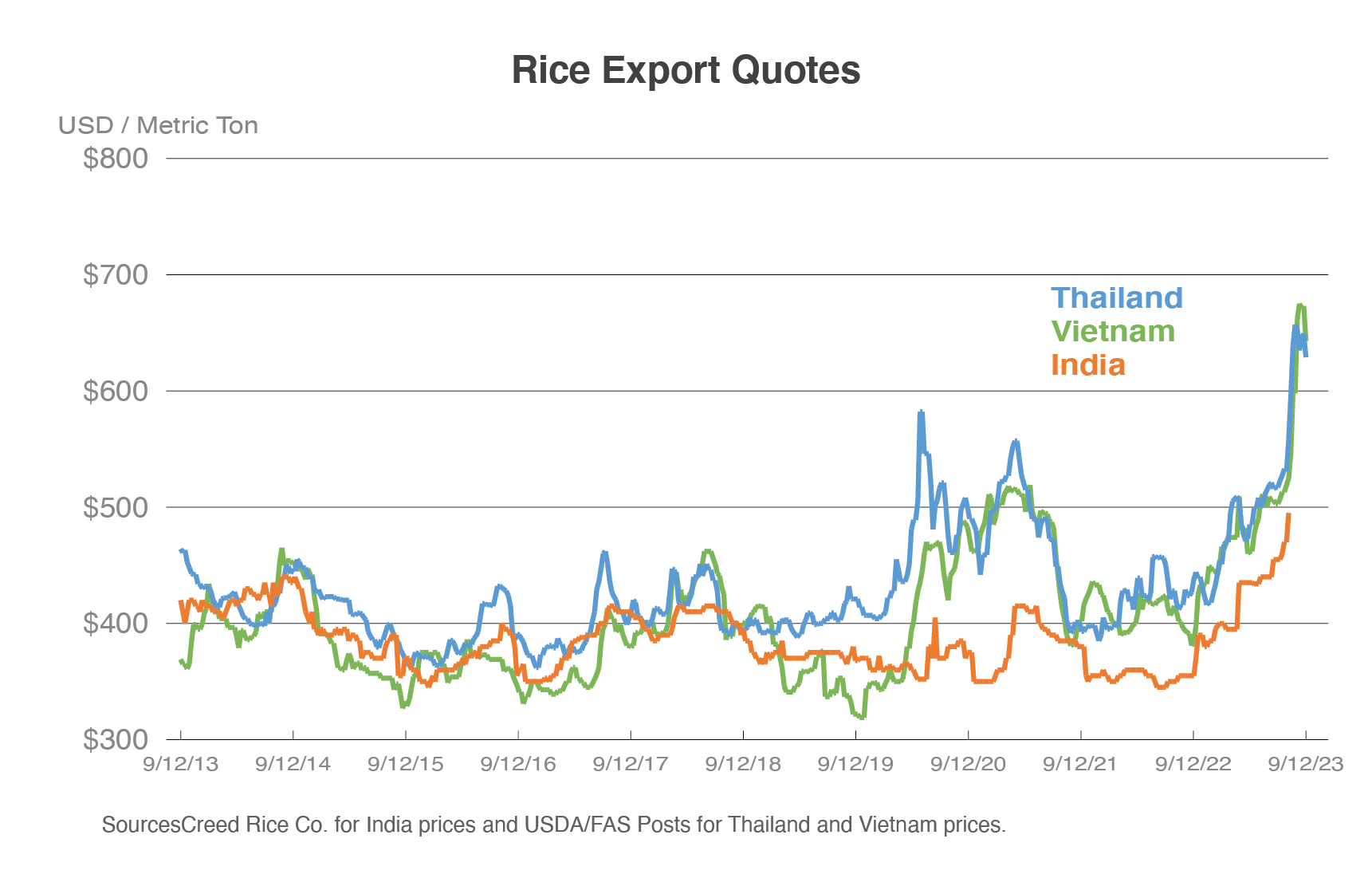

Global importers have shifted to the next largest suppliers – Thailand and Vietnam – causing their export quotes to surge to the highest levels since 2008. Before India’s restrictions, global prices had already been rising due to strong import demand and lower production in several exporting countries. U.S. rice exports are unlikely to be substantially impacted due to higher U.S. prices. For more information, please read Rice Export Prices Highest in 15 Years as India Restricts Trade.