Opportunities for U.S. Consumer-Oriented Products in CAFTA-DR and Panama

Contact:

Link to report:

Executive Summary

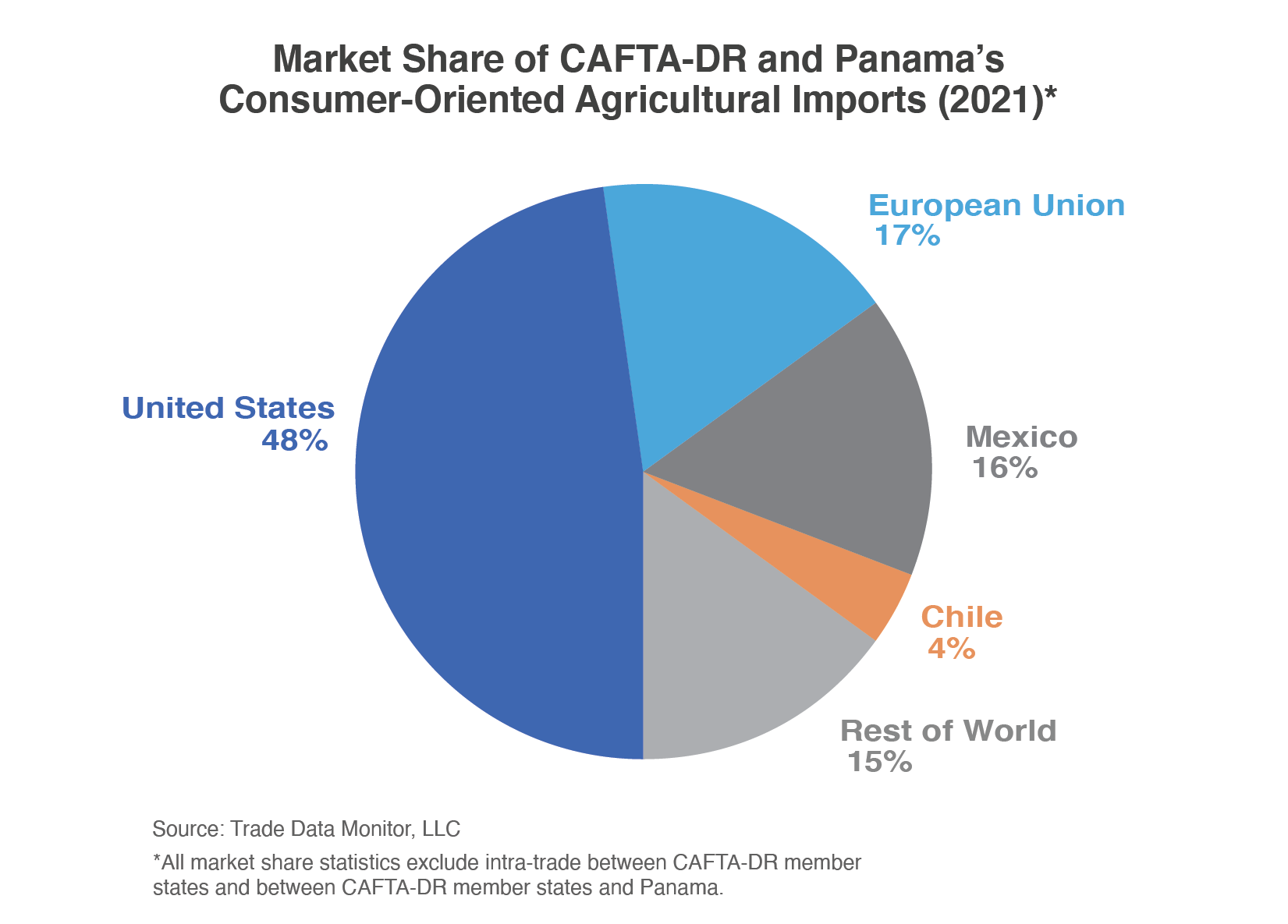

The Dominican Republic-Central America Free Trade Agreement (CAFTA-DR)1 region and Panama combine to represent the seventh-largest market for U.S consumer-oriented products, totaling $3.7 billion in 2022. Free trade agreements (FTA) implemented with CAFTA-DR in 20062 and Panama in 2012 have increased the value of U.S. agricultural exports to the region by nearly fourfold. Significant differences in economic development and purchasing power exist between countries, leading to variation in the volume and composition of consumer-oriented exports. However, dairy, poultry, pork, and beef have been most successful at penetrating markets across the region, with continued growth prospects for these products as new consumers enter the middle class.

Macroeconomic Perspective

Economic development in Central America varies on latitudinal lines. Southern Central America is service oriented with strong financial and tourism sectors, while Northern Central America is more agricultural and dependent on remittances from the United States. The real gross domestic product (GDP) per capita of the richest country, Panama ($29,000), is more than five times that of the poorest, Nicaragua ($5,600). Despite the comparable value of agricultural production, nearly 40 percent of Hondurans are employed in the farm sector compared to just 11 percent in Costa Rica. Guatemala and Nicaragua have similarly high numbers of agricultural laborers as a percentage of their total labor forces. According to the Gini index, which is a measure of income inequality, Central America is home to four of the world’s 20 most unequal countries, Honduras (10), Panama (16),Guatemala (18), and Costa Rica(19).

Despite some challenges, most Central American countries are projected to average real GDP growth between 3 and 4 percent per annum through the middle of the decade.3 According to Euromonitor, Guatemala and the Dominican Republic will respectively add 1 million new middle-class consumers in the next 5 years. In total, the population of CAFTA-DR and Panama is projected to increase 6 percent to eclipse 65 million in 2026. A surge in personal expenditures is also expected, particularly in Guatemala and the Dominican Republic, which will see tens of millions of dollars in additional consumer spending per year through the mid-2020s.

Like the United States, CAFTA-DR countries suffered from high year-on-year inflation in 2022, ranging from 7 percent in El Salvador to 11 percent in Nicaragua.To ameliorate the impact of rising prices on domestic consumer purchasing power, the Government of Panama capped the cost of 18 imported and local agricultural products in late July 2022. Tariffs on basic commodities were temporarily eliminated and profit margin controls ranging from 15 to 20 percent were imposed on bakery goods, corn flakes, garlic, and eight other food categories. The Dominican Republic took similar action in May 2022 by suspending tariffs on a number of imported agricultural products, but these exemptions have since expired.

Consumption Trends and Market Drivers

In Central America, U.S. consumer-oriented products are primarily marketed and sold in modern hypermarkets and supermarkets, which import as much as 85 percent of their food products. The prevalence of chain outlets has grown significantly in recent years. Since 2020, the number of new Dominican stores has increased 30 percent. Guatemala’s major stores opened more than 30 new locations in 2021 and El Salvador’s Super Selectos plans to open five more stores annually through 2024. Walmart holds more than a third of retail market share in Guatemala, Costa Rica, Honduras, and Nicaragua through its own name and subsidiaries. Consumers value the modern retail sector’s myriad product offerings and discounts. Panama has the highest per-capita GDP in Central America and the most modern retail economy. Supermarkets, hypermarkets, and independent food stores dominate the grocery sector in Panama, with pharmacies leveraging their proximity to consumers to offer products like snacks, dairy, and pet food.

Despite significant expansion of the modern retail sector, mom and pop stores continue to account for most retail purchases in CAFTA-DR countries because they offer smaller format products to low-income and rural consumers, many of whom lack refrigeration. These markets primarily source products locally and benefit from intimate knowledge of consumer tastes and preferences.

Prospects for U.S. Agricultural Exports

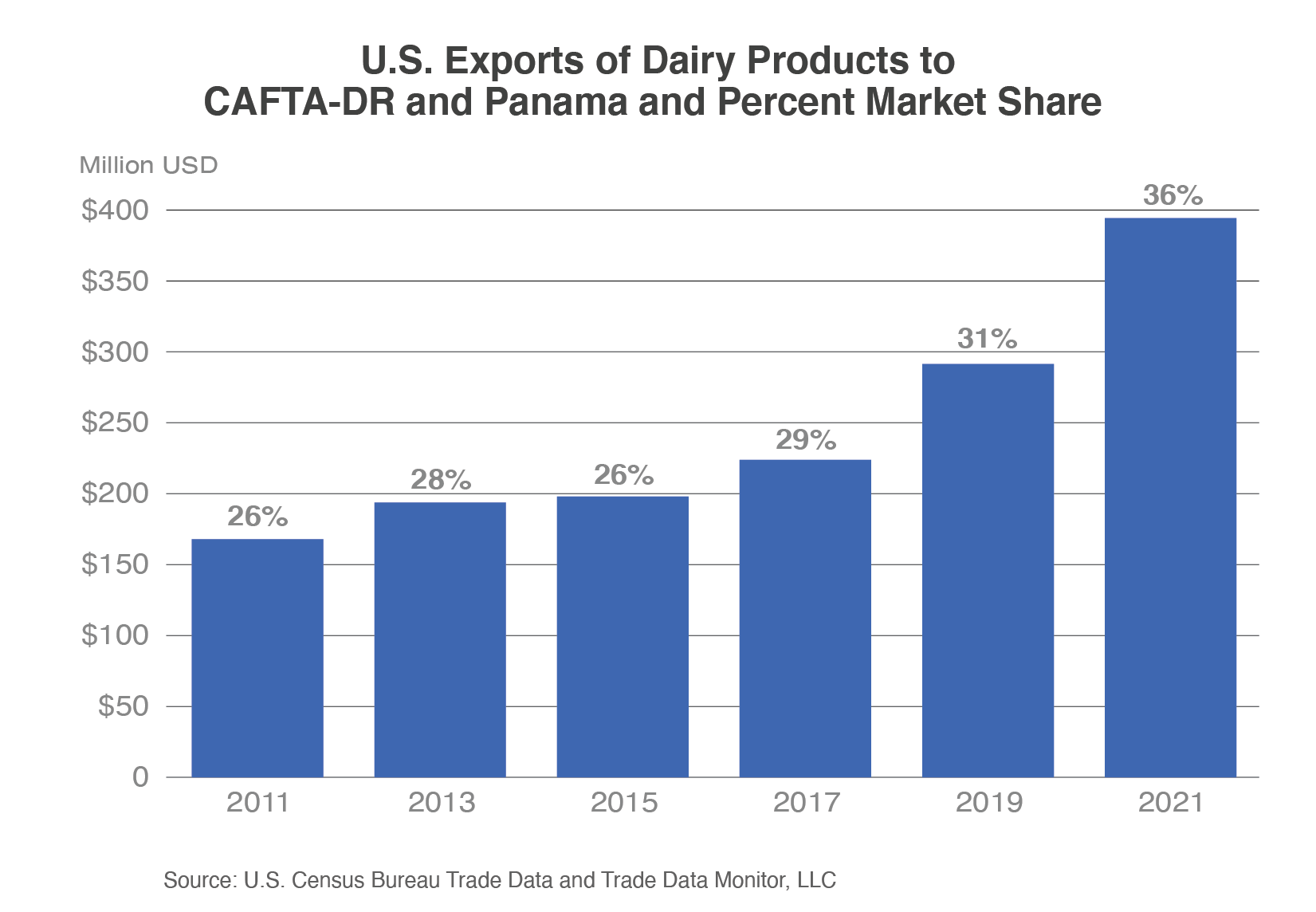

Dairy Products

U.S. dairy exports to CAFTA-DR increased more than ninefold since 2006 to total $453 million in 2022. Exports in 2022 exceeded the previous annual record by $140 million, led by cheeses ($203 million) and milk powders ($147 million). CAFTA-DR countries recognize the high quality of U.S. products and use them in the food service sector, both individually and as ingredients.

After bilateral implementation of the U.S.- Panama Trade Promotion Agreement (TPA), similarly high growth has been recorded to Panama, with dairy exports almost tripling from $40 million in 2012 to a record $113 million in 2022. Sixty-six percent of dairy exports to Panama in 2022 were cheeses including fresh and processed varieties. In aggregate, the United States has a 36-percent share of imported dairy products throughout CAFTA-DR and Panama, followed by the European Union (EU) at 34 percent and Mexico at 15 percent.

Per the terms of the CAFTA-DR agreement, U.S. dairy products – including milk powders, cheeses, and ice cream – will enter CAFTA-DR markets duty-free and quota-free by 2025, significantly improving export growth prospects.

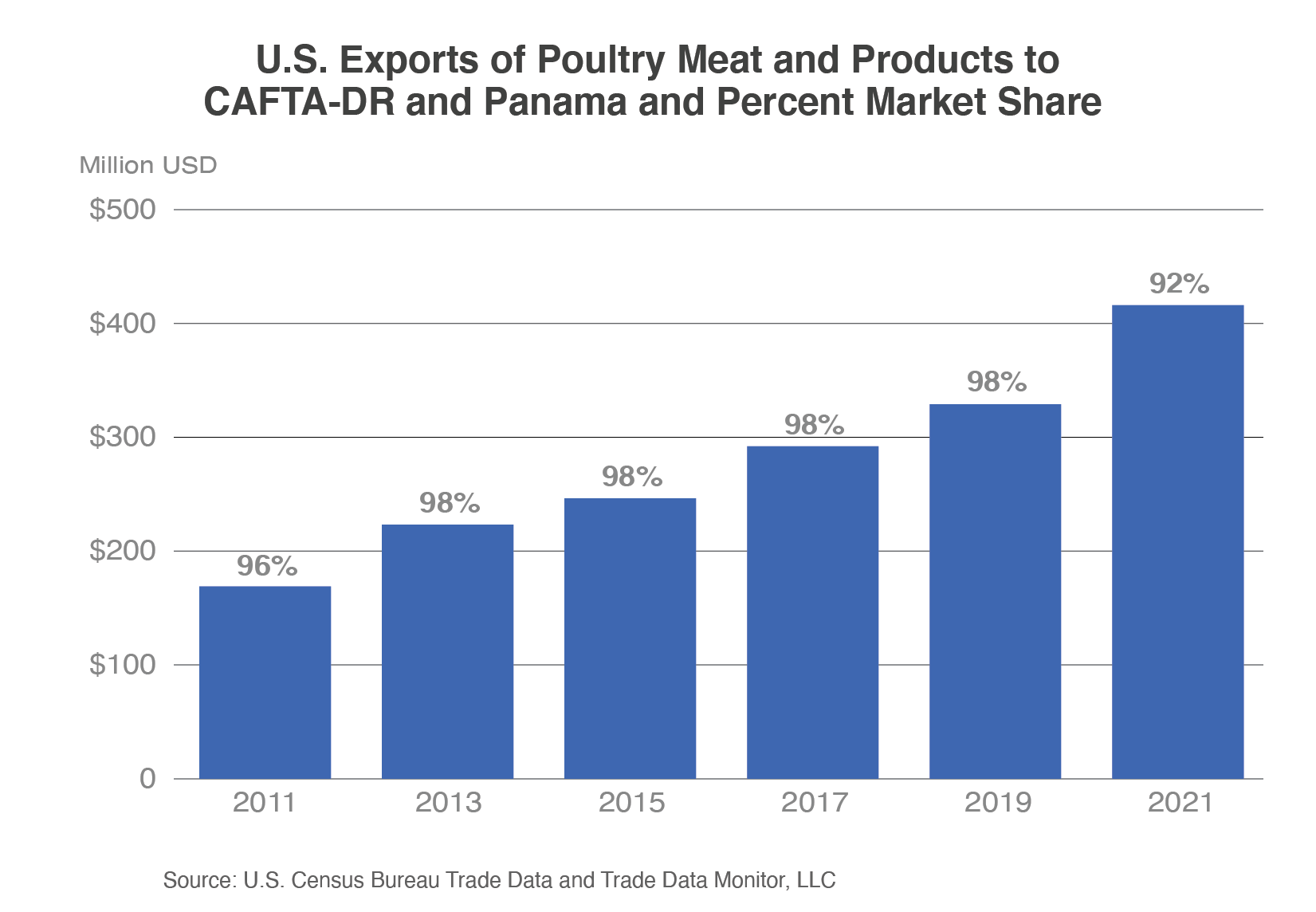

Poultry Meat and Products

U.S. exports of poultry meat and products (excluding eggs) to CAFTA-DR and Panama decreased slightly in 2022 to $405 million after a record-setting $416 million in 2021. Guatemala accounted for $176 million of this value, more than double the next-largest importer in the region. U.S. chicken leg quarters are attractive to consumers because they often cost less than domestically produced poultry. Recent U.S. Department of Agriculture (USDA), Foreign Agricultural Service (FAS) advocacy in Guatemala resulted in the elimination of a regulation requiring an official USDA export mark on individual boxes of U.S. poultry. Instead, labels will only be needed on consignments, pallets, or transportation units, reducing logistic costs in the United States and thus the final sale price of poultry by $0.02 to $0.10 per pound.

According to Euromonitor, total chicken meat sales in Latin America are projected to rise 10 percent by 2027. After being negatively affected by the COVID-19 pandemic in 2020, poultry consumption increased in the Dominican Republic to 411,270 metric tons in 2021, galvanized by the return of tourists to the country and a decline in the availability of pork due to African Swine Fever (ASF). Demand in Costa Rica is also on the rise as consumers seek protein-intensive diets at an affordable price, and in Honduras, where the growing popularity of burger restaurants has created a market for U.S. chicken nuggets, chicken wings, and chicken thighs. The United States averages a 96-percent market share of all poultry exports to CAFTA-DR and Panama.

U.S. poultry exports to the Dominican Republic declined slightly in 2022 due to restrictions on states with any type of highly pathogenic avian influenza detection. However, after multiple engagements with FAS Santo Domingo, the Dominican Republic is allowing exports from states with non-poultry detections on a case-by-case basis if importers provide a traceability “certificate” stating the origin of poultry flock.

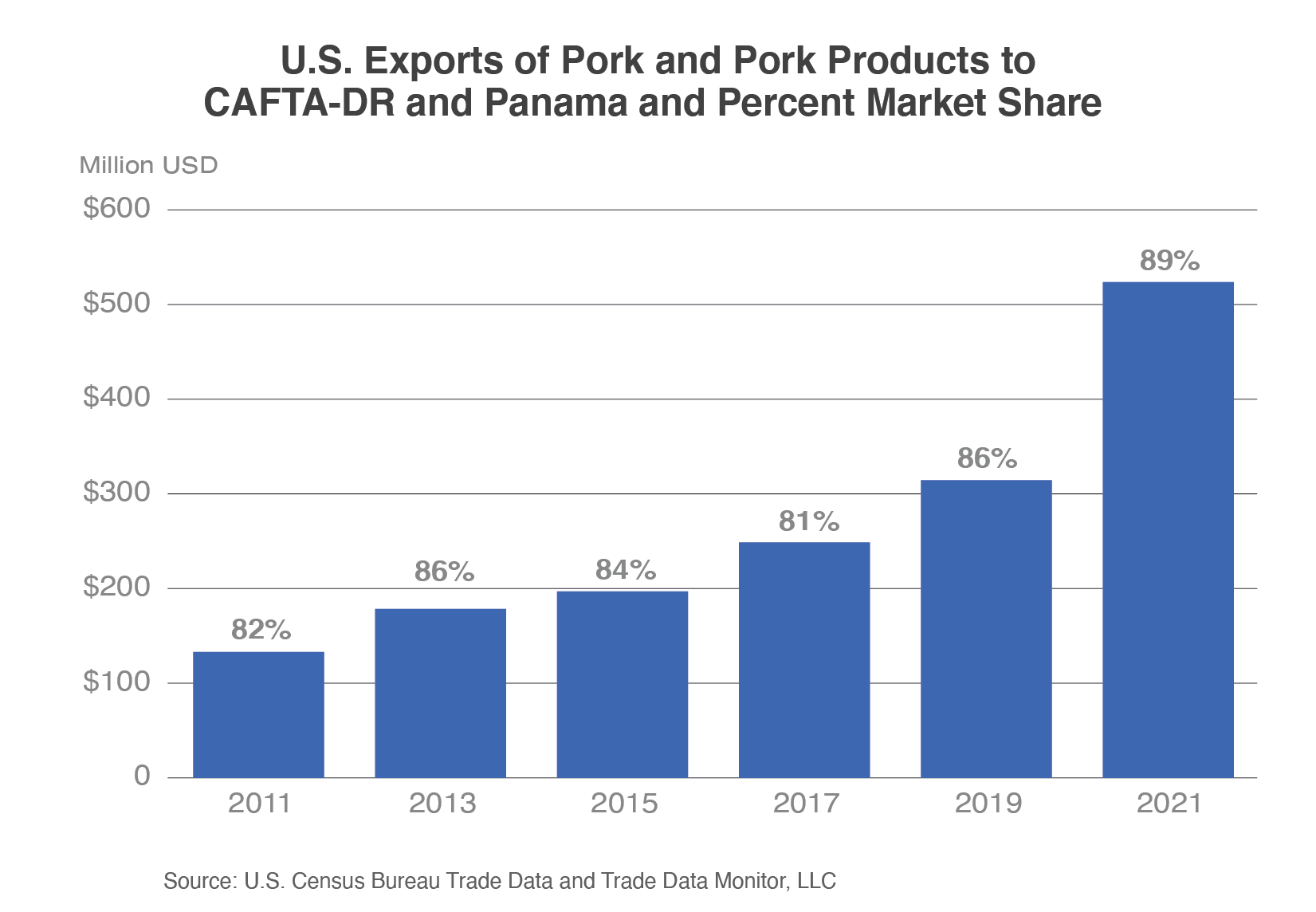

Pork and Pork Product

U.S. pork exports to Central America and the Dominican Republic increased 9 percent in 2022 to $568 million. Per the terms of the CAFTA-DR trade agreement, U.S. pork is no longer subject to tariff-rate quotas (TRQs). In total, U.S. market share of imported pork and pork products across the region is 89 percent, nearly 30 times greater than the next competitor, Canada.

Dominican hog farmers have recently seen herds dwindle from widespread transmission of ASF. Full recovery may not occur until 2025, largely due to difficulty coordinating a policy response. In the interim, U.S. pork exports to the Dominican Republic increased 55 percent to a record $234 million in 2022, led by a sizable uptick in frozen meat. Prior to the outbreak of ASF, local production averaged 62 percent of the total value of the Dominican pork market. This number is now down to 46 percent, with imports rising from 38 percent to 54 percent of total value. In 2023, the Dominican Republic is again projected to face a sizable production shortfall that will be filled by U.S. imports.

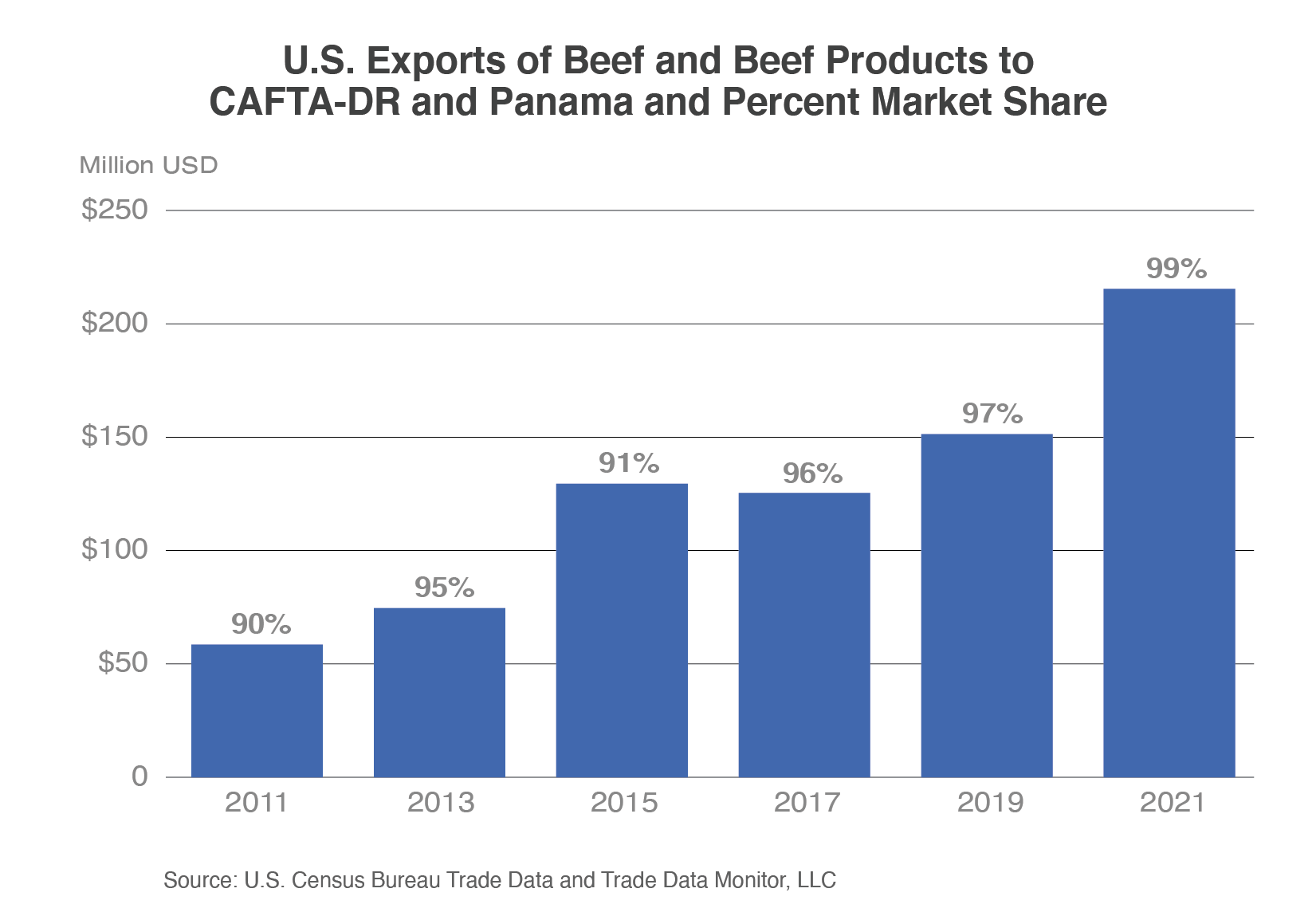

Beef and Beef Products

As Central America’s hotel, restaurant, and institutional sector rebounded from the COVID-19 pandemic, U.S. exports of beef and beef products to CAFTA-DR and Panama rose 10 percent in 2022 to eclipse $236 million in value. Increased exports were also a manifestation of tariff-free trade, as U.S. beef is no longer subject to CAFTA-DR duties. The Dominican Republic is the region’s largest consumer of U.S. beef ($98 million in 2022), with Certified Angus cuts popular in Dominican hotels and restaurants. Premium beef cuts are also frequently prepared in Panama for barbeques and parties. In Costa Rica, U.S. imports of beef in 2022 were more than 50 percent above pre-COVID volumes and reached a record $34 million as tourism recovered and as retailers and restaurants around San Jose expanded offerings of high-quality U.S. beef cuts. U.S. beef is especially popular with local caterers on airlines and cruises.

Other Consumer-Oriented Products

According to Euromonitor, sales of dog and cat food in Latin America are projected to increase 79 percent in the next 5 years to total almost $25 billion, buoyed by rising pet ownership and evolving perception of pets as family members. Costa Rica and Panama, at $48 million and $28 million respectively, were both significant importers of dog and cat food from the United States in 2022. Demand is rising for healthy offerings of freeze-dried raw and fresh food, as well as ingredients for nascent processing companies. In December 2021, a new export certificate enabled U.S. companies to ship raw bovine parts to Costa Rica as ingredients in pet treats. Opportunities have also arisen from FAS-supported trade missions, where Costa Rican and Panamanian companies have formed relationships with U.S. suppliers leading to millions of dollars in new food and ingredient exports.

In 2022, U.S. exports of processed vegetables to CAFTA-DR and Panama increased 9 percent to total $195 million, galvanized by the return of the restaurant industry after the COVID-19 pandemic and the proliferation of modern supermarkets. French fries and other frozen potato products totaled $92 million as a result of booming demand from fast-food restaurants and at-home preparation. Air fryer sales in countries like Guatemala and Costa Rica have popularized frozen potatoes as a quick snack. Elsewhere, processed vegetables are routinely consumed when fresh options are not available. Frozen spinach is also popular as an alternative to the cumbersome process of cleaning and cutting spinach leaves.

The United States continues to be the largest exporter of condiments and sauces to CAFTA-DR and Panama, averaging a market share of 66 percent since 2017. U.S. exports soared 22 percent in 2022 to a new record of $147 million. Central American consumers seek flavors that are additive to traditional local foods. Asian, Italian, and Mexican sauces have become popular among high-income consumers, with at-home pasta and pizza preparation a frugal solution to rising food prices. There is also a nascent trend toward the consumption of condiments devoid of added sugars and preservatives. Because the prevalence of diabates and hypertension is rising, Central American consumers are increasingly looking for seasonings that are healthy and natural.

Trade Policy

The EU’s 2012 FTA with Central America4 granted suppliers preferential access to markets for agricultural, machinery, and pharmaceutical products. Tariffs were removed on 62 percent of EU agricultural products, galvanizing a 104 percent increase in European food and beverage exports in the first 10 years of the agreement. Mexico also has an FTA with Central America5 which increased the value of its fresh fruit exports to the region by 89 percent in the last decade to total $86 million. Additional export gains have been made by Mexico in condiments and sauces, which have risen 266 percent since the agreement’s implementation, and dairy products, which have increased 27 percent.

U.S. exports to CAFTA-DR require a certificate of origin so that preferential tariffs can be applied. Similarly, FAS Panama City advises companies to heed rules of origin requirements to reap the full benefits of the Panama TPA. Rules can vary by commodity and be quite complex. El Salvador, Guatemala, and the Dominican Republic stipulate that all product labels must be in Spanish.

The customs clearance process in Central America varies from relatively fast and trouble-free in Panama to protracted and inconsistent in El Salvador and Nicaragua. The situation in Nicaragua is exacerbated by a weak rule of law and use of bureaucratic instruments to extract additional rents from routine transactions. Throughout the region, personal relationships are paramount to successful business transactions. FAS recommends prospective exporters travel to Central America and meet face-to-face with businesses prior to entering contractual partnerships to learn more about the market.

Conclusion

FTAs brokered with CAFTA-DR and Panama facilitated a significant increase in U.S. exports of meats, dairy, and other consumer-oriented products to Central America in the last two decades. Economic and population growth, combined with the opening of modern supermarkets, will continue to increase regional demand through the mid-and late-2020s. Remaining CAFTA-DR and Panama TRQs are set to liberalize by 2025 and 2031, respectively. Promotional activities to increase awareness among local businesses and consumers will further improve prospects for U.S. exporters in the future.

1 Comprised of Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua.

2 Dominican Republic and Costa Rica implemented the agreement later in 2007 and 2009, respectively.

3 International Monetary Fund

4 Includes Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama.

5 Includes Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua.