Growing Demand for Fats and Oils Due to Global Biodiesel Expansion

The production of biomass-based diesel (BBD) is expanding globally, driven by policies mandating and incentivizing its use as an alternative to petroleum-based diesel. BBD policies tend to support rural economies, lower greenhouse gas emissions in transportation, and improve air quality. Developing economies also look to replace imported petroleum products with ‘home-grown” fuels to improve their balance of trade and support domestic industries. Global BBD production has reached 15 billion gallons, around 3.5 percent of the total diesel pool, and is widely expected to rise further now that the sustainable aviation fuel (SAF) industry is on pace to become a larger consumer. BBD production remains concentrated in Europe, North America, Indonesia, and Brazil, which account for 80 percent of the market.

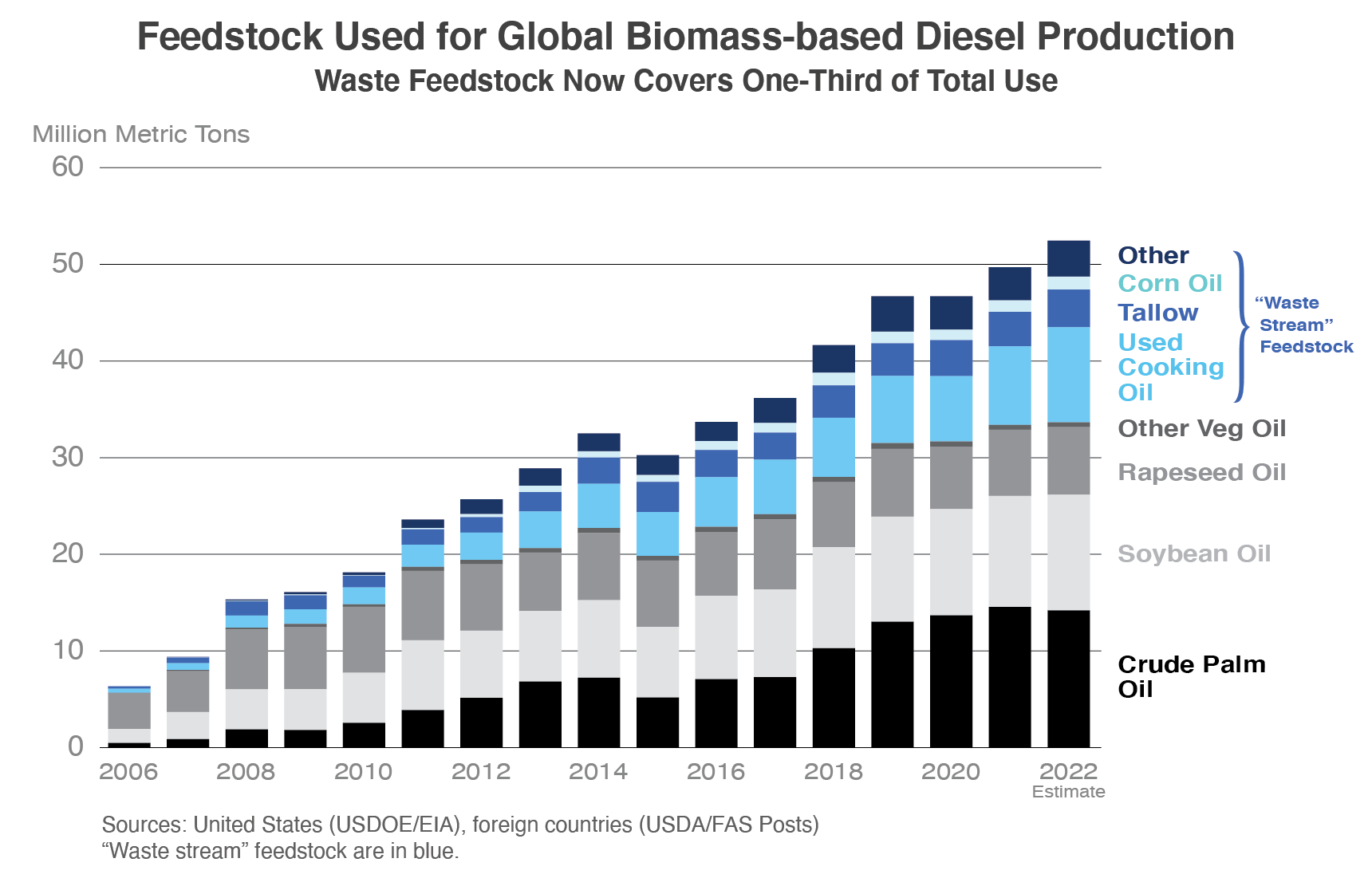

With the recent increase in BBD demand, spurred by Indonesian expansion, Europe’s push toward renewable energy, including SAF, and the United States’ new SAF tax credits and low-carbon fuel standards, concerns have risen over price effects and the global availability of feedstock. Global fats and oils used in BBD (see graph) are concentrated in North America, Europe, Indonesia, and Brazil, and industry will continue to rely on them this decade until novel oilseed feedstock, such as winter cover crops, can be harnessed. “Waste” feedstock, including used cooking oil, tallow, and corn oil coproducts from ethanol plants, now covers one-third of total use. Trade also plays some role in moving fats and oils to centers of greatest demand, especially to feedstock-scarce Europe. Trade’s role in supplying feedstock may grow in importance as demand for clean transport fuel rises faster than new domestic production of fats and oils.