Wheat 2021 Export Highlights

Top 10 Export Markets for U.S. Wheat(values in million USD) |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Mexico | 852 | 662 | 812 | 778 | 1,294 | 66% | 880 |

| Philippines | 555 | 642 | 708 | 827 | 871 | 5% | 721 |

| China | 351 | 106 | 56 | 570 | 803 | 41% | 377 |

| Japan | 714 | 717 | 609 | 635 | 702 | 11% | 675 |

| Nigeria | 372 | 193 | 473 | 311 | 504 | 62% | 371 |

| Korea, South | 328 | 363 | 300 | 355 | 496 | 40% | 368 |

| Taiwan | 295 | 267 | 324 | 309 | 304 | -2% | 300 |

| Colombia | 173 | 88 | 137 | 133 | 193 | 45% | 145 |

| Thailand | 175 | 180 | 162 | 171 | 187 | 9% | 175 |

| Yemen | 84 | 103 | 168 | 193 | 154 | -20% | 140 |

| All Others | 2,159 | 2,066 | 2,484 | 2,022 | 1,739 | -14% | 2,094 |

| Total Exported | 6,058 | 5,387 | 6,232 | 6,303 | 7,246 | 15% | 6,245 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2021, the value of U.S. wheat exports to the world reached $7.3 billion, up 15 percent from 2020 due to higher unit values. The top three markets, accounting for 40 percent of sales, were Mexico at $1.3 billion, the Philippines at $871 million, and China at $803 million. Rising unit prices more than offset lower export volumes. The United States faced tight supplies and increased international competition in Western Hemisphere and Asian markets.

Drivers

- Mexico, the Philippines, and Japan continue to be consistent buyers of U.S. wheat, accounting for 46 percent of total U.S. wheat exports.

- Mexico was the largest growth market for U.S. wheat in 2021 with stronger shipment volumes and higher prices.

- China’s imports reached the highest in 25 years with strong demand for feed use and increased public sector purchases.

- Global wheat prices surged in 2021 as tight supplies in Canada and the United States limited global exportable supplies amidst strong import demand, especially from the Middle East and North Africa.

- A major challenge for U.S. wheat was competition from Black Sea suppliers and the EU in price-sensitive markets in Africa and the Middle East, as well as renewed competition from Australia’s bumper crop in East and Southeast Asian markets.

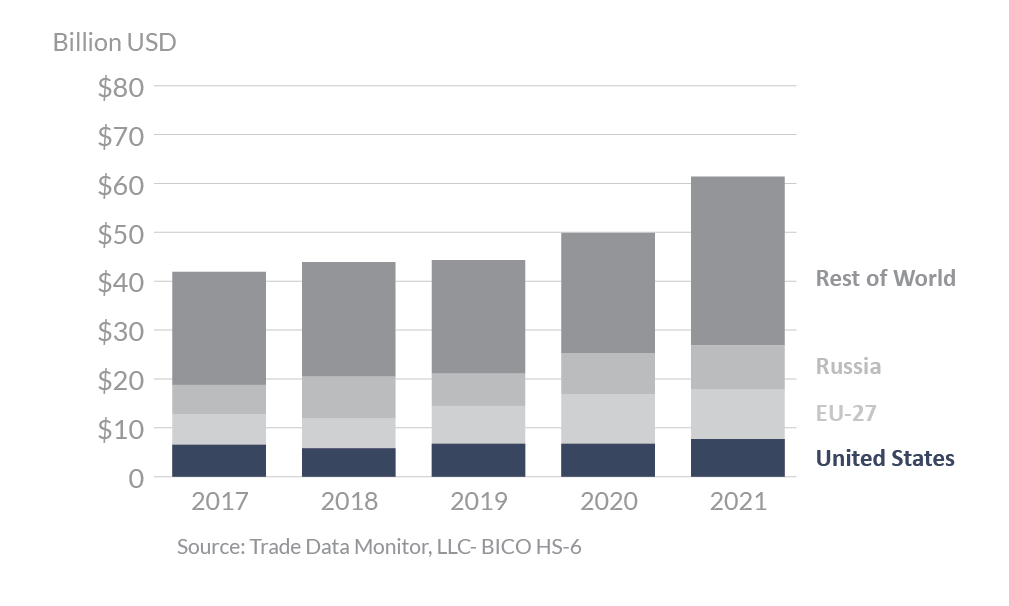

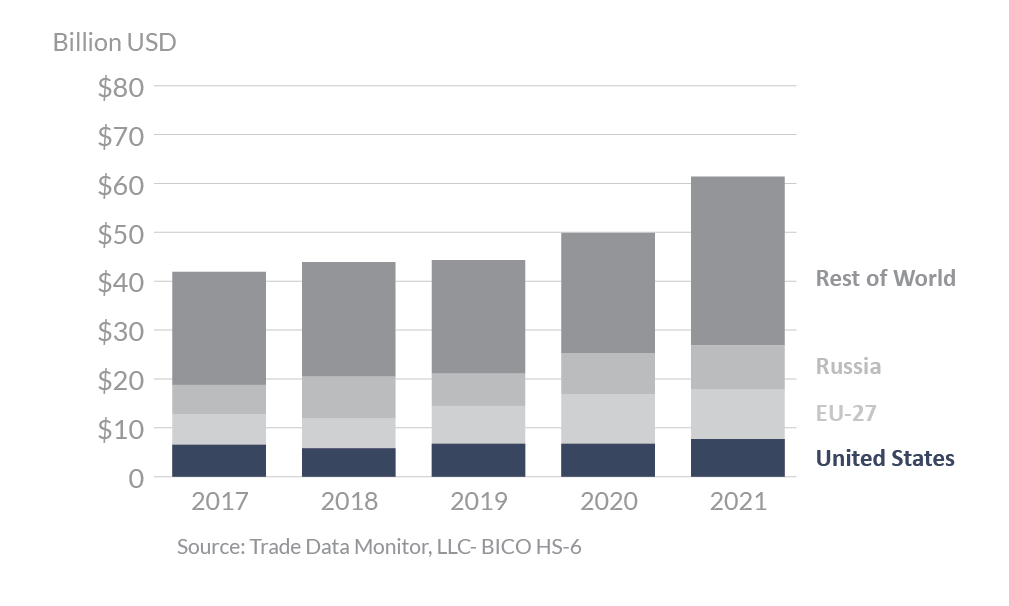

Global Wheat Exports

Looking Ahead

Global trade in wheat is expected to grow in years to come, with increased demand from Africa, the Middle East, and Southeast Asia. Major competitors to the United States will be Russia, Canada, Australia, Ukraine, and the EU. India has also transformed into a major global exporter in recent years, mostly shipping to South and Southeast Asia. Global wheat supplies are expected to expand in 2022 with larger crops from many major wheat producers and exporters.

The United States is likely to continue as a major supplier of wheat to much of Latin America and East and Southeast Asia, with Mexico, the Philippines, and Japan expected to be strong, reliable markets for U.S. wheat. Larger crops from major competitors, however, may limit U.S. wheat exports to more price-sensitive markets in Africa, Middle East, and Southeast Asia. China’s strong demand for imported wheat is expected to continue into 2022, which may offset losses in other markets due to increased international competition.