Wheat 2020 Export Highlights

Top 10 Export Markets for U.S. Wheat(values in million USD) |

|||||||

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Change | 2016-2020 Average |

| Philippines | 592 | 555 | 642 | 708 | 826 | 17% | 665 |

| Mexico | 612 | 852 | 662 | 812 | 778 | -4% | 743 |

| Japan | 604 | 714 | 717 | 609 | 635 | 4% | 656 |

| China | 205 | 351 | 106 | 56 | 570 | 926% | 258 |

| South Korea | 248 | 328 | 363 | 300 | 340 | 13% | 316 |

| Nigeria | 265 | 372 | 193 | 473 | 312 | -34% | 323 |

| Taiwan | 257 | 295 | 267 | 324 | 311 | -4% | 291 |

| Indonesia | 192 | 298 | 177 | 282 | 275 | -3% | 245 |

| EU27+UK | 165 | 153 | 210 | 210 | 246 | 17% | 197 |

| Yemen | 92 | 84 | 103 | 168 | 195 | 16% | 128 |

| All Others | 2,113 | 2,055 | 1,946 | 2,290 | 1,810 | -21% | 2,043 |

| Total Exported | 5,346 | 6,058 | 5,387 | 6,232 | 6,298 | 1% | 5,864 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2020, the value of U.S. wheat exports to the world reached $6.3 billion, up 1 percent from 2019 due to increased demand from China. The top three markets, accounting for 36 percent of sales, were the Philippines at $826 million, Mexico at $778 million, and Japan at $635 million. Increased demand from China offset stronger competition from Russia and Canada in key markets including Nigeria.

Drivers

- Mexico, the Philippines, Japan, and South Korea continue as consistent buyers of U.S. wheat, accounting for 41 percent of total U.S. wheat exports.

- China was the largest growth market for U.S. wheat in 2020. U.S. wheat exports to China shrunk to $56 million in 2019 but surged to $570 million in 2020, a ten-fold increase

- The extension of Brazil’s wheat tariff rate quota (TRQ) for non-Mercosur countries, along with reduced competition from Argentina, allowed U.S. wheat to expand its market share in Brazil. U.S. wheat exports to Brazil were $159 million in 2020, up 84 percent from 2019.

- A major challenge for U.S. wheat was competition from major exporting countries in price-sensitive markets in Africa and the Middle East.

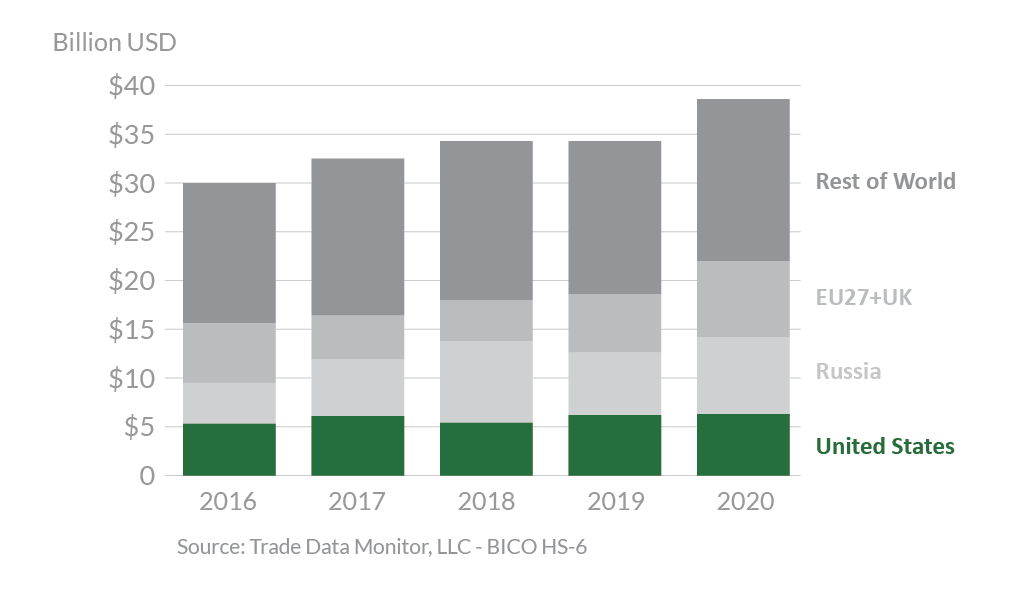

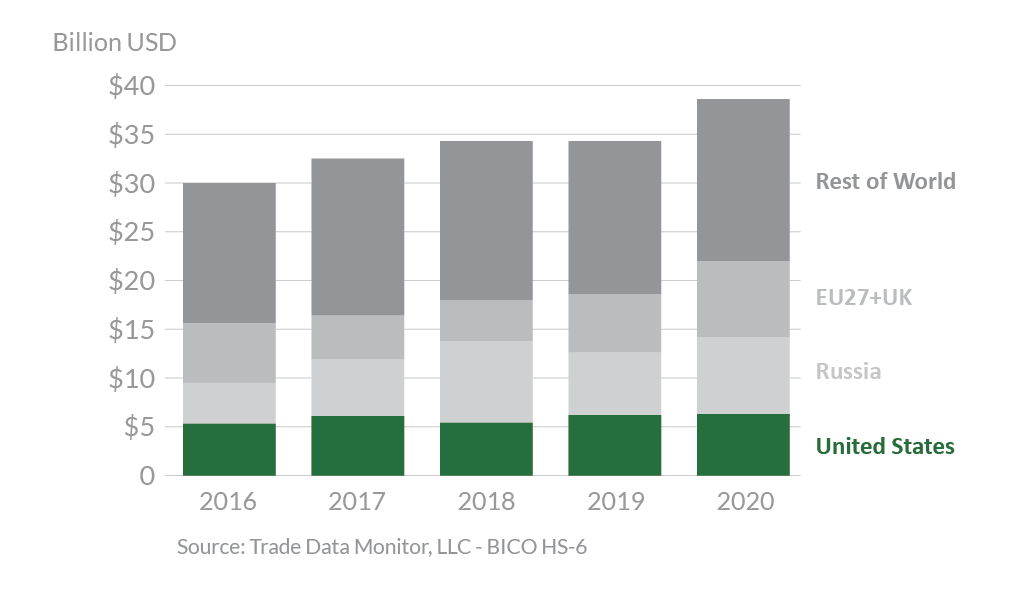

Global Wheat Exports

Looking Ahead

Global trade in wheat is expected to grow in years to come, with major competitors to the United States being Russia, Canada, Australia, Ukraine, and the European Union. The United States is likely to continue as a major supplier of wheat to much of Latin America and East & Southeast Asia, with Mexico, the Philippines, and Japan expected to be strong, reliable markets for U.S. wheat.

U.S. competitiveness in core markets during 2021 is likely to remain strong based on continued demand from China and export restrictions in Russia. The Russian government will implement an indefinite floating export tax on wheat that may limit the country’s production and exports. This could offer an opportunity for U.S. wheat to expand its exports to markets where Russia has maintained a price advantage. However, the European Union is expected to have abundant exportable supplies amid a larger crop. Considering this competition, U.S. exports to Africa and the Middle East may face challenges in 2021. China is expected to have strong demand for imported wheat in 2021, and the United States will likely continue expanding exports there. Brazil’s 750,000-ton TRQ was recently extended for another year, offering additional export opportunities for U.S. wheat in South America.