South Korea 2021 Export Highlights

Top 10 U.S. Agricultural Exports to South Korea(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Beef & Beef Products | 1,220 | 1,746 | 1,843 | 1,714 | 2,383 | 39% | 1,781 |

| Corn | 705 | 1,356 | 359 | 548 | 858 | 57% | 765 |

| Pork & Pork Products | 475 | 670 | 593 | 453 | 557 | 23% | 549 |

| Wheat | 328 | 363 | 300 | 355 | 496 | 40% | 368 |

| Food Preparations | 283 | 313 | 471 | 419 | 493 | 18% | 396 |

| Fresh Fruit | 493 | 494 | 405 | 455 | 436 | -4% | 457 |

| Dairy Products | 279 | 290 | 330 | 370 | 426 | 15% | 339 |

| Tree Nuts | 306 | 290 | 291 | 295 | 345 | 17% | 305 |

| Ethanol (non-beverage) | 91 | 134 | 196 | 170 | 343 | 102% | 187 |

| Distillers Grains | 161 | 236 | 252 | 271 | 317 | 17% | 248 |

| All Others | 2,645 | 2,588 | 2,701 | 2,657 | 2,729 | 3% | 2,664 |

| Total Exported | 6,987 | 8,481 | 7,742 | 7,707 | 9,382 | 22% | 8,060 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

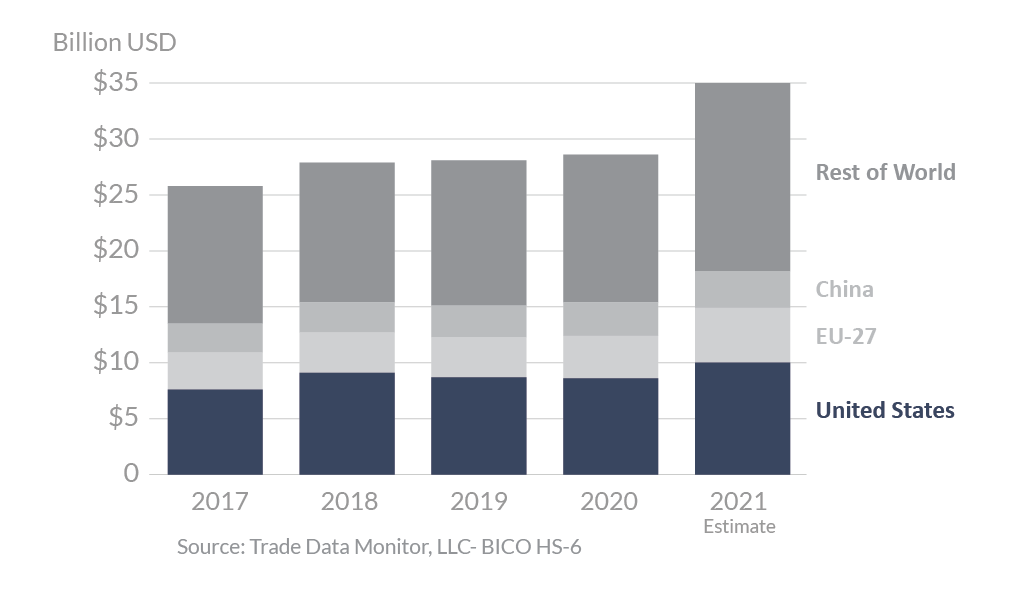

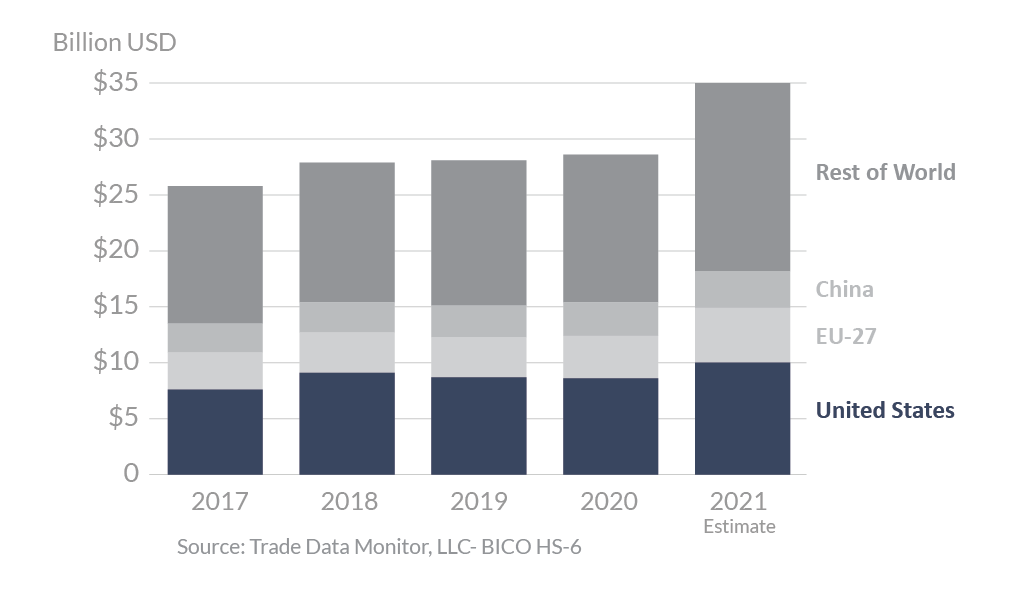

In 2021, South Korea was the sixth-largest export destination for U.S. products, with exports totaling nearly $9.4 billion, a 22-percent increase over 2020. The United States is South Korea’s top supplier of agricultural goods by a wide margin, representing 28 percent of the total import market. The EU, the second largest exporter, has a 14-percent market share. The U.S. – Korea Free Trade Agreement (KORUS FTA) expanded export opportunities for many U.S. agricultural products. This is particularly true for U.S. beef, the top exported product, and the highest growth with a $669 million (39 percent) increase in 2021 over 2020. Exports of corn, ethanol, and wheat also performed well, increasing by $310 million, $173 million, and $141 million respectively. Most top commodities performed well, with only fresh fruit declining by $19 million. South Korea was the top export destination for U.S. beef, third largest for fresh fruit, and fifth largest for corn and pork.

Drivers

- South Korea’s GDP declined slightly by 0.9 percent in 2020 due to the COVID pandemic but grew by 3.9 percent in 2021, contributing to significant increases in food and agricultural imports.

- U.S. agricultural exports to South Korea reached record levels in 2021, and exports of most products were up. Much of the increase can be attributed to the strength of U.S. exports of meat products like beef and pork, and bulk products like corn and wheat.

- U.S. beef exports continue to drive trade to South Korea. South Korea’s preference for high marbling and competitive pricing will continue to grow demand for high-quality U.S. beef.

- South Korea’s announced goal of achieving carbon neutrality has driven imports of ethanol.

South Korea’s Agricultural Suppliers

Looking Ahead

South Korea remains one of the largest destinations for U.S. agricultural exports. The U.S. trade value to South Korea is expected to remain positive in 2022. Rising incomes and a growing, advanced economy continue to fuel consumers’ appetite for quality U.S. agricultural products. Moreover, the advantages of KORUS will continue to stimulate demand as the agreement passes its 10-year anniversary and tariffs are further reduced for a wide range of agricultural products. However, U.S. products face strong competition from other exporting countries due to the recent economic slowdown due to the COVID-19 pandemic as consumers become more price sensitive, favoring lower price competitors.