Poultry 2021 Export Highlights

Top 10 Export Markets for U.S. Poultry Meat*(values in million USD) |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Mexico | 933 | 956 | 1,077 | 983 | 1,331 | 35% | 1,056 |

| China | 36 | 47 | 10 | 759 | 879 | 16% | 346 |

| Canada | 459 | 406 | 354 | 350 | 391 | 12% | 392 |

| Cuba | 165 | 155 | 190 | 144 | 280 | 95% | 187 |

| Guatemala | 118 | 123 | 132 | 111 | 173 | 55% | 131 |

| Taiwan | 152 | 189 | 187 | 223 | 167 | -25% | 184 |

| Philippines | 92 | 111 | 102 | 64 | 147 | 130% | 103 |

| Angola | 156 | 184 | 150 | 81 | 130 | 60% | 140 |

| Colombia | 70 | 82 | 114 | 93 | 117 | 26% | 95 |

| Haiti | 65 | 65 | 56 | 69 | 111 | 61% | 73 |

| All Others | 2,020 | 1,956 | 1,871 | 1,364 | 1,525 | 12% | 1,747 |

| Total Exported | 4,267 | 4,274 | 4,243 | 4,242 | 5,250 | 24% | 4,455 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excluding eggs

Highlights

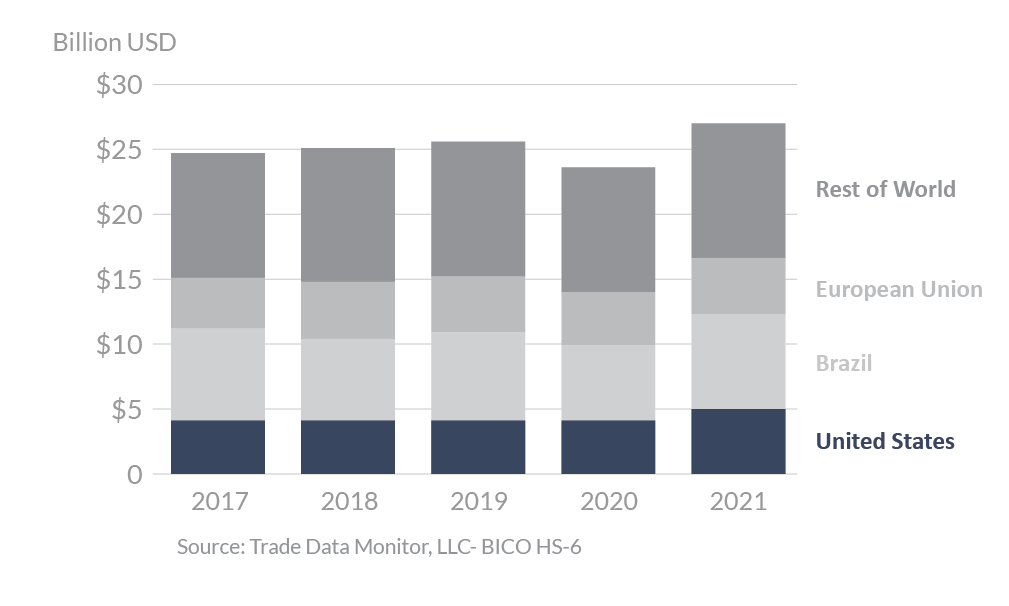

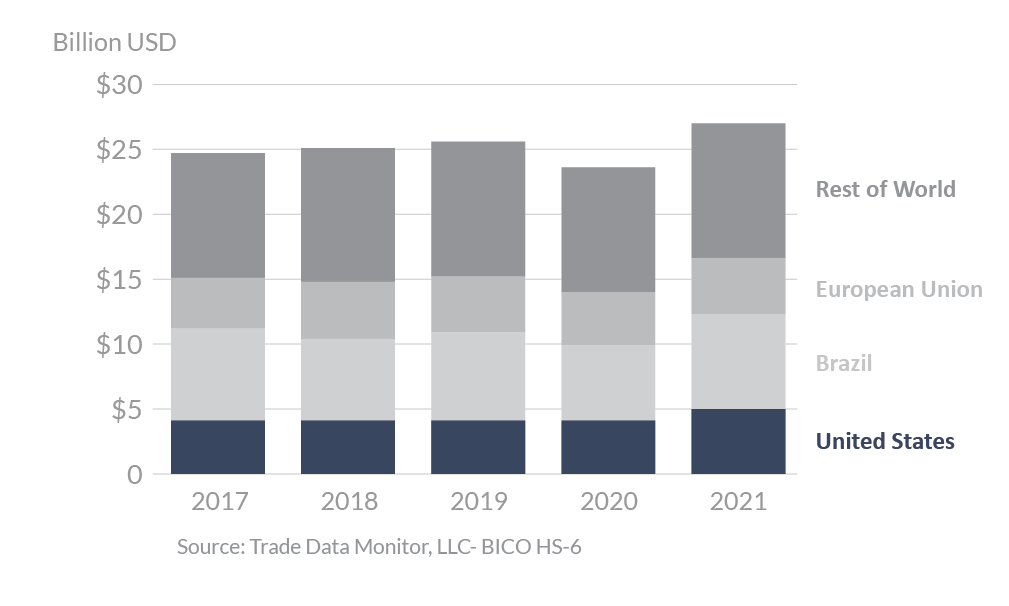

In 2021, the value of U.S. poultry and poultry products exports increased 24 percent with growth in all major markets except Taiwan. However, expansion was driven by elevated prices as volumes remained flat (1 percent higher). U.S. broiler meat exportable supplies were constrained as production grew by less than just 1 percent in 2021. In addition, shipping challenges and a sluggish global economy in the wake of the COVID-19 pandemic also limited greater volumes. Mexico remained the largest U.S. market for poultry meat as demand continued an upward trajectory despite all-time high prices, deteriorating consumer purchasing power, and a nascent economic recovery. Although average Mexican meat expenditures as a share of total household food expenditures was reportedly lower, consumption was higher as rising demand from high- and middle-income consumers more than offset falling demand among lower-income consumers. Similarly, U.S. poultry meat continued to achieve success in developing markets such as Cuba, Guatemala, Angola, Colombia, and Haiti as consumers favored chicken as a relatively low-cost animal protein amid economic turbulence. Exports to China were buoyed by strong demand for chicken paws which comprise the majority (80 percent) of poultry and products shipments, with prices ramping up during 2021.

Drivers

- China continues to demonstrate its importance to buoying U.S. poultry and poultry product exports. Most shipments are chicken paws, a product for which there is virtually no other significant market. U.S. exports of chicken paws to China accounted for 13 percent of total U.S. poultry and product exports in 2021.

- The United States continued to face market access issues in South Korea, South Africa, and Saudi Arabia due to non-tariff barriers and purported sanitary issues.

- Competition from leading world exporter Brazil continues to be robust in many markets.

Global Poultry Meat Exports

Looking Ahead

For 2022, only a marginal increase in U.S. broiler meat production is forecast which will again constrain exportable supplies. With no relief to elevated feed prices in sight for the coming year, anticipated higher chicken prices will constrain export expansion. While short term gains may be limited, medium and long-term growth will be supported by a growing world population and rising incomes, particularly in low- and middle-income countries. The United States continues to emphasize that risk-based analysis and sound science are the best ways to approach long-standing challenges, including regionalization in the event of outbreaks of highly pathogenic avian influenza, and establishment of veterinary drug standards.