Pork and Pork Products 2021 Export Highlights

Top 10 Export Markets for U.S. Pork(values in million USD) |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| China | 662 | 571 | 1,300 | 2,280 | 1,698 | -26% | 1,302 |

| Japan | 1,626 | 1,631 | 1,523 | 1,623 | 1,694 | 4% | 1,619 |

| Mexico | 1,514 | 1,311 | 1,278 | 1,153 | 1,675 | 45% | 1,386 |

| Canada | 793 | 765 | 802 | 854 | 952 | 12% | 833 |

| Korea, South | 475 | 670 | 593 | 453 | 557 | 23% | 550 |

| Colombia | 163 | 215 | 221 | 147 | 258 | 76% | 201 |

| Philippines | 98 | 116 | 93 | 114 | 204 | 78% | 125 |

| Australia | 208 | 227 | 302 | 253 | 197 | -22% | 237 |

| Dominican Republic | 71 | 93 | 78 | 90 | 151 | 67% | 96 |

| Honduras | 54 | 59 | 67 | 73 | 115 | 57% | 74 |

| All Others | 821 | 745 | 694 | 670 | 607 | -9% | 707 |

| Total Exported | 6,485 | 6,403 | 6,951 | 7,711 | 8,107 | 5% | 7,131 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2021, the value of U.S. pork and pork product exports to the world reached a record $8.1 billion, up 5 percent from the prior year as stronger prices offset lower volumes. The top three markets, accounting for 63 percent of exports, were China, Japan, and Mexico – each importing approximately $1.7 billion of pork. China remained the top market for U.S. pork despite a sharp decline in shipments after a record high in 2020. Meanwhile, pork exports to Mexico rebounded on pent-up consumer demand and a stronger peso. A better economic and foodservice environment, coupled with less demand in China, allowed U.S. pork exports to a variety of markets to rebound after depressed demand in 2020. In the Philippines, shortages due to ASF in domestic supplies and more favorable import policies saw U.S. pork exports surge 79 percent to surpass $200 million for the first time.

Drivers

- Shipments to China were lower year-over-year in every month of 2021 as its recovering domestic supplies and a tariff rate disadvantage weighed on U.S. pork exports.

- U.S. pork exports to China dropped below $100 million per month in October for the first time since June 2019 and remained there throughout 2021.

- Despite overall declining pork exports to China, pork variety meat exports continued to grow, rising 44 percent from 2020 on strong consumer demand.

- U.S. pork prices surged on tighter domestic supplies, causing the value of exports to rise despite volumes being down 2 percent from the year prior.

- As economic and foodservice conditions recovered, U.S. shipments to most major markets saw significant recovery, especially in the Western Hemisphere where U.S. pork holds large market share.

- U.S. pork exports to several Latin American markets were at record levels, including Mexico, Colombia, and the CAFTA-DR region.

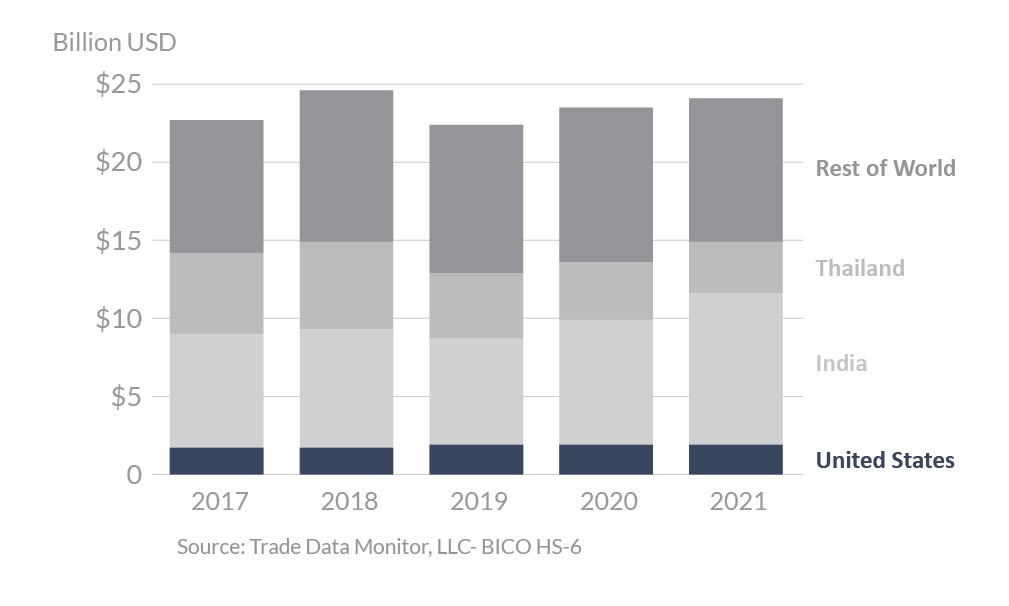

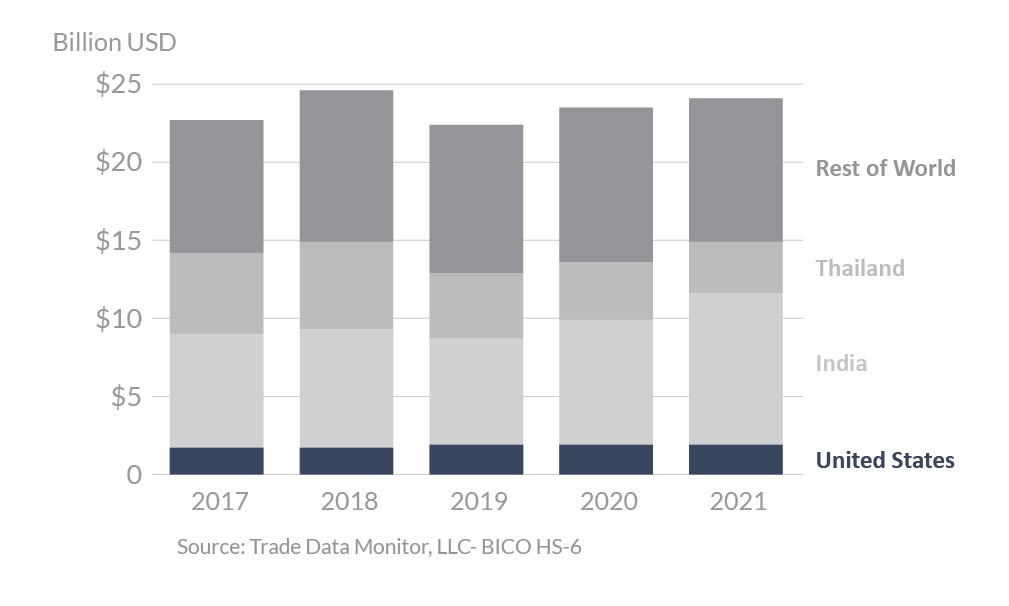

Global Pork Exports

Looking Ahead

In recent years, global pork trade increased dramatically as China sought to offset supply deficits caused by ASF. As pork production in China recovers and import demand wanes, exporters will be hard pressed to find alternative markets capable of absorbing such large amounts of pork. This will likely increase competition to place product, particularly in Asian markets, and create headwinds for U.S. pork exports in 2022. However, the U.S. maintains a large market share and duty-free access to many Latin American markets under a variety of trade agreements – which should help partially offset challenges in Asia as demand in these Western Hemisphere markets continues to grow.