Japan 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Japan(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Corn | 2,163 | 2,813 | 2,011 | 1,844 | 3,187 | 73% | 2,404 |

| Beef & Beef Products | 1,889 | 2,102 | 1,950 | 1,940 | 2,376 | 22% | 2,052 |

| Pork & Pork Products | 1,626 | 1,631 | 1,523 | 1,623 | 1,694 | 4% | 1,619 |

| Soybeans | 973 | 927 | 971 | 1,064 | 1,350 | 27% | 1,057 |

| Wheat | 714 | 717 | 609 | 635 | 702 | 11% | 675 |

| Hay | 414 | 426 | 491 | 485 | 517 | 7% | 467 |

| Processed Vegetables | 521 | 509 | 507 | 475 | 485 | 2% | 499 |

| Tree Nuts | 398 | 434 | 416 | 386 | 440 | 14% | 415 |

| Dairy Products | 291 | 269 | 282 | 322 | 376 | 17% | 308 |

| Fresh Fruit | 316 | 319 | 323 | 314 | 301 | -4% | 315 |

| All Others | 2,821 | 2,993 | 2,917 | 2,626 | 2,815 | 7% | 2,835 |

| Total Exported | 12,127 | 13,140 | 12,000 | 11,715 | 14,244 | 22% | 12,645 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2021, Japan was the fourth-largest export destination for U.S. agricultural products, importing $14.2 billion. This was a 22-percent increase over 2020. The United States is Japan’s top supplier of agricultural goods, with a market share of 24 percent. The U.S.-Japan Trade Agreement (USJTA) completed its second year of implementation, which led to meaningful tariff reductions on U.S. agricultural products. The largest year-to-year export increase was seen in corn products, a $1.3 billion (73 percent) increase over last year. U.S. exports of beef and beef products, and soybeans, also performed well, increasing by $436 million and $287 million, respectively. Commodities showing declines in 2021 were other coarse grains (mostly sorghum and barley), down $50 million, and fresh fruit, down $13 million. Japan was the second-largest export destination for U.S. fruit and vegetable juices, beef and beef products, hay, processed vegetables, pork and pork products, and rice.

Drivers

- Exports of U.S. agricultural goods to Japan remained stable in 2021 due to consistent demand, while increases in prices for higher-value commodities limited growth in exports by volume.

- High global prices, a weak yen, and higher global freight costs limited Japanese imports and demand for feed commodities, including corn.

- Uncertainty surrounding the negotiations for the revision of the beef safeguard established in USJTA, along with higher global prices, dampened demand of U.S. beef products in Japan.

- Overall lack of inflation in Japan contributed to a resistance to raise food prices, despite general increases in global commodity prices, creating unique challenges for the Japanese food service industry.

- Under USJTA, nearly 90 percent of U.S. food and agricultural products are duty free or receive preferential tariff access.

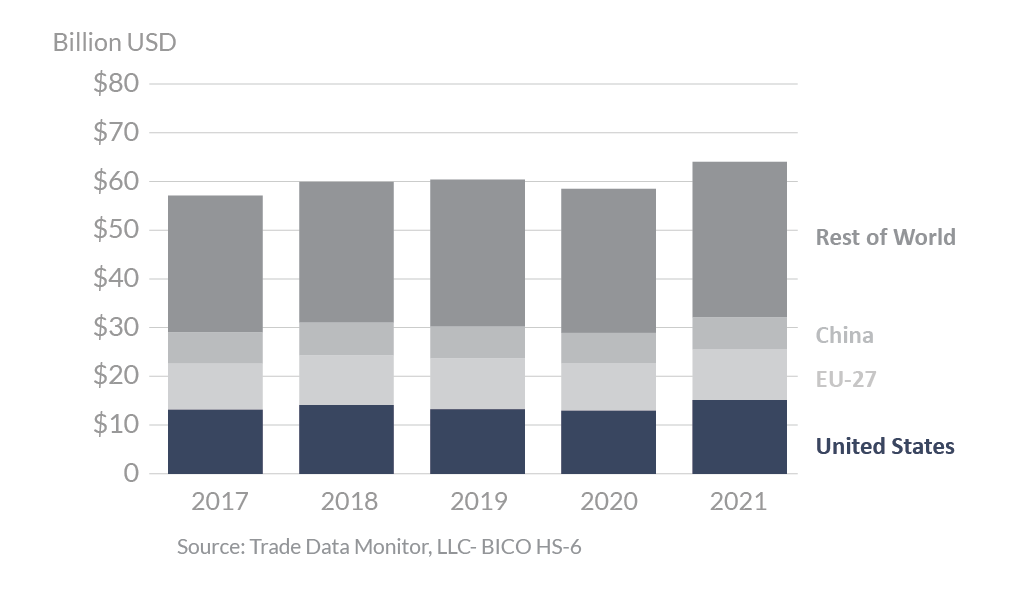

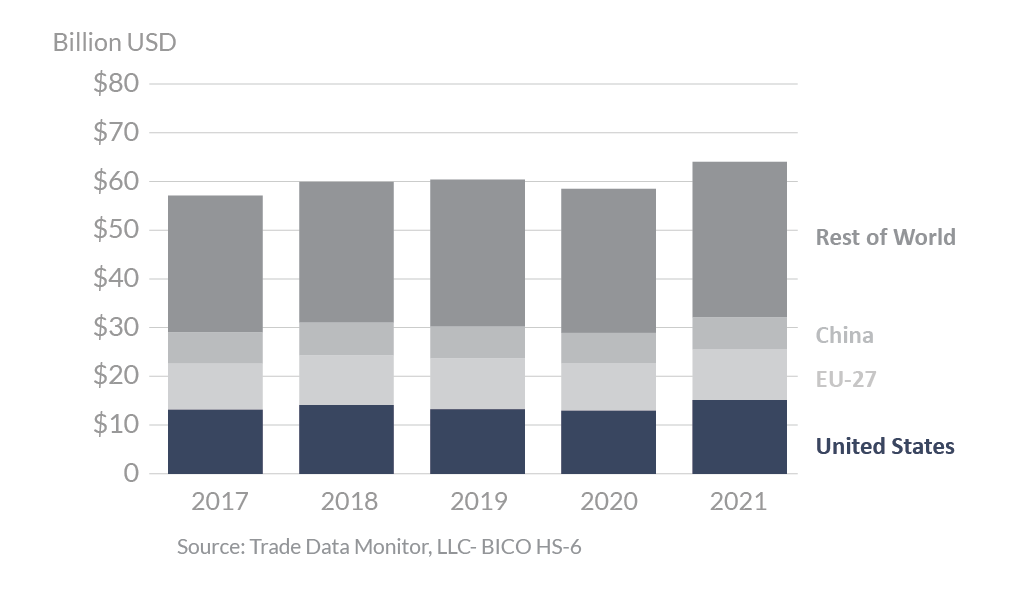

Japan’s Agricultural Suppliers

Looking Ahead

Japan’s agricultural import market will continue to liberalize through the reduction of tariffs for producers in the United States as well as competing nations that benefit from preferential trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Japan – European Union Economic Partnership Agreement. Outstanding issues, such as the revision to the beef safeguard mechanism established in the USJTA, are likely to be resolved in 2022, while other barriers for U.S. agricultural exports to Japan remain. The United States will continue to work with Japan to address long-standing trade barriers to provide further access for U.S. producers.