Japan 2019 Export Highlights

Top 10 U.S. Agricultural Exports to Japan(values in million USD) |

|||||||

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Corn | 2,022 | 2,091 | 2,145 | 2,813 | 1,977 | -30% | 2,210 |

| Beef & Beef Products | 1,284 | 1,510 | 1,889 | 2,102 | 1,950 | -7% | 1,747 |

| Pork & Pork Products | 1,565 | 1,553 | 1,626 | 1,631 | 1,523 | -7% | 1,580 |

| Soybeans | 1,048 | 1,001 | 974 | 927 | 965 | 4% | 983 |

| Wheat | 747 | 604 | 714 | 717 | 608 | -15% | 678 |

| Processed Vegetables | 459 | 477 | 510 | 502 | 500 | 0% | 489 |

| Tree Nuts | 480 | 374 | 398 | 433 | 416 | -4% | 420 |

| Hay | 424 | 374 | 415 | 426 | 490 | 15% | 426 |

| Fresh Fruit | 299 | 344 | 316 | 318 | 324 | 2% | 320 |

| Dairy Products | 273 | 206 | 291 | 270 | 283 | 5% | 265 |

| All Other | 2,533 | 2,496 | 2,620 | 2,791 | 2,685 | -4% | 2,625 |

| Total Exported | 11,135 | 11,030 | 11,897 | 12,930 | 11,721 | -9% | 11,742 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

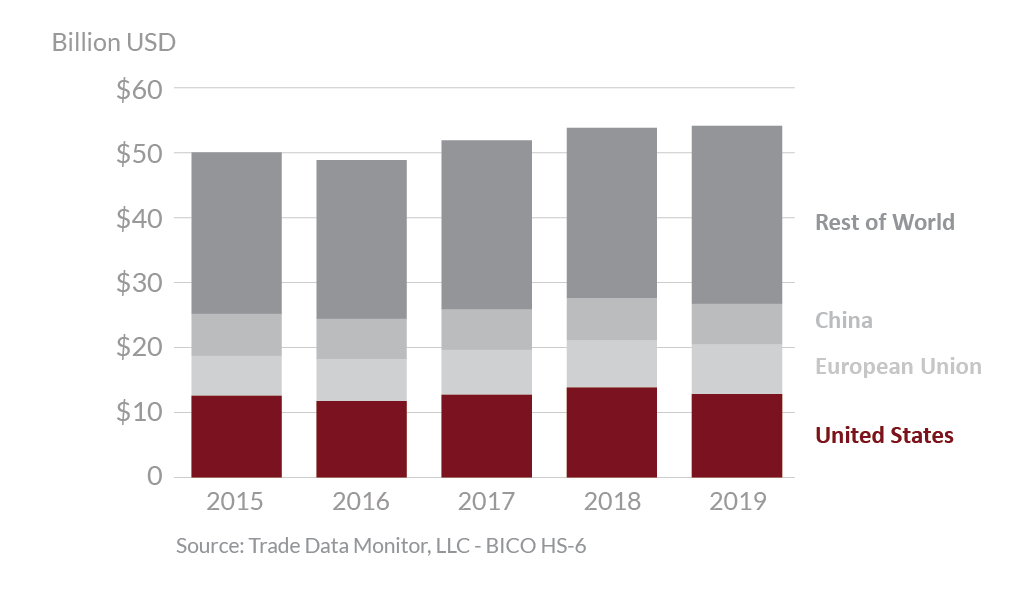

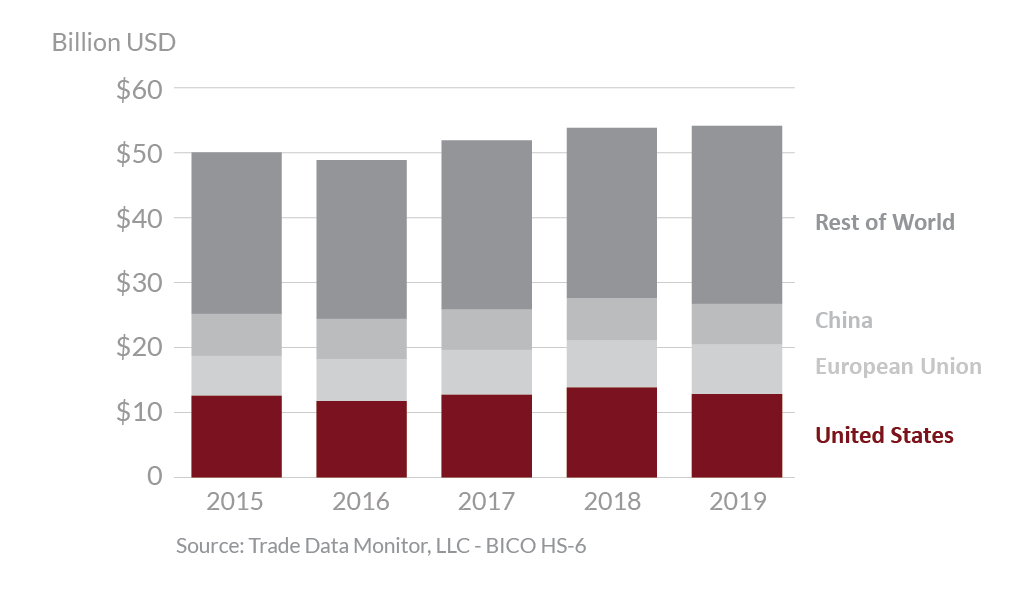

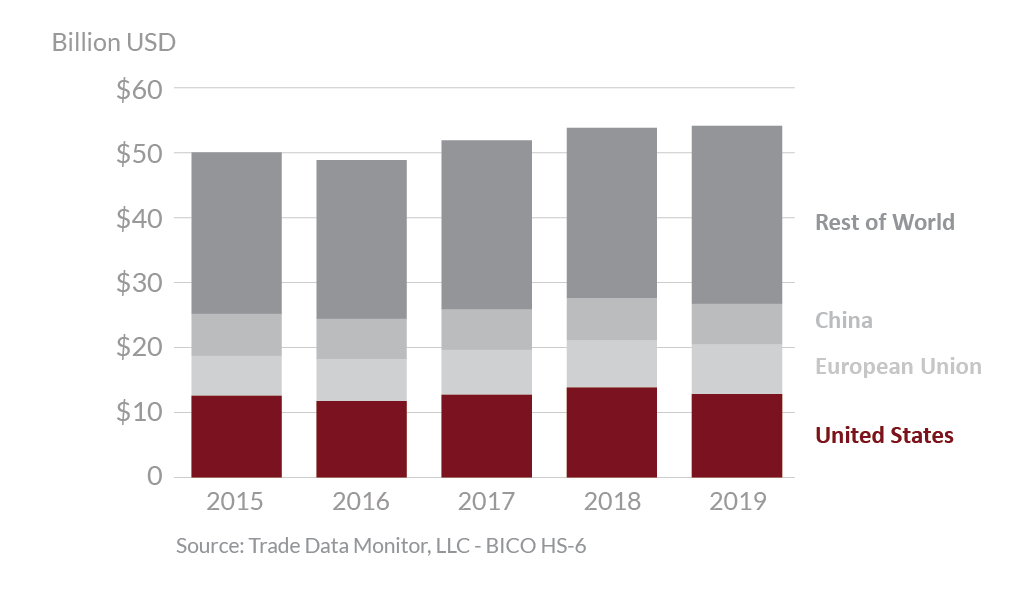

In 2019, Japan was the fifth largest destination for U.S. agricultural exports, which totaled $11.7 billion, a 9 percent decrease from 2018. The United States continued to be Japan’s top supplier of agricultural goods with 24 percent market share, followed by the European Union with 14 percent. The quality, reliability and reputation of U.S. products have been competitive in Japan for many decades. The largest export growth in 2019 was seen in hay and rice, up $64 million and $43 million, respectively. Additionally, increases in exports of soybeans, wine and beer, and live animals were up $37 million, $20 million, and $15 million, respectively. The most notable impact in 2019 was that exports of corn were down by more than $836 million. Exports of beef & beef products, wheat, and pork & pork products were down $152 million, $109 million, and $107 million, respectively. Despite these decreases, Japan in 2019 was the top market for U.S. beef and beef products, pork and pork products, rice, and hay.

Drivers

-

A 30 percent decrease in exports of corn were due to US corn prices hitting 5-year highs as a result of unprecedented planting delays, while other exporters – Argentina, Brazil, and Ukraine- had record exportable supplies

-

Overall U.S. agricultural exports to Japan declined 9.4 percent in 2019 as the United States faced tariff disadvantages compared to other major suppliers including the European Union and members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

-

In May 2019, Japan formally removed the requirement that U.S. beef be derived from cattle less than 30 months of age, allowing beef from cattle of any age to be exported to Japan for the first time since 2003.

-

Japan relies heavily on imported feed and is an important, stable market for U.S. corn, soybeans and hay for feed exports. The United States was Japan’s largest supplier of corn, soybeans and hay for feed in 2019.

-

U.S. wheat exports to Japan fell by 15 percent from 2018 levels and Japan dropped out of the top two export markets for U.S. wheat for the first time this decade.

Japan's Agricultural Suppliers

Looking Ahead

Exports of key U.S. agricultural products are expected to increase following implementation of the U.S.-Japan Trade Agreement on January 1, 2020. Tariff parity with major beef, pork, and wheat competitors eliminated disadvantages U.S. producers previously faced in the Japanese market. However, despite the successes achieved in the stage one portion of the agreement, multiple trade barriers exist. In the upcoming year, efforts will continue achieving a fair and reciprocal trading relationship with Japan, including increased access for U.S. agricultural products.