Indonesia 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Indonesia(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Soybeans | 922 | 998 | 868 | 887 | 1,085 | 22% | 952 |

| Dairy Products | 132 | 165 | 239 | 348 | 327 | -6% | 242 |

| Feeds, Meals & Fodders | 336 | 252 | 254 | 228 | 322 | 41% | 278 |

| Distillers Grains | 123 | 174 | 184 | 196 | 235 | 20% | 183 |

| Cotton | 498 | 600 | 417 | 257 | 218 | -15% | 398 |

| Beef & Beef Products | 54 | 62 | 85 | 72 | 118 | 65% | 78 |

| Wheat | 298 | 177 | 282 | 275 | 85 | -69% | 223 |

| Food Preparations | 71 | 69 | 88 | 84 | 80 | -5% | 78 |

| Soybean Meal | 28 | 123 | 12 | 94 | 55 | -41% | 62 |

| Fresh Fruit | 64 | 52 | 59 | 48 | 44 | -8% | 54 |

| All Others | 370 | 427 | 371 | 335 | 365 | 9% | 374 |

| Total Exported | 2,895 | 3,101 | 2,859 | 2,823 | 2,935 | 4% | 2,923 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

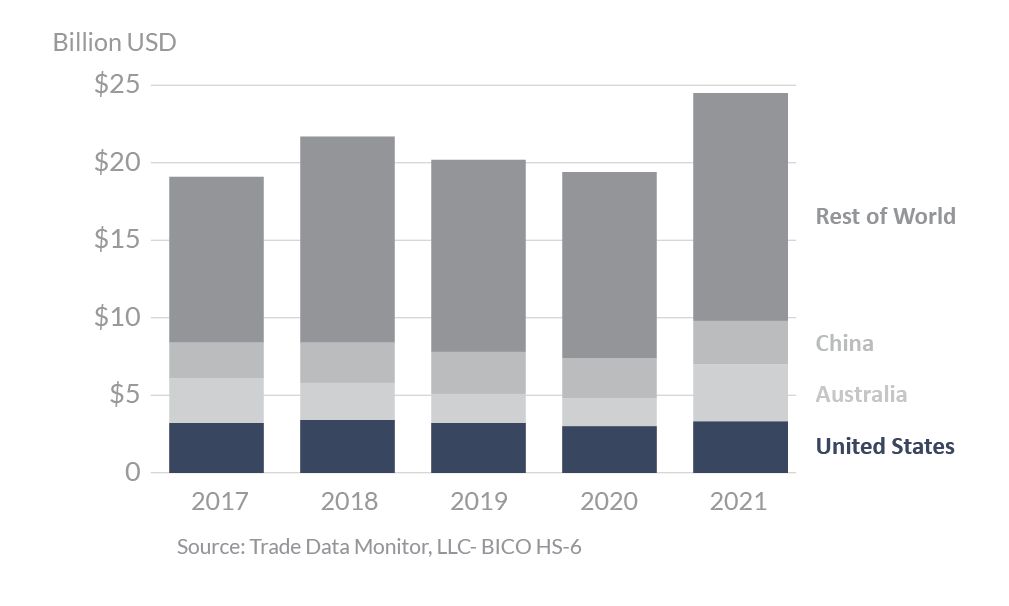

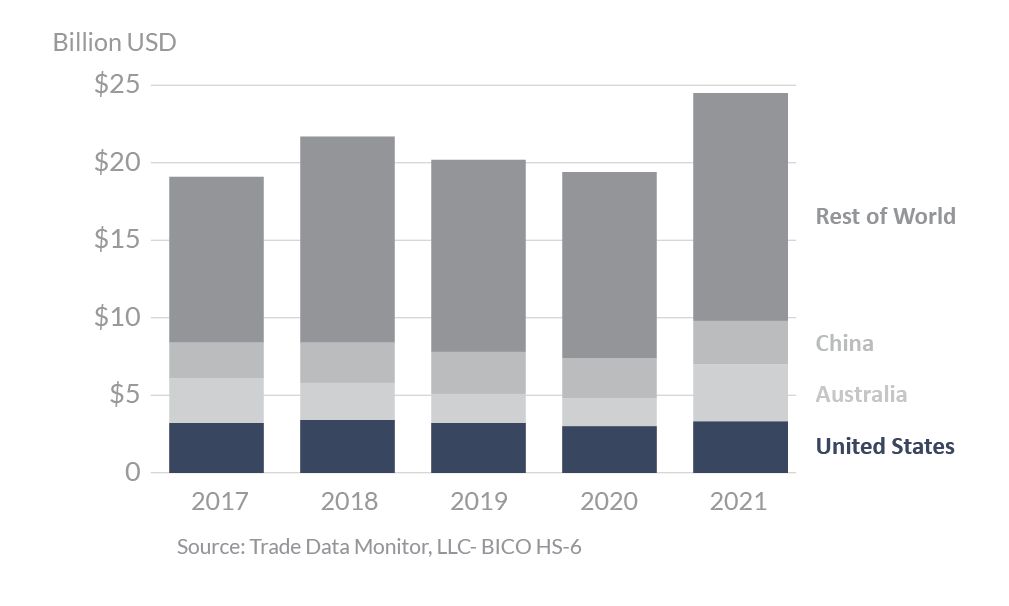

In 2021, Indonesia was the 11th-largest destination for U.S. agricultural exports, totaling $2.9 billion. This represents a 4-percent increase from 2020 and only a 5-percent decrease from a record-setting 2018. The United States is Indonesia’s second supplier of agricultural goods with 13-percent market share, just behind Australia who holds 15 percent. The United States is followed by China and India, with 11 percent and 9 percent respectively. Australia moved from fourth place to first with a substantial increase in wheat (511-percent increase) and cotton (521-percent increase) exports to Indonesia.

Indonesia is the largest economy in Southeast Asia, with a rapidly growing middle class. The largest increases in imports from the United States were seen in soybeans up $198 million from 2020 and a record-breaking increase in beef and beef products exporting more than $118 million. Soybeans continued to be the largest export product to Indonesia by a wide margin, reaching nearly $1.1 billion last year, a 22-percent increase over the previous year. Exports of cotton continued to decrease starting in 2020 and continuing last year with a further decrease of 15 percent ($39 million) after a record high in 2018.

Drivers

- U.S. soybeans saw its largest export to Indonesia in 5 years sending more than $1.1 billion in 2021. The United States is the top supplier of soybeans to Indonesia, with the U.S. supplying more than 90 percent of Indonesia’s soybean imports over the past 5 years.

- Beef and beef products reached a record high in exports to Indonesia in 2021. Beef and beef products have one of the best growth opportunities due to insufficient local production capacity to meet growing demand.

- Continued strong demand from Indonesia’s poultry sector drove strong growth in U.S. feed ingredients. Feeds, meals, and fodders saw an increase of $94 million since 2020.

- U.S. dairy exports to Indonesia have been growing at a compound annual growth rate of 25 percent since 2017 to reach $327 million in 2021. U.S. dairy exports comprise primarily skimmed milk powder and whey and whey products. The Indonesian import market for dairy products has been expanding at an annual average pace of 10 percent since 2017 and this growth is expected to continue a demand exceeds domestic milk production.

- The delay and shortage of shipping vessels/containers contributed to a decline in some categories of U.S. exports to Indonesia (e.g., cotton and dairy products). In addition, the rising cost of U.S. products forced some importers to source from cheaper suppliers, including China.

Indonesia’s Agricultural Suppliers

Looking Ahead

With an estimated population of 271 million, Indonesia is the fourth most populous country in the world and has the largest economy in Southeast Asia. Indonesia’s growing middle class provides excellent growth opportunities for U.S. exports. However, the country’s lack of transparency surrounding several market access restrictions generates uncertainty and roadblocks for U.S. exporters.

Indonesia maintains a complex and trade-restrictive system for obtaining permission to import agricultural commodities. The regulatory requirements for importing horticultural goods and beef products are opaque and conflicting. Despite the United States ultimately prevailing in 2017 on all 18 claims it raised in a WTO dispute settlement case regarding horticultural and meat import licenses, regulatory requirements remain burdensome. For the 2022 import license season, Indonesia began implementing a new commodity balances policy for salt, fish, and beef. In addition, Indonesia remained on course to implement its 5-year phased new halal requirements for food and beverages that began in October 2019 and will enter into force in 2024.

Indonesia lacks the capacity to sufficiently produce high-value agricultural inputs (e.g., soybeans, dairy, and cotton) needed to generate value-added products. So, despite the challenging regulatory environment, Indonesia’s limitations provide opportunities for U.S. exporters to capitalize on rising domestic demand for international products.