India 2021 Export Highlights

Top 10 U.S. Agricultural Exports to India(values in million USD) |

|||||||

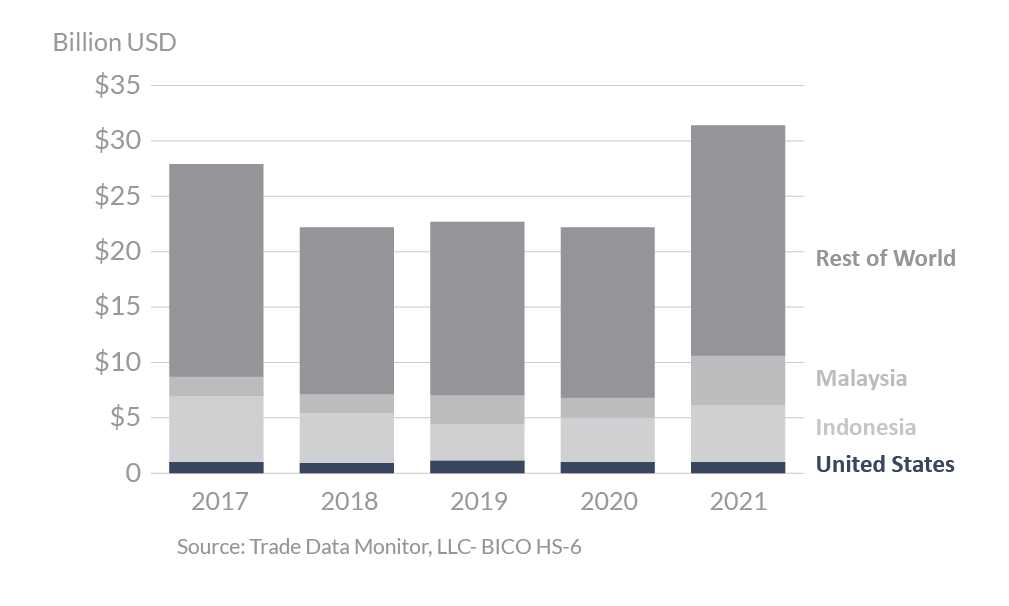

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Tree Nuts | 738 | 663 | 823 | 913 | 889 | -3% | 805 |

| Ethanol (non-beverage) | 281 | 258 | 287 | 293 | 267 | -9% | 277 |

| Cotton | 435 | 333 | 586 | 147 | 214 | 45% | 343 |

| Soybean Oil | 0 | 0 | 0 | 34 | 109 | 221% | 29 |

| Dairy Products | 43 | 48 | 60 | 34 | 33 | -2% | 44 |

| Essential Oils | 27 | 32 | 29 | 31 | 33 | 7% | 30 |

| Dextrins, Peptones, & Proteins | 41 | 54 | 40 | 25 | 29 | 15% | 38 |

| Food Preparations | 30 | 33 | 34 | 22 | 29 | 34% | 29 |

| Feeds, Meals & Fodders | 13 | 20 | 13 | 17 | 25 | 46% | 17 |

| Fresh Fruit | 104 | 162 | 62 | 41 | 24 | -41% | 79 |

| All Others | 186 | 163 | 193 | 187 | 150 | -20% | 176 |

| Total Exported | 1,898 | 1,765 | 2,127 | 1,744 | 1,802 | 3% | 1,867 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

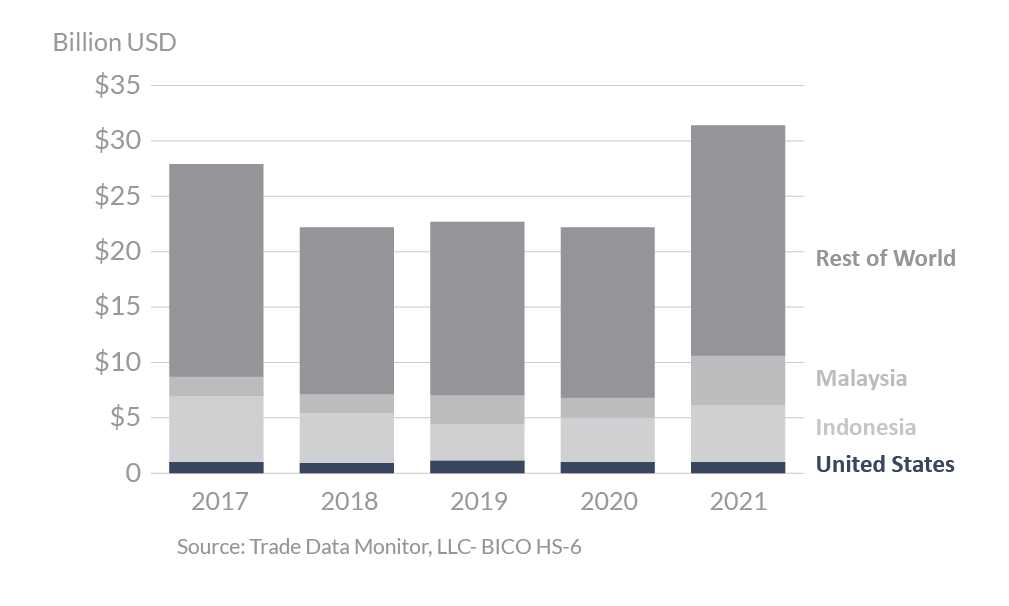

In 2021, India was the 13th-largest export destination for U.S. products, importing nearly $1.8 billion, a 3-percent increase over 2020. The United States is India’s fifth-largest supplier of agricultural goods, representing 5.2 percent of the total import market, behind Indonesia, Malaysia, Argentina, and Ukraine. Indonesia is the top supplier of agricultural products to India, representing 17.0 percent of all imported agricultural products. Malaysia, the second-largest exporter, has 14.0 percent import market share. Currently, there is no trade agreement between the United States and India. The largest year-to-year export increase was seen in soybean oil, a $75 million (221 percent) increase over last year. Exports of cotton also performed well, increasing by $67 million (45 percent) over last year. Commodities showing the largest declines in 2021 were soybeans, down $41 million (92 percent), and ethanol, down $26 million (9 percent). India was the third-largest export destination for U.S. tree nuts, fourth largest for ethanol, fifth largest for soybean oil, and eighth largest cotton export destination.

Drivers

- Coming out of the COVID-19 pandemic and economic recession, India rebounded from its 2020 GDP decline of 7.5 percent with a projected 8.2 percent GDP growth in 2021 which contributed to increased levels of food and agricultural imports.

- India continues to be the second most populous country in the world, with a rapidly increasing GDP leading to rising disposable income, and more willingness to spend on high quality imported U.S. agricultural products.

- U.S. soybean oil exports to India more than tripled in 2021 compared to the previous year, and to levels unseen in more than a decade, to become our third-largest market. Exports of soybean oils were up primarily due to higher unit values and competitive prices, particularly in late 2020 / early 2021, as U.S. soybean oil prices were lower, and India is a price sensitive buyer.

- An expanding agricultural sector continue to drive demand for feeds, meals, and fodders.

- In January 2022, India opened its market for U.S. pork products, and announced that it intends to open its market to U.S. cherries and alfalfa hay for animal feed in 2022.

India’s Agricultural Suppliers

Looking Ahead

In November 2021, India and the United States held the 12th Ministerial-level meeting of the United States- India Trade Policy Forum (TPF) in New Delhi. Following the TPF meetings, India opened its market to U.S. pork. In 2022, the United States expects to continue TPF engagement with India to resolve additional trade challenges. In particular, the United States will continue to press India on commitments it made to open market access for cherries and alfalfa hay.

While India is among the most populous countries in the world and a significant U.S. agricultural export market, barriers to trade continue to create obstacles for U.S. exporters. Notably, India imposes sanitary barriers on dairy products, livestock genetics, and poultry, as well as phytosanitary barriers on pulses. In addition, India bans the import of ethanol for fuel use. India’s troublesome biotechnology approval processes limits the types of products the United States can export, and India’s “GM-free” certificate requirements for 24 grains, oilseeds, fruits, and vegetables create challenges for U.S. producers. In November 2021, Prime Minister Narendra Modi announced India would repeal three farm laws introduced in 2020, meant to liberalize India’s agricultural market and which could have created opportunities for U.S. exporters. In 2022, it appears likely that India will continue heavy government involvement in its agricultural sector, including through long-standing subsidy programs for commodities like wheat and rice.