Ethanol 2021 Export Highlights

Top 10 Export Markets for U.S. Ethanol(values in million USD) |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Canada | 621 | 590 | 573 | 594 | 1,021 | 72% | 680 |

| South Korea | 91 | 134 | 196 | 170 | 343 | 102% | 187 |

| India | 281 | 258 | 287 | 293 | 267 | -9% | 277 |

| European Union-27 | 85 | 161 | 140 | 252 | 191 | -24% | 166 |

| China | 83 | 82 | 0 | 49 | 156 | 218% | 74 |

| Brazil | 736 | 761 | 490 | 280 | 154 | -45% | 484 |

| Mexico | 56 | 51 | 49 | 119 | 104 | -12% | 76 |

| United Kingdom | 16 | 6 | 45 | 48 | 102 | 113% | 43 |

| Colombia | 56 | 76 | 116 | 120 | 89 | -27% | 91 |

| Peru | 72 | 69 | 79 | 76 | 83 | 9% | 76 |

| All Others | 314 | 477 | 356 | 292 | 258 | -12% | 339 |

| Total Exported | 2,412 | 2,663 | 2,330 | 2,293 | 2,767 | 21% | 2,493 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2021, U.S. ethanol exports totaled 1.2 billion gallons valued at $2.8 billion. Compared to 2020, the value of exports rose 21 percent due to higher export unit value, recovery in Canadian gasoline demand, and strong sales of non-fuel grade product to South Korea. The 2021 volume exported was 5 percent lower than 2020 due to reduced price competitiveness and continued weakness in gasoline demand, and 25 percent below the record 1.7 billion gallons shipped in 2018. Exports of fuel ethanol to China jumped in the first quarter of 2021 as a result of previous quarter contracts negotiated at bargain prices. Sales of fuel ethanol to the United Kingdom (UK) rose late in the year with the country’s move to the E10 blend. Ethanol exports to Brazil saw the largest absolute decline in 2021. This was due to Brazil’s COVID-19 impacted fuel market and the trade-limiting impact of a 20 percent tariff that Brazil began applying on all ethanol imports – almost all of which is supplied by the United States – in December 2020, given higher U.S. prices and a weaker Brazilian currency. Exports to Brazil were already in freefall since 2020. They declined further by both volume and value to a mere 80 million gallons valued at $154 million, 80 percent below the volume shipped in 2018. Normally the first or second-largest market for U.S. ethanol, Brazil fell to sixth place in 2021. Export volumes were also weaker to price-sensitive fuel markets in 2021, most notably Colombia and the Philippines.

Drivers

- Regulations and limited infrastructure limit growth of ethanol blends above 10 percent in the U.S. market, thus raising the importance of export growth. Static fuel demand limits U.S. domestic market expansion.

- Ethanol exports are heavily impacted by gasoline fuel markets, with a little more than half the value of U.S. export sales used as transport fuel. Demand for ethanol used as an industrial chemical and in consumer products has become equally important recently. Since the pandemic, exports of ethanol for industrial, non-fuel use has risen from 25 percent to a little less than half of U.S. exports.

- In 2021, despite some recovery, COVID-19 continued to impact mobility unevenly across the globe, as did rising fuel costs and thus fuel ethanol demand. Sharply higher prices for U.S. ethanol impacted U.S. sales in price sensitive fuel markets.

- Higher U.S. ethanol prices, continued weakness in the Brazilian real, and Brazil’s 20 percent tariff contributed to further export declines to that country.

- The United States has FTAs with 5 of the top 10 ethanol export destinations, which help reduce barriers to U.S. ethanol.

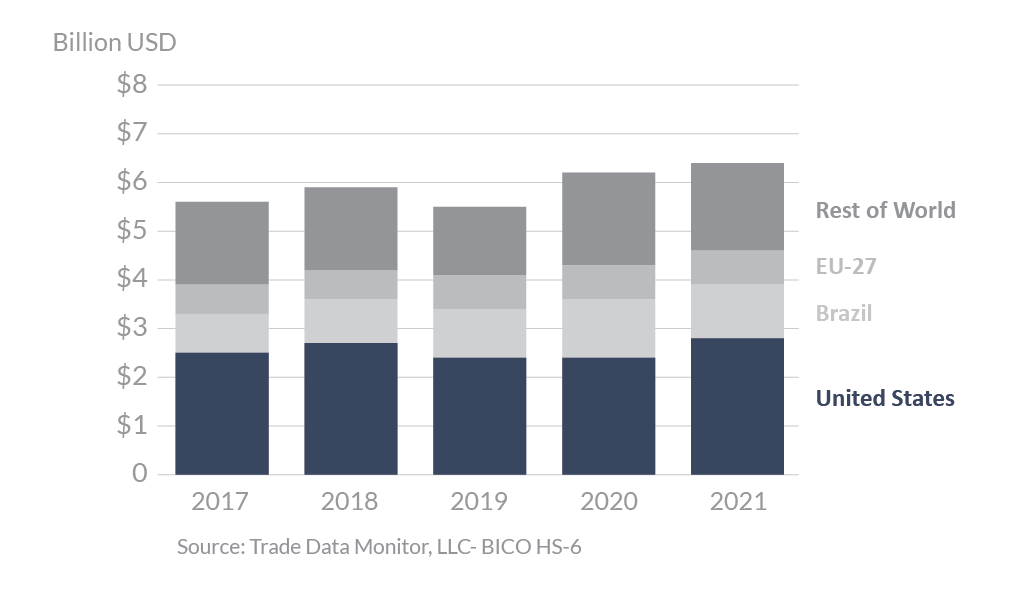

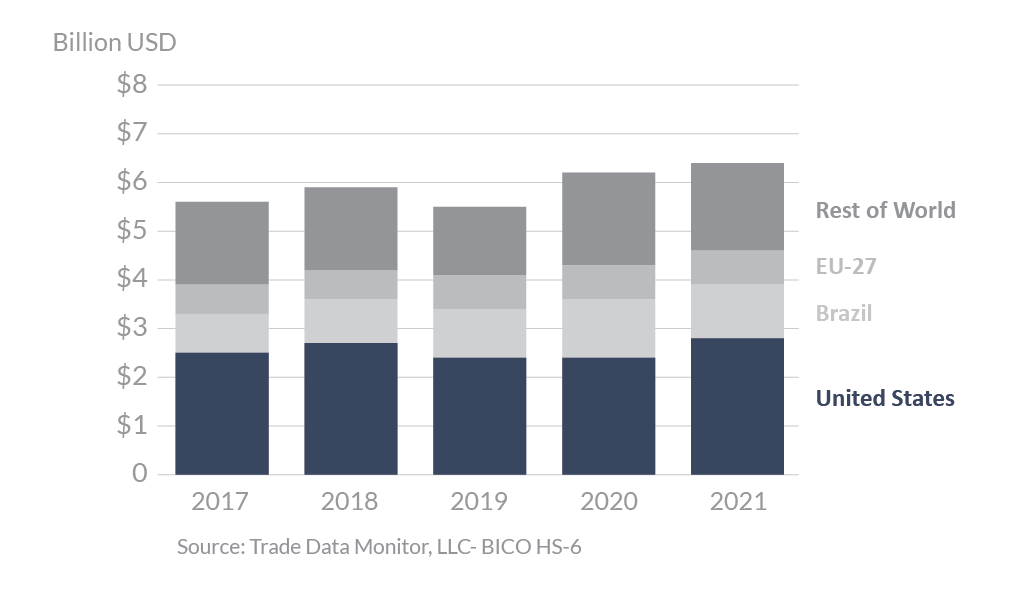

Global Ethanol Exports

Looking Ahead

As immunization rates rise in the developed world and the largest developing countries, which together account for most gasoline consumption, global gasoline and ethanol demand will continue to recover. The pace and degree of recovery varies by country and remains slower than expected. Pre-pandemic, the United States accounted for 45 percent (excluding intra-EU trade) of global ethanol export value. Its market share dropped to 39 percent in 2020 as fuel demand collapsed and some countries (notably China, Brazil and Canada) captured more trade, some of which was medical-grade product. The U.S. share recovered to an estimated 45 percent in 2021 on the strength of higher prices even though sales volume was down. Gasoline markets should mostly recover in the coming years, permitting U.S. market share to rise as fuel ethanol reasserts its dominance in trade and assuming U.S. ethanol returns to its longer run price competitiveness. Demand for mobility grows as population and incomes grow, but ethanol-blended gasoline is only one of several means to meeting increased demand for mobility while lowering greenhouse gas emissions. Increased mass transit, improved internal combustion engine efficiency, lifestyle changes, and alternative drivetrains like electric motors are all factors affecting transport demand, with which ethanol producers must contend. Retaliatory duties levied by China, Brazil, the EU and others; and licensing restrictions or import bans imposed by Argentina, Thailand, India, and the Philippines; limit the United States’ ability to export fuel ethanol. Conversely, markets for ethanol used as an industrial chemical and in consumer products are relatively barrier-free.