Dominican Republic 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Dominican Republic(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Soybean Meal | 174 | 188 | 184 | 166 | 228 | 38% | 188 |

| Tobacco | 83 | 95 | 125 | 171 | 193 | 13% | 133 |

| Pork & Pork Products | 71 | 93 | 78 | 90 | 151 | 67% | 96 |

| Dairy Products | 72 | 81 | 89 | 92 | 116 | 26% | 90 |

| Corn | 95 | 165 | 64 | 93 | 116 | 25% | 107 |

| Wheat | 81 | 66 | 69 | 44 | 99 | 126% | 72 |

| Poultry Meat & Prods.* | 61 | 74 | 78 | 81 | 96 | 18% | 78 |

| Beef & Beef Products | 53 | 59 | 66 | 34 | 79 | 133% | 58 |

| Soybean Oil | 141 | 107 | 91 | 122 | 63 | -49% | 105 |

| Fruit & Vegetable Juices | 22 | 29 | 31 | 35 | 49 | 40% | 33 |

| All Others | 415 | 439 | 490 | 501 | 582 | 16% | 485 |

| Total Exported | 1,268 | 1,395 | 1,363 | 1,429 | 1,771 | 24% | 1,445 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

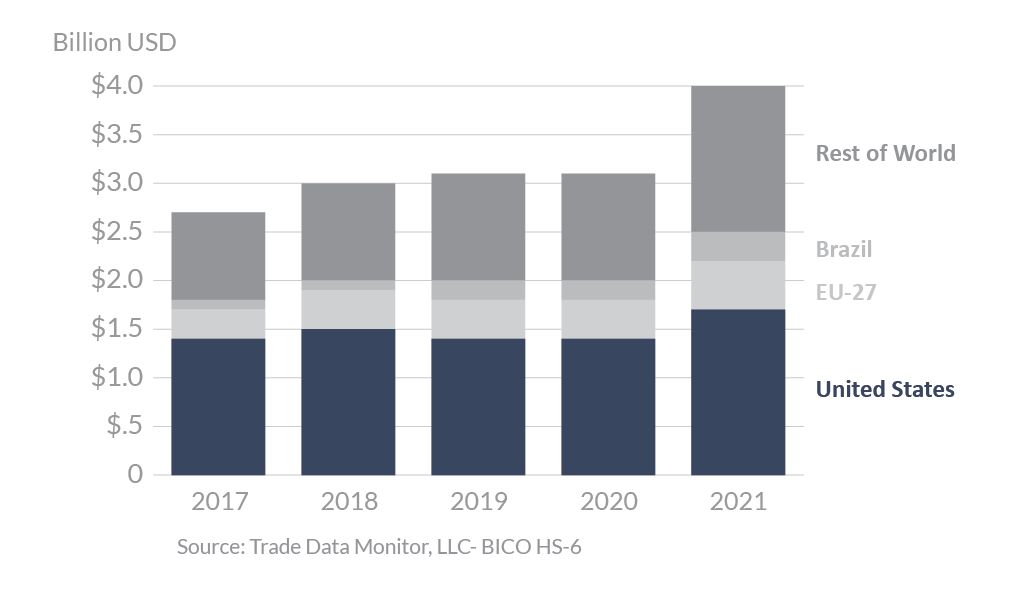

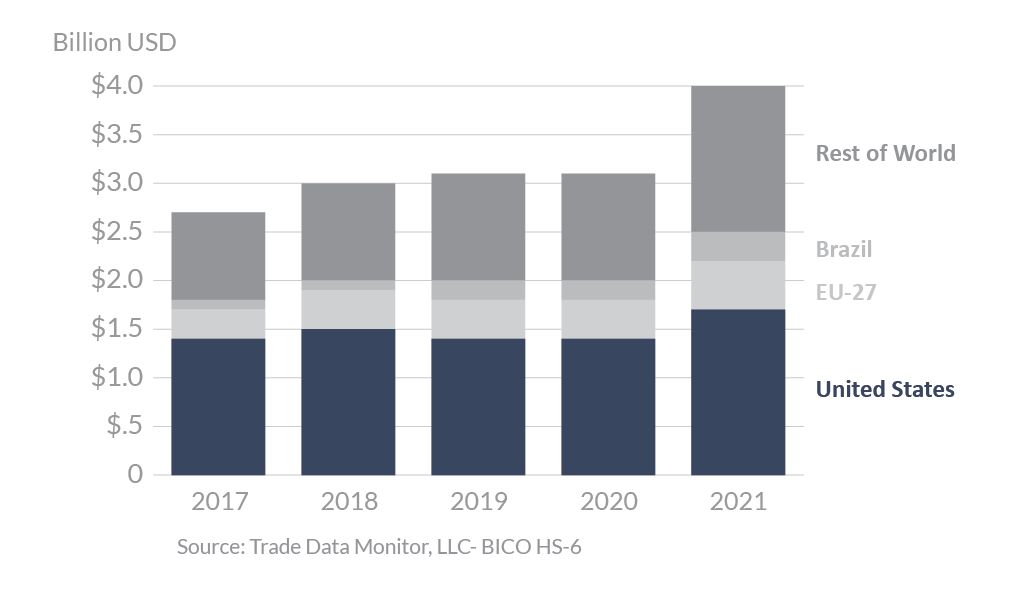

In 2021, the Dominican Republic (DR) was the 15th-largest export destination for U.S. products, importing $1.7 billion, a 24-percent increase over 2020. The United States is the largest supplier of agricultural goods with a 43-percent market share, followed by the EU and Brazil. Since the DR became a member of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) in 2007, total U.S. agricultural exports to the DR have grown by 124 percent. Due to the economic recovery in 2021, U.S. agricultural exports to the DR reached a record of $1.8 billion. The largest year-to-year export increase was seen in soybean meal, a $63 million (38 percent) increase over 2020. U.S. exports of pork and pork products, wheat, and beef and beef products were up $60 million, $55 million, and $45 million, respectively. Soybean oil exports to the DR were down $59 million in the same year. The DR was the fourth-largest export destination for U.S. fruit and vegetable juices and pulses and the fifth-largest destination for soybean oil.

Drivers

- The DR economy appears to have recovered from the ongoing global pandemic. In 2020, the real GDP growth rate fell sharply to -6.7 percent but is expected to rebound to 9.5 percent in 2021. From 2020 to 2021, the demand for U.S. consumer-oriented products increased by 34 percent due to the re-opening of the economy.

- Wheat exports were up 126 percent due to an expected recovery of Dominican exports of flour and baked goods and in tourism after the adverse impact of the COVID-19 pandemic on the food service sector.

- The United States has a nearly 100-percent market share of domestic consumption of soy products in the Dominican Republic.

- As of September 2020, the Dominican Republic’s food processing industry was valued at $2.5 billion, with an additional $0.7 billion for processed beverages and other products during the same period. Meat processing, wheat milling, bakery products, and dairy processing continue to lead the domestic food processing sector.

- The recovery of the tourism industry in the DR has been a market driver for U.S. exports in 2021 and will continue to be so in 2022 and beyond. According to the Central Bank of the DR, during 2021 the country received 5 million tourists after receiving barely 1.8 million during 2020, and for the month of January 2022, the country received 530,956 tourists. The tourism sector is a large customer for U.S. consumer-oriented products such as meats, fruits and vegetables, and other products.

Dominican Republics’s Agricultural Suppliers

Looking Ahead

The Dominican Republic is the largest market for U.S. agricultural goods in the Caribbean. As CAFTA-DR reaches full implementation in 2025, TRQs for remaining products to be liberalized (rice, yogurt, mozzarella cheese, powdered milk, and chicken leg quarters) will continue to increase and tariff rates will decrease, creating more opportunities for U.S. exporters.

The Government of the Dominican Republic has historically delayed issuing import licenses to protect sensitive domestic products, such as dry beans, dairy, and rice. On September 27, 2021, President Luis Abinader issued Decree 605-21, in which he established a new Commission for Agricultural Imports. The Commission had 15 days to provide a regulation that establishes its operations and processes to assign permits for agricultural imports. While the Commission has not met this deadline, this new mechanism could become a challenge for U.S. exports such as beans, potatoes, poultry, dairy, rice, and others.

Inflation is slowly becoming a factor in terms of purchasing decisions for Dominican consumers. For 2021, the Dominican Central Bank estimated inflation at 8.5 percent, the highest since 2004. With international prices of oil and other commodities increasing, the trend will continue during 2022.

In July 2021, ASF was detected in the DR for the first time in more than 40 years. ASF outbreaks continued to spread throughout the country through late 2021/early 2022, devastating swine herd numbers. The ASF situation will likely cause a net increase in U.S. pork exports to the DR. The current official forecast is that DR pork imports will increase nearly 30 percent in 2022 on a volume (carcass weight) basis when compared to 2021. The United States has more than a 95-percent share of the DR imported pork market. With swine genetic centers in the DR also affected recently by ASF, opportunities for U.S. high-value genetics may also be available in this market.