Dairy 2021 Export Highlights

Top 10 Export Markets for U.S. Dairy(values in million USD) |

|||||||

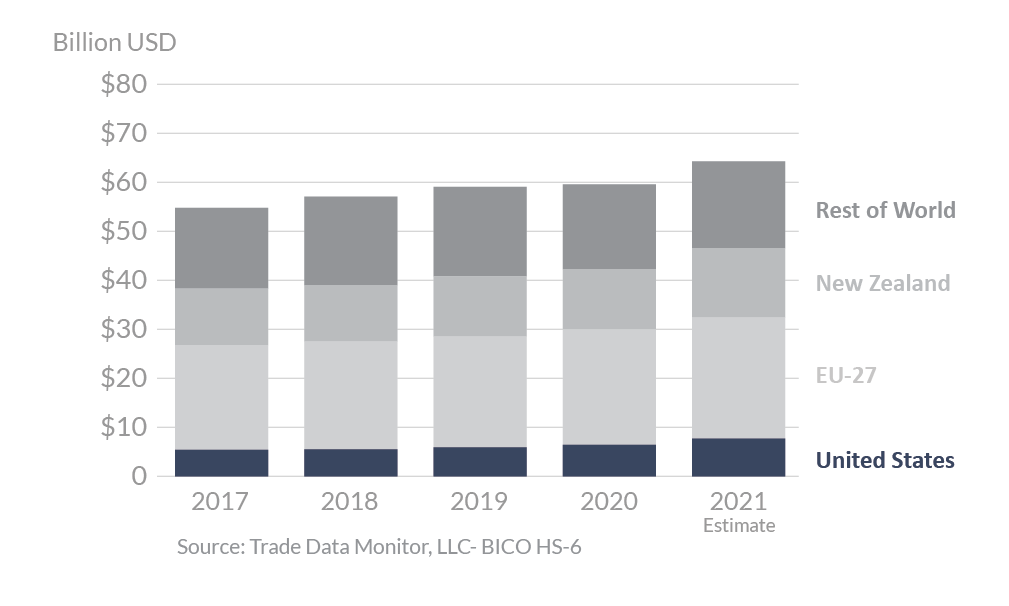

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Mexico | 1,293 | 1,375 | 1,526 | 1,401 | 1,787 | 28% | 1,476 |

| Canada | 699 | 700 | 728 | 736 | 851 | 16% | 743 |

| China | 577 | 498 | 373 | 539 | 703 | 31% | 538 |

| Philippines | 242 | 247 | 273 | 409 | 437 | 7% | 322 |

| Korea, South | 279 | 290 | 330 | 370 | 426 | 15% | 339 |

| Japan | 291 | 269 | 282 | 322 | 376 | 17% | 308 |

| Indonesia | 132 | 165 | 239 | 348 | 327 | -6% | 242 |

| Vietnam | 112 | 145 | 170 | 185 | 280 | 52% | 178 |

| Australia | 185 | 153 | 148 | 170 | 162 | -5% | 164 |

| Malaysia | 90 | 101 | 109 | 157 | 161 | 3% | 124 |

| All Others | 1,468 | 1,536 | 1,737 | 1,809 | 2,149 | 19% | 1,740 |

| Total Exported | 5,368 | 5,479 | 5,914 | 6,447 | 7,660 | 19% | 6,174 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

Despite the logistical challenges posed by the COVID-19 pandemic, U.S. dairy exports soared in 2021, growing by 19 percent to reach a record $7.7 billion. This will be the fifth consecutive year that U.S. dairy exports have grown, reflecting an annual average growth rate of 9 percent since 2017. Mexico remains the leading market for U.S. dairy products accounting for nearly a quarter of all exports. After a disappointing year in 2020, shipments to Mexico rebounded strongly by 28 percent, led by sales of skimmed milk powder (SMP) and cheese. Strong sales were also posted to Canada and China, which had year-over-year gains of 16 percent and 38 percent, respectively. Most shipments to Canada consisted of highly processed dairy products, such as infant formula and milk-based drinks, while exports to China were comprised mostly of SMP, whey, and whey products. U.S. dairy exports also registered notable gains in established markets such Japan and South Korea and newer markets in Southeast Asia such as Vietnam.

Drivers

- Following the 2020 recession, Mexico posted a strong economic recovery in 2021 marked by higher per capita gross domestic product (GDP) and consumer expenditures. Further, easing COVID-19 conditions led to the reopening of the hotel, restaurant, and institutional sectors, which accelerated the demand for dairy products, particularly cheese and SMP.

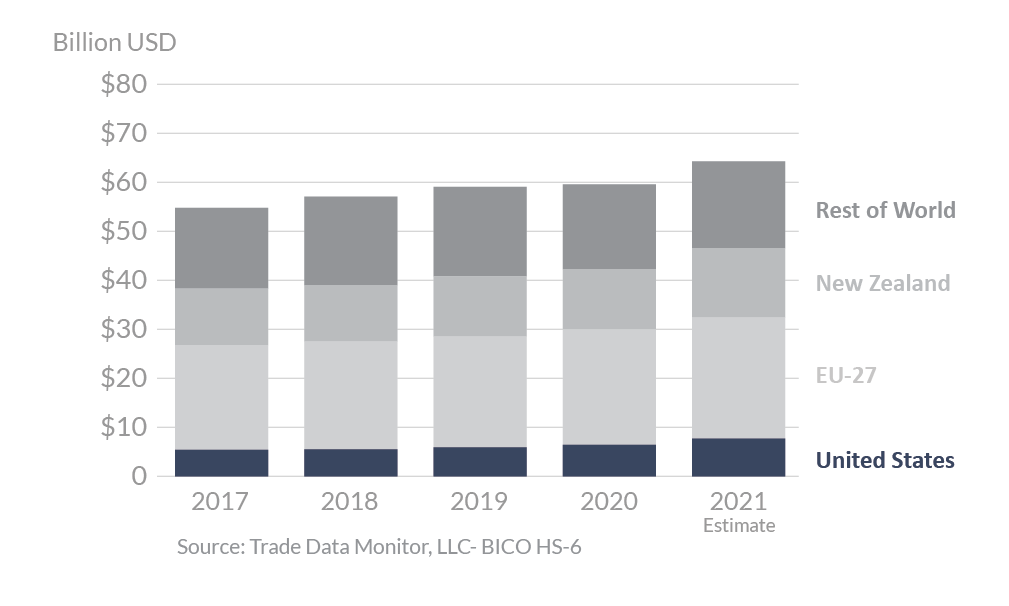

- Global milk production from such major exporters as New Zealand and the EU was unexpectedly flat. In contrast, U.S. milk output grew by 1 percent and U.S. exporters had access to ample exportable supplies of SMP, cheese, and butter.

- World prices of major dairy products increased rapidly as global demand for dairy products surpassed supplies. U.S. prices of such major commodities as SMP, cheese, whey and whey products, and butter were competitive during 2021 which led to sharply higher exports.

Global Dairy Exports

Looking Ahead

Due to higher projected feed costs and a smaller domestic herd, milk output in 2022 is expected to decline. However, domestic demand is likely to remain relatively strong and this is expected to lead to higher, less competitive export prices. Consequently, the outlook for U.S. dairy exports in 2022 is for lower exports both on a milk fat milk equivalent basis and a skimmed milk equivalent basis. Over the longer term, dairy exports are expected to resume growing at prior growth rates to become an increasingly critical supplier to global dairy markets.

On the global stage, milk production from the major exporters has been stagnant. With higher levels of demand, this has led to a recent rapid rise in dairy product prices. Markets are projected to remain relatively tight and dairy prices are expected to stabilize at relatively high levels during the first half of the year. During the first two months of 2022, global import demand has remained firm, but as prices advance, it becomes more questionable as to whether high consumer demand can be sustained. This will be particularly critical in the key markets of Asia and Mexico.