Cotton 2021 Export Highlights

Top 10 Export Markets for U.S. Cotton(values in million USD) |

|||||||

| Country | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| China | 973 | 920 | 705 | 1,822 | 1,343 | -26% | 1,153 |

| Vietnam | 1,056 | 1,312 | 1,428 | 1,161 | 1,026 | -12% | 1,197 |

| Pakistan | 297 | 615 | 628 | 787 | 710 | -10% | 608 |

| Turkey | 730 | 682 | 648 | 574 | 558 | -3% | 638 |

| Mexico | 404 | 372 | 288 | 178 | 407 | 129% | 330 |

| Bangladesh | 284 | 387 | 388 | 329 | 311 | -6% | 340 |

| Indonesia | 498 | 600 | 417 | 257 | 218 | -15% | 398 |

| India | 435 | 333 | 586 | 147 | 214 | 45% | 343 |

| South Korea | 248 | 231 | 167 | 111 | 153 | 38% | 182 |

| Peru | 97 | 113 | 87 | 61 | 128 | 111% | 97 |

| All Others | 805 | 985 | 799 | 525 | 643 | 22% | 752 |

| Total Exported | 5,827 | 6,550 | 6,140 | 5,951 | 5,711 | -4% | 6,036 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2021, the value of U.S. cotton exports declined 4 percent year-over-year, but the quantity fell by more than 20 percent. During the second half of 2021, strong unit values helped offset weak shipments, but shipments to China were down 70 percent year-over-year as State Reserve imports of U.S. cotton halted. Also, exports to Vietnam were down by more than 50 percent as Australia’s bountiful 2021 crop hit the market – which was four and a half times as large as the previous year.

Exports to Mexico in both value and volume saw strong growth as Mexico’s production fell and consumption showed a strong recovery from 2020’s COVID-19-depressed levels. Strong shipments of high-valued Pima cotton to India and Peru boosted values to those markets.

The United States was the world’s third-largest producer and largest cotton exporter by volume, accounting for one-third of world shipments.

Drivers

- A much smaller 2020 U.S. crop reduced exportable supplies in 2021 while production by major competitors remained stable.

- A large rally in prices during the second half of the year was somewhat spurred by purchases from the PRC’s State Reserve.

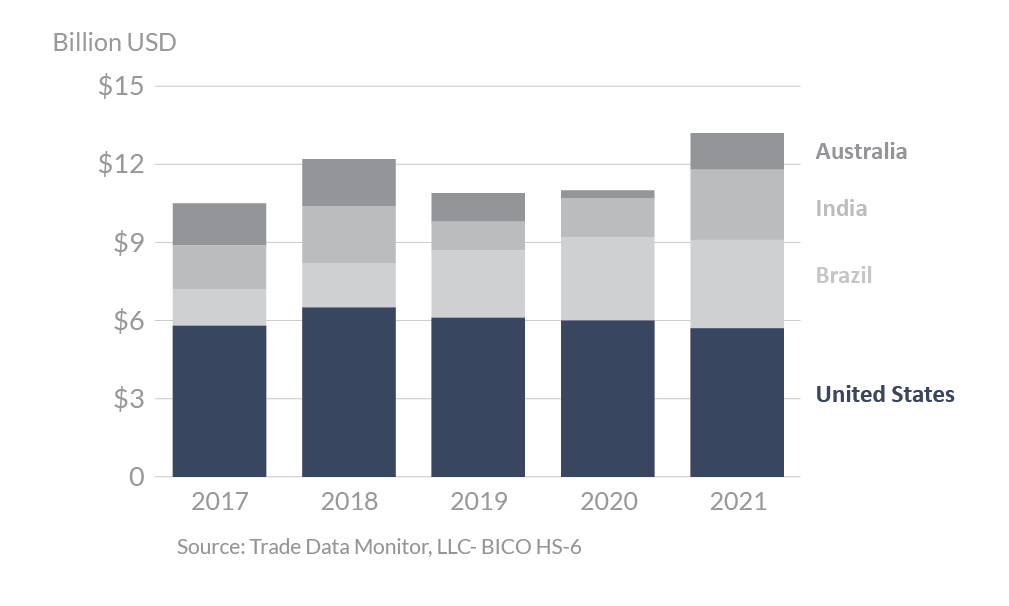

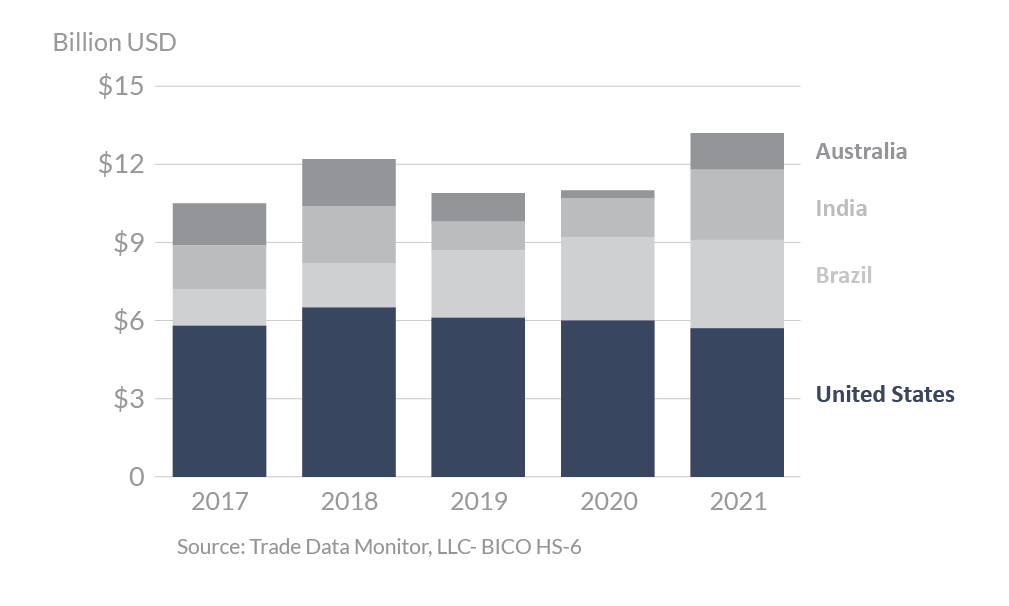

Global Cotton Exports

Looking Ahead

For 2022, U.S. cotton exports are likely to increase on both a volume and value basis. Higher global trade is expected, and a larger U.S. crop is expected to support larger shipments. Cotton prices, which are at a 10-year high, are expected to boost export values above the 2021 level. China’s imports are expected to remain stable. Competition for market share in Southeast and East Asian markets will intensify with an even larger Australian crop in 2022.