Corn 2019 Export Highlights

Top 10 Export Markets for U.S. Corn(values in million USD) |

|||||||

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Mexico | 2,302 | 2,550 | 2,646 | 3,061 | 2,719 | -11% | 2,655 |

| Japan | 2,022 | 2,091 | 2,145 | 2,813 | 1,977 | -30% | 2,210 |

| Colombia | 770 | 771 | 785 | 927 | 683 | -26% | 787 |

| South Korea | 648 | 865 | 705 | 1,356 | 358 | -74% | 786 |

| Canada | 212 | 147 | 131 | 309 | 349 | 13% | 229 |

| Taiwan | 344 | 460 | 395 | 593 | 227 | -62% | 404 |

| Peru | 303 | 452 | 515 | 507 | 178 | -65% | 391 |

| Guatemala | 149 | 174 | 145 | 196 | 177 | -10% | 168 |

| Costa Rica | 115 | 115 | 138 | 143 | 148 | 4% | 132 |

| Honduras | 78 | 106 | 86 | 107 | 123 | 15% | 100 |

| All Others | 1,329 | 2,149 | 1,423 | 2,456 | 677 | -72% | 1,607 |

| Total Exported | 8,271 | 9,879 | 9,113 | 12,467 | 7,617 | -39% | 9,469 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

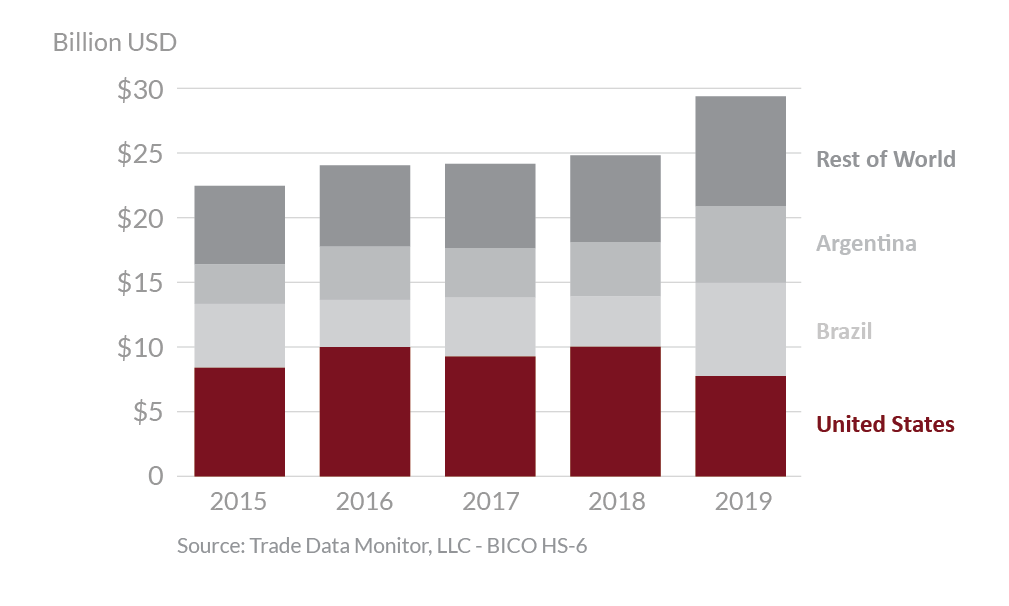

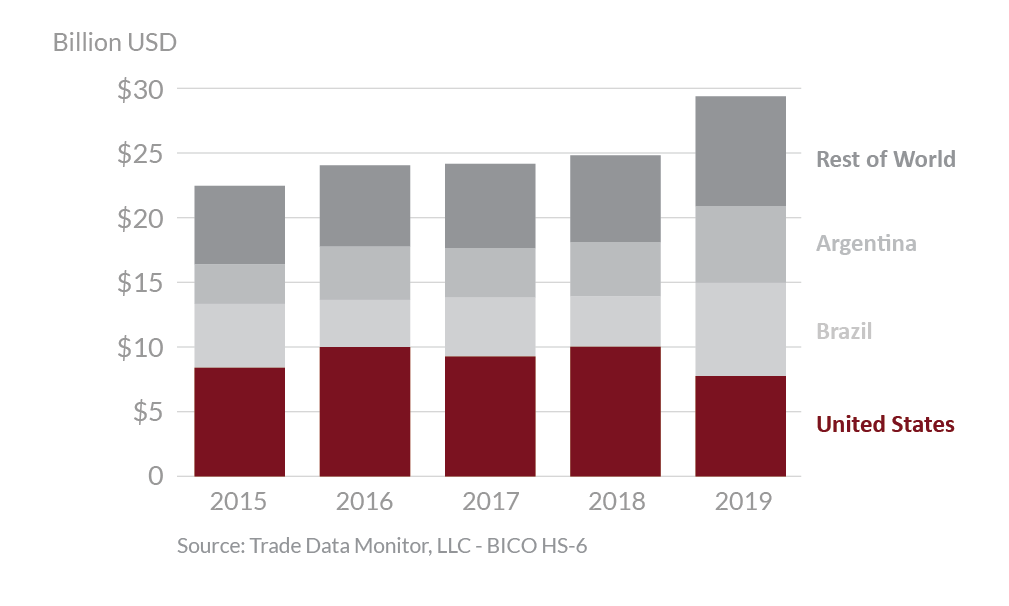

U.S. corn exports at $7.6 billion were down 39 percent or nearly $5 billion in 2019, from the 2018 record. This is the lowest level of corn exports since 2013. The sharp decline was attributed to higher U.S. prices impacted by unprecedented planting delays, reduced yield, relatively strong domestic use in the United States, and abundant competitor supplies. Top destinations were Mexico, Japan, Colombia, and South Korea, accounting for three-quarters of total U.S. corn exports.

Drivers

- U.S. corn prices were higher than other major exporters for most of the year due to planting delays and reduced crop yields.

- Demand in the U.S. domestic market was strong. Corn for domestic feed and ethanol use was strong and consumed large volumes.

- Other major exporters - Argentina, Brazil, and Ukraine - had record production. The depreciation of their respective currencies against the U.S. dollar contributed to a loss in U.S. competitiveness and further stimulated foreign sales to the global market.

Global Corn Exports

Prior to the COVID-19 outbreak, global import demand remained solid. Corn is the primary feed grain and is typically less expensive compared to other feed grains due to relative abundance. Many countries seek competitively priced feedstuffs to satisfy rising needs in the livestock and poultry sectors.

At the end of 2019, U.S. corn became competitive against other origins, and is expected to sustain competitiveness through 2020. Exports to countries in the Western Hemisphere are expected to remain strong, supported by preferential agreements and transportation advantages. Exports to other destinations have yet to improve. Key importing countries in Asia have voiced concerns over the quality of U.S. corn, which endured a series of adverse weather events throughout the season.

In December 2019, Argentina changed its export tax structure, effectively raising the tax on corn exports. The impact on corn trade will be seen in coming years. For Brazil, massive exports in 2019 have drawn down stocks to the smallest in nearly 10 years, constraining further sales for several months. The size of South American crop will foretell potential export levels.

Competition from Ukraine is expected to intensify. The country has expanded its production and exports benefit from preferential access to China and the European Union. Continued expansion in port capacity, proximity to markets in the Middle East and North Africa, a biotech-free reputation (despite evidence that some Ukrainian farmers grow biotech crops), and declining domestic use have all contributed to growth in Ukrainian exports.