Colombia 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Colombia(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Corn | 785 | 927 | 682 | 879 | 1,100 | 25% | 875 |

| Soybean Meal | 340 | 481 | 412 | 485 | 557 | 15% | 455 |

| Pork & Pork Products | 163 | 215 | 221 | 147 | 258 | 76% | 201 |

| Soybeans | 212 | 256 | 223 | 192 | 229 | 19% | 222 |

| Wheat | 173 | 88 | 137 | 133 | 193 | 45% | 145 |

| Dairy Products | 65 | 72 | 144 | 124 | 145 | 17% | 110 |

| Poultry Meat & Products* | 70 | 82 | 114 | 93 | 117 | 26% | 95 |

| Feeds, Meals & Fodders** | 81 | 100 | 83 | 86 | 116 | 35% | 93 |

| Ethanol (non-beverage) | 56 | 76 | 116 | 120 | 89 | -27% | 91 |

| Distillers Grains | 33 | 46 | 42 | 46 | 65 | 42% | 46 |

| All Others | 606 | 642 | 608 | 558 | 544 | -2% | 591 |

| Total Exported | 2,584 | 2,985 | 2,781 | 2,863 | 3,413 | 19% | 2,925 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

**Corn Gluten Meal, Mixed Feeds

Highlights

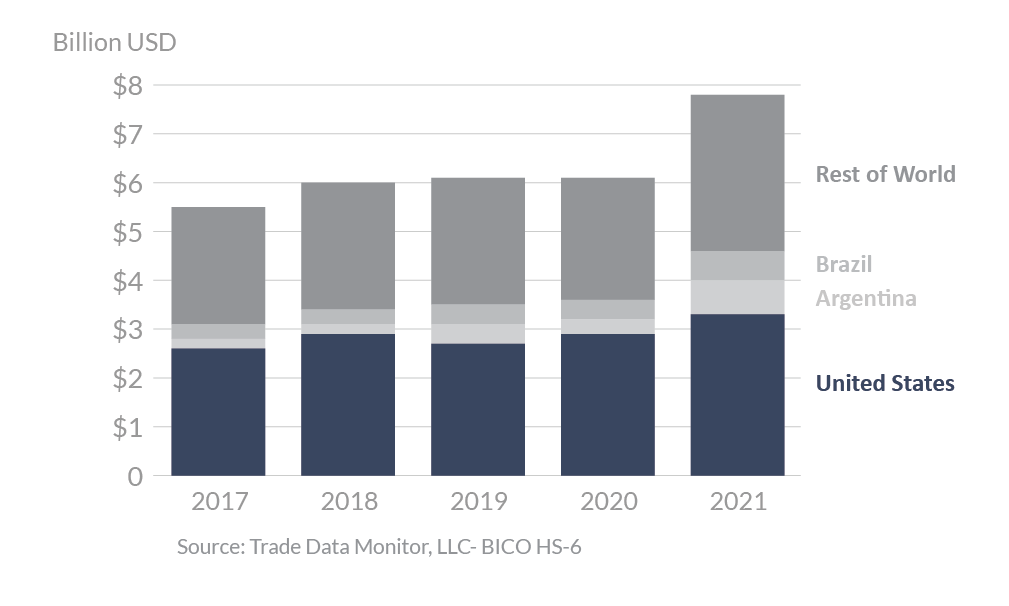

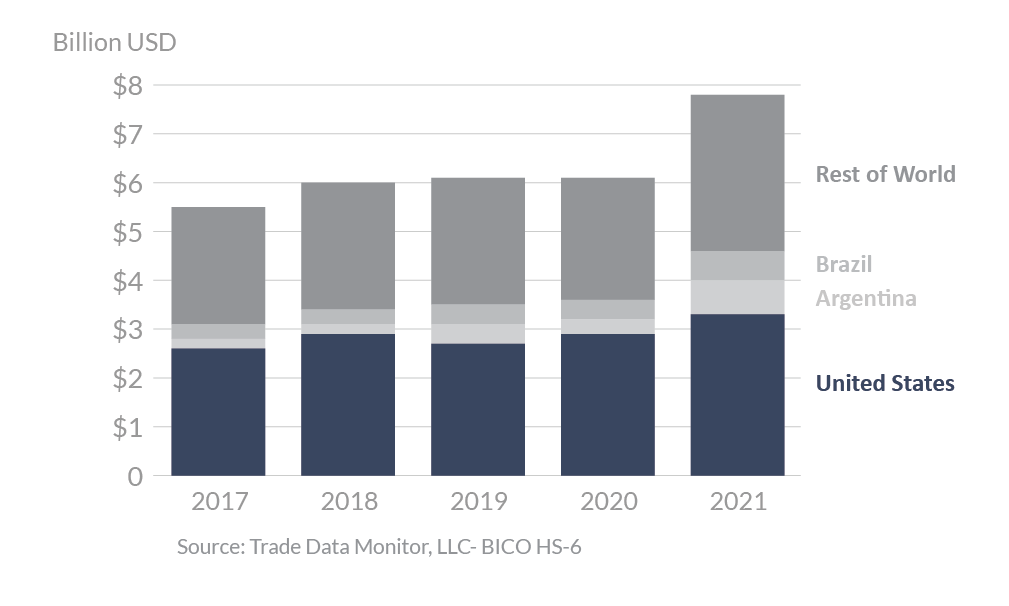

In 2021, Colombia was the 10th-largest export destination for U.S. agricultural products, importing $3.4 billion, a 19-percent increase over 2020. The United States is Colombia’s top supplier of agricultural goods by a wide margin, representing 42 percent of the total import market. Argentina, the second-largest exporter, only has 8-percent market share. The U.S.-Colombia Trade Promotion Agreement (CTPA) has expanded export opportunities for many U.S. agricultural products. The largest year-to-year export increase was seen in corn, a $221 million (25 percent) increase over last year. Exports of pork and pork products, soybean meal, and wheat also performed well, increasing by $111 million, $72 million, and $60 million respectively. Commodities showing declines in 2021 were rice, down $59 million, and soybean oil, down $40 million. Colombia was the fourth-largest export destination for U.S. corn, third largest for soybean meal exports, sixth largest for pork exports, and eighth largest wheat export destination.

Drivers

- Coming out of the 2020 COVID pandemic and economic recession, Colombia rebounded from its 2020 GDP decline of 6.8 percent with 9.3-percent GDP growth in 2021, which contributed to increased levels of food and agricultural imports.

- In 2021, U.S. agricultural exports to Colombia reached their highest historical levels surpassing $3 billion. Although the Colombian peso has depreciated significantly against the U.S. dollar, Colombia’s rapid economic recovery contributed to increased demand for imported food and agricultural products, especially consumer-oriented products.

- U.S. exports of corn were up primarily due to higher unit values and more competitive prices than South American competitors. However, the strong U.S. dollar, increased competition from Argentina and Brazil, and the impact of Hurricane Ida on the grain handling infrastructure in the Port of New Orleans and Mississippi River Grain Corridor had a negative impact the U.S. market share of Colombia’s corn market, in terms of volume.

- Expanding aquaculture and egg sectors, combined with the rapid recovery of the chicken meat sector, continue to drive demand for soy products and corn.

- Policy issues constrained U.S. ethanol exports to Colombia. In 2021, the Colombian government issued several emergency measures to decrease the ethanol blend mandate in gasoline to adjust for supply shortages and pricing challenges, due to lower production by domestic industry. In 2021, U.S. ethanol exports to Colombia decreased 26 percent from $120 million to $89 million, which corresponds to a 49-percent decrease in volume.

- As a result of increased local production and low domestic prices that discouraged imports during 2021, U.S. rice and U.S. pulses exports to Colombia decreased.

Colombia’s Agricultural Suppliers

Looking Ahead

Colombia continues to be the leading destination for U.S. agricultural exports to South America, supplying 42 percent of the total Colombian agricultural imports in 2021 as a result of the CTPA trade preferences and geographical advantages compared to other competitors.

Colombia’s economy is forecast to grow between 3 to 4 percent annually for the next 5 years, supported by increasing consumption and investment. This rapid recovery of U.S. consumer-oriented exports is even more impressive given the current strength of the U.S. dollar. It reflects Colombian consumers’ growing interest in greater food variety, as well as an increasing segment of consumers who value quality over price. FAS/Bogotá’s Sabor USA marketing initiative has also increased awareness among Colombian consumers of the innovativeness and diversity of U.S. products.

Colombia faces several policy issues, notably on labeling and ethanol, that could affect the trajectory of agricultural trade with the United States:

- The Colombian Congress has approved a law to regulate nutritional labeling for processed food products. The law will be mandatory for local and imported products, and its implementation will represent higher costs for producers and importers.

- Colombia continues to decrease its ethanol blend levels in gasoline to adjust for overall supply shortages and pricing challenges to meet increased fuel demand.

- In addition, Colombia may reopen the countervailing duty (CVD) investigation on U.S. ethanol at the behest of local industry. The CVD measure levied against U.S. ethanol is scheduled to expire in May 2022.

- Following multiple bilateral and multilateral engagements with trading partners, on November 9, 2020, the Colombian Ministry of Health issued Resolution 2013, which sets mandatory maximum sodium content limits for 59 processed food categories and an implementation timeline beginning in November 2022. This measure also introduces a conformity certificate requirement and mandatory sodium content targets to support Colombia’s sodium reduction objectives.