Colombia 2019 Export Highlights

Top 10 U.S. Agricultural Exports to Colombia(values in million USD) |

|||||||

| Commodity | 2015 | 2016 | 2017 | 2018 | 2019 | % Change 2018-2019 |

5-Year Average 2015-2019 |

| Corn | 770 | 771 | 785 | 927 | 683 | -26% | 787 |

| Soybean Meal | 311 | 259 | 340 | 481 | 425 | -12% | 363 |

| Soybeans | 199 | 195 | 212 | 256 | 222 | -13% | 217 |

| Pork & Products | 102 | 105 | 163 | 215 | 222 | 3% | 161 |

| Dairy Products | 55 | 88 | 65 | 73 | 145 | 100% | 85 |

| Wheat | 166 | 181 | 173 | 88 | 137 | 55% | 149 |

| Poultry Meat & Products* | 44 | 66 | 70 | 82 | 114 | 39% | 75 |

| Feeds & Fodders NESOI | 79 | 76 | 80 | 98 | 80 | -18% | 83 |

| Prepared Food | 101 | 97 | 53 | 65 | 76 | 17% | 79 |

| Soybean Oil | 25 | 62 | 73 | 100 | 57 | -43% | 63 |

| All Other | 557 | 483 | 514 | 520 | 523 | 1% | 520 |

| Total Exported | 2,410 | 2,383 | 2,528 | 2,904 | 2,684 | -8% | 2,582 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

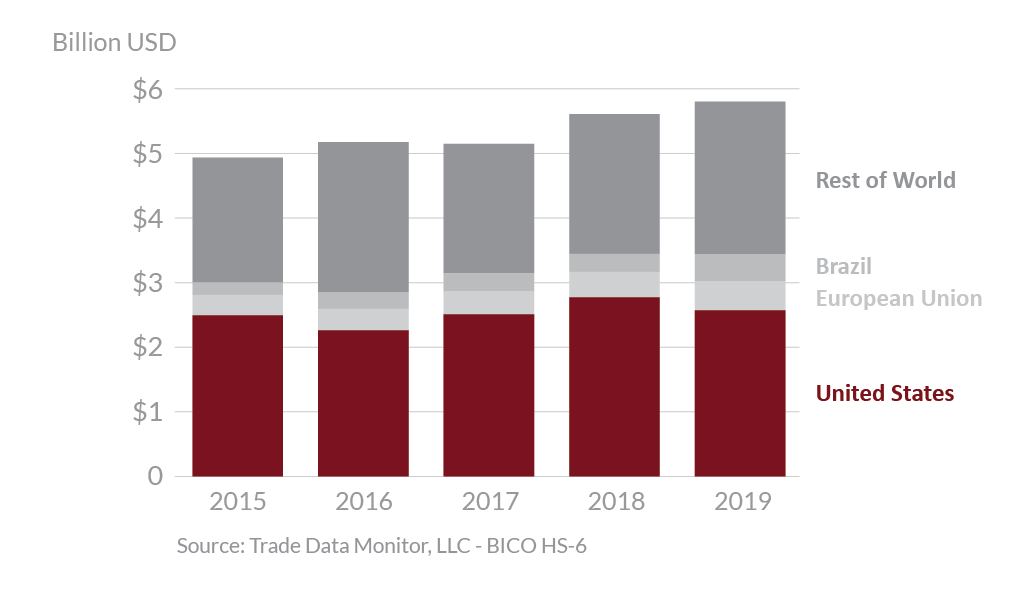

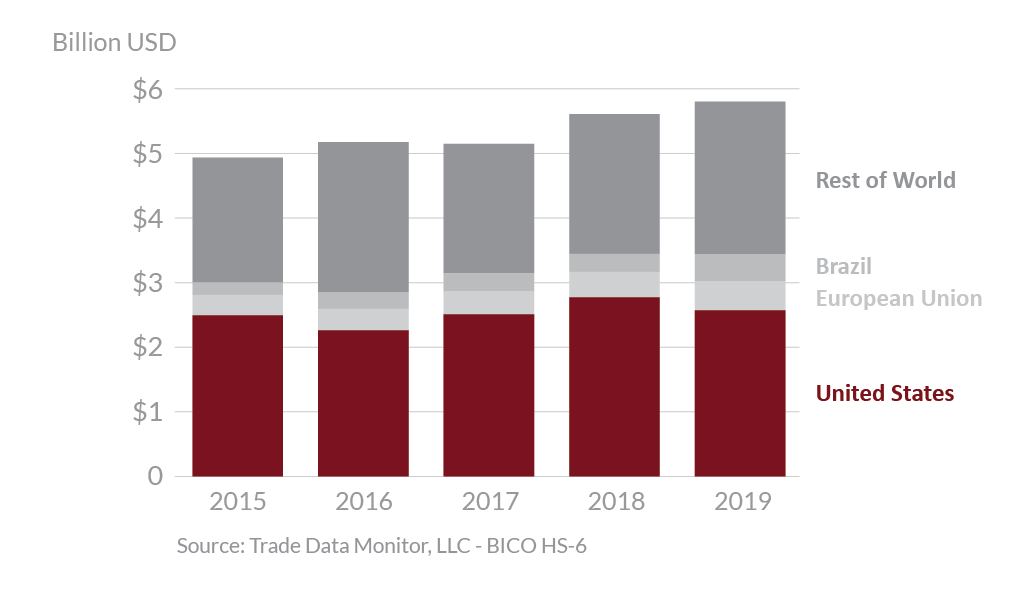

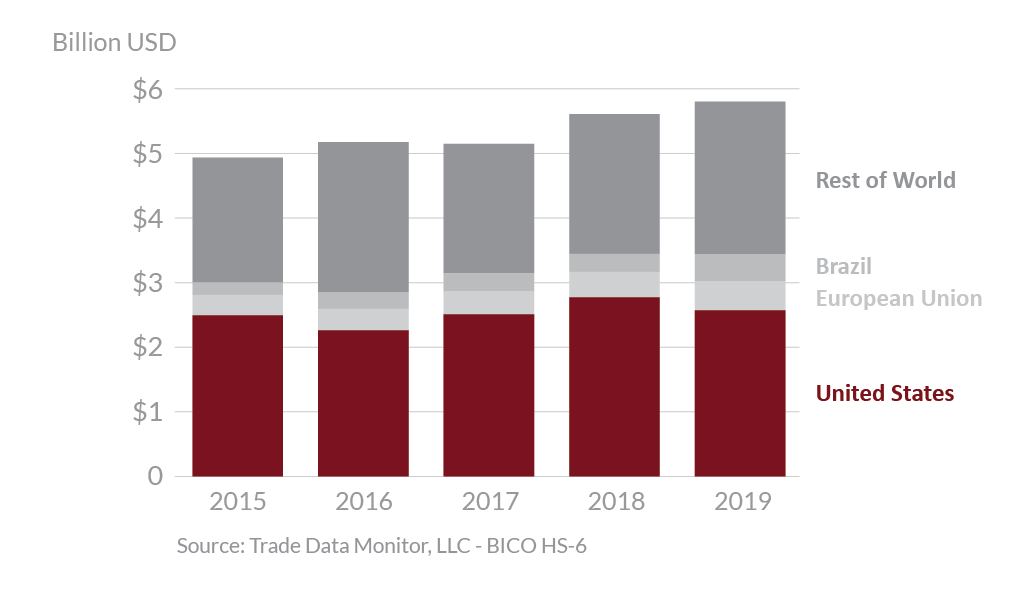

In 2019, Colombia was the 12th largest destination for U.S. agricultural exports, which totaled $2.7 billion, an 8 percent decrease from 2018. The United States is Colombia’s top supplier of agricultural goods with 44 percent market share, ahead of the European Union with 7 percent. The U.S.-Colombia Trade Promotion Agreement (CTPA) has expanded export opportunities for many agricultural products. The largest year-to-year export increases were seen in dairy products and wheat, up $73 million and $49 million, respectively. Additionally, increases in exports of poultry meat & products (excluding eggs) and prepared foods were up $32 million and $11 million, respectively. Exports of corn were down by more than $244 million. Exports of soybean meal, soybean oil, and soybeans were down $56 million, $43 million, and $34 million, respectively. In 2019, Colombia was the world’s 4th largest market for U.S. corn exports, 7th largest market for U.S. pork, 9th largest market for U.S. poultry, and 10th largest market for U.S. dairy products.

Drivers

-

In 2019, U.S. consumer-oriented agricultural product exports to Colombia, including dairy, poultry, meat products, and prepared foods, were up 21 percent to nearly $800 million. Continued strong economic growth of 3.3 percent in 2019 drove the demand for imported goods.

-

In 2019, competitive prices helped U.S. wheat exporters increase its market share in Colombia to 33 percent from 25 percent in 2018.

-

U.S. bulk commodity exports such as corn and soybeans were hurt by the strong U.S. dollar and increased competition from Brazil and Argentina.

-

Mercosur countries, Brazil and Argentina, benefited from competitive prices under the Andean Community Price Band System, which grants them preferential duty treatments. U.S. corn market share in Colombia decreased from 97 percent in 2018 to 68 percent in 2019 as the U.S. experienced higher prices compared to South American competitors.

-

In 2019, Colombia imported larger quantities of soybean meal and soybeans compared to the previous year as a result of increased demand by Colombia’s feed industry. In 2019, the United States market share for soybean and soybean meal was 100 percent and 80 percent, respectively, making Colombia the third largest market for U.S. soybean meal globally.

Colombia's Agricultural Suppliers

Looking Ahead

Colombia is the leading destination for U.S. agricultural exports to South America, and the United States continues to be the main supplier for most Colombian agricultural imports due to CTPA trade preferences. In 2019, 44 percent of all food and agricultural products imported to Colombia came from the United States.

In 2020, the United States may continue facing increased competition from South American exporters because of the Colombia-Mercosur Economic Complementation Agreement, which removes or lowers duties on many agricultural products imported from Brazil, Argentina, Paraguay and Uruguay.

Income and population growth in Colombia are projected to continue driving increases in demand for most imported agricultural products. Most importantly, corn, soybean meal and soybean oil imports are expected to grow over the next ten years and the United States is in a favorable position to meet Colombia’s needs. Although the COVID-19 pandemic will temporarily slow economic growth and demand for imports, Colombia is expected to make a fast economic recovery. U.S. consumer-oriented food exports, such as pork, poultry and dairy, are expected to continue rapid growth in Colombia as economic growth and middle-class expansion return.

Competition from Canadian wheat exporters continue to be the most significant challenge for U.S. exporters. The Colombia-Canada Free Trade Agreement was signed a year before the CTPA, which resulted in a “head-start” advantage to Canadian exporters that strengthened their trade relations with Colombian millers.