China 2021 Export Highlights

Top 10 U.S. Agricultural Exports to China(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Soybeans | 12,224 | 3,119 | 8,005 | 14,077 | 14,101 | 0% | 10,305 |

| Corn | 142 | 50 | 55 | 1,224 | 5,096 | 316% | 1,313 |

| Sorghum | 838 | 521 | 186 | 1,145 | 1,864 | 63% | 911 |

| Pork & Pork Products | 662 | 571 | 1,300 | 2,280 | 1,698 | -26% | 1,302 |

| Beef & Beef Products | 31 | 61 | 86 | 311 | 1,592 | 413% | 416 |

| Cotton | 973 | 920 | 705 | 1,822 | 1,343 | -26% | 1,153 |

| Tree Nuts | 243 | 328 | 605 | 747 | 978 | 31% | 580 |

| Poultry Meat & Products* | 36 | 47 | 10 | 759 | 879 | 16% | 346 |

| Wheat | 351 | 106 | 56 | 570 | 803 | 41% | 377 |

| Dairy Products | 577 | 498 | 373 | 539 | 703 | 31% | 538 |

| All Others | 3,481 | 3,021 | 2,471 | 2,927 | 3,921 | 34% | 3,164 |

| Total Exported | 19,558 | 9,243 | 13,853 | 26,399 | 32,977 | 25% | 20,406 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes eggs

Highlights

In 2021, U.S. agricultural exports to China totaled $33 billion, up 25 percent from 2020. China was the largest market for U.S. agricultural exports and the largest food import market in the world. While Brazil remained the top supplier of agricultural goods to China with 22-percent market share, the United States was able to expand its market share from 14 percent in 2020 to 18 percent in 2021, but still below 2017 levels. The country’s hog sector continued to cope with ASF but was moving towards recovery, leading to robust demand for feed ingredients such as soybeans, corn, and sorghum. Corn volume and value, in particular, reached record levels. As China’s hog sector recovers, its demand for imported pork has softened, leading to a 26-percent decline in U.S. exports from 2020. China’s demand for imported cotton also fell in 2021 as the country liquidated record stocks of foreign cotton in bonded warehouses. U.S. exports of other top commodities to China performed well, especially beef and beef products. Between 2003 and 2017, with limited market access, China was not a major market for U.S. beef; by 2021, it became the third-largest U.S. beef export market.

Drivers

- China’s economic rebound from COVID-19 led to strong demand for U.S. agricultural products.

- China’s demand for U.S. soybeans remained robust, and demand for corn and other feed products rose sharply, as the country’s hog sector continued to recover.

- Reduced exportable quantities of corn in Brazil and Ukraine helped boost demand for U.S. grains.

- PRC’s continued application of its process for waiving retaliatory tariffs on U.S. products facilitated strong export growth.

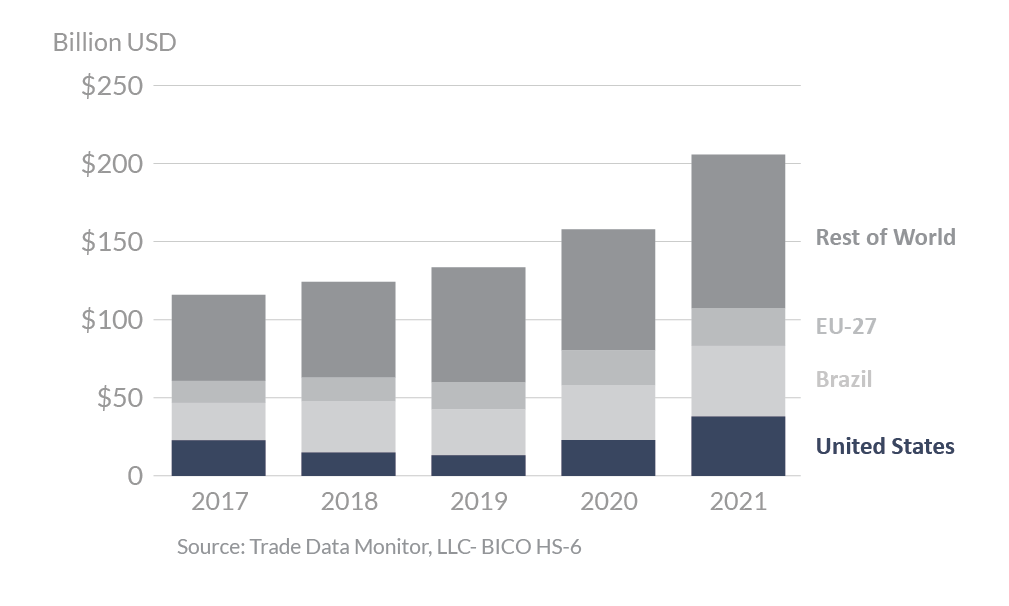

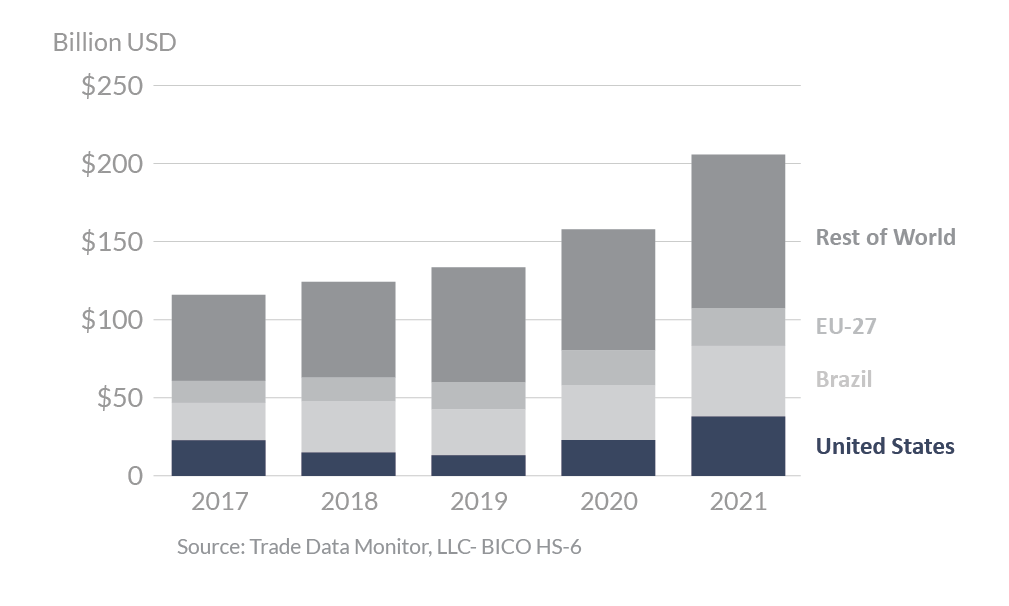

China’s Agricultural Suppliers

Looking Ahead

U.S. exports to China should remain strong in 2022 amid continued demand for imported food and agricultural products. Strong consumer demand coming out of the COVID recession, a return to eating away from home coupled with high commodity prices will keep U.S. export values to China at near record values. The continued recovery of the China’s swine herd from ASF may lead to an increase in exports of U.S. feed products and a decline in exports of U.S. pork and pork products.

Global supplies of grains and oilseeds are tighter than it was in in the previous 4 years with 2021/22 soybean production in Brazil and Argentina down and global ending stocks are the lowest since 2015/16. Corn and wheat markets are also relatively tight compared to the situation prior to the trade war. Tighter markets, coupled with trade restrictions (export controls, etc.) could make it harder for China to find alternative suppliers, although China could draw down stocks to meet market shortfalls, at least in the short term. Given that Brazil does not currently have an approved phytosanitary certificate to export corn to China, and if Ukraine remains out of the market, China will have fewer alternatives to U.S. corn.

The outlook for other commodities also remains strong due certain market access barriers that were resolved under the Phase One Agreement. U.S. exports of beef and poultry are expected to remain strong following Phase One while cotton and hides and skins should benefit from a return to work following the COVID pandemic.