Canada 2021 Export Highlights

Top 10 U.S. Agricultural Exports to Canada(values in million USD) |

|||||||

| Commodity | 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 % Change | 2017-2021 Average |

| Bakery Goods, Cereals, & Pasta | 2,080 | 2,144 | 2,227 | 2,268 | 2,205 | -3% | 2,185 |

| Fresh Vegetables | 1,878 | 1,884 | 1,986 | 1,900 | 1,977 | 4% | 1,925 |

| Fresh Fruit | 1,608 | 1,533 | 1,484 | 1,585 | 1,740 | 10% | 1,590 |

| Food Preparations | 959 | 987 | 1,052 | 1,203 | 1,193 | -1% | 1,079 |

| Non-Alcoholic Beverages* | 1,296 | 1,277 | 1,213 | 1,191 | 1,175 | -1% | 1,230 |

| Ethanol (non-beverage) | 621 | 590 | 573 | 594 | 1,021 | 72% | 680 |

| Dog & Cat Food | 640 | 645 | 751 | 837 | 976 | 17% | 770 |

| Pork & Pork Products | 793 | 765 | 802 | 854 | 952 | 12% | 833 |

| Dairy Products | 699 | 700 | 728 | 736 | 851 | 16% | 743 |

| Chocolate & Cocoa Products | 748 | 713 | 713 | 757 | 806 | 6% | 747 |

| All Others | 10,422 | 10,765 | 10,417 | 10,352 | 12,154 | 17% | 10,822 |

| Total Exported | 21,744 | 22,001 | 21,944 | 22,277 | 25,049 | 12% | 22,603 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

*Excludes fruit juices

Highlights

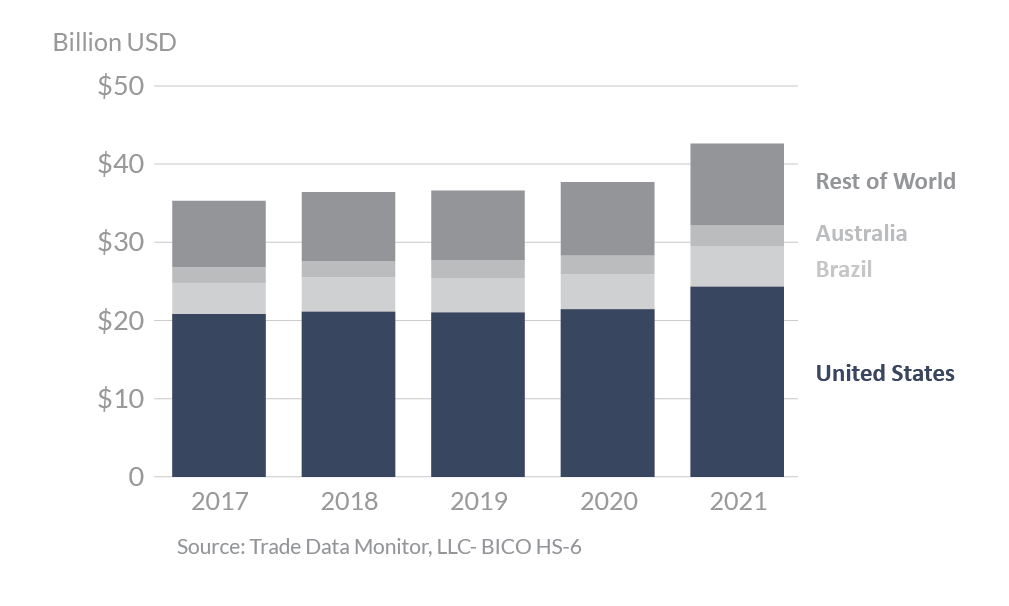

In 2021, Canada was the third-largest export destination for U.S. agricultural products, with agricultural exports totaling more than $25 billion, a 12-percent increase over 2020. The United States is Canada’s top supplier of agricultural goods with a market share of 58 percent. Mexico is the second-largest supplier of agricultural products to Canada, with a seven-percent market share. Exports of ethanol to Canada saw the largest year-to-year increase by value, with sales increasing by $427 million, a 72-percent increase over 2020. However, most of the increase in ethanol export value was price driven, as export quantity increased by only 12 percent. Exports of fresh fruit to Canada were also strong with total shipments increasing from $1.5 billion to more than $1.7 billion in 2021. Exports of dog and cat food also increased significantly from $790 million to $976 million, an increase of 17 percent. While bakery goods, cereals, pasta remain the top exported group of agricultural products to Canada, sales declined slightly from $2.3 billion in 2020 to $2.2 billion in 2021. Canada is the largest export market for an array of processed foods, as well as fresh fruit and vegetables, and often ethanol blended in gasoline.

Drivers

- Canada’s economy bounced back from the 2020 pandemic-driven downswing to post record GDP more than $2 trillion in 2021, as real GDP grew by 5.7 percent. Real GDP is expected to continue to grow in 2022 by 4.9 percent, which will support food import demand.

- Exports of fresh fruits and vegetables increased both in value and volume, indicating consumer demand growth, rather than a price-driven increase lifting export values.

- While remaining top agricultural exports to Canada, processed foods such as bakery goods and food preparations saw declines in both value and volume. Coupled with the increases in exports of fresh fruits and vegetables, the export declines may indicate a consumer demand shift away from processed products.

- Pork and pork product exports were up 12 percent by value, but volumes fell 3 percent in 2021.

- Ethanol shipment value rose mainly on higher prices as ethanol unit values rose in line with gasoline prices throughout 2021 recovering from lows of the previous year. Volume too was up as fuel demand recovery took hold.

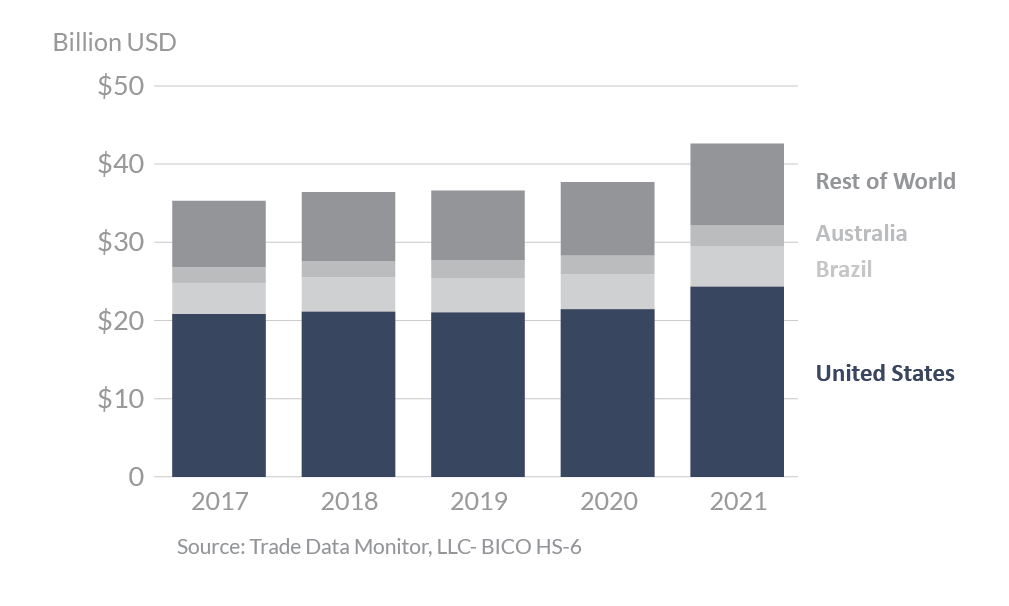

Canada’s Agricultural Suppliers

Looking Ahead

On July 1, 2020, the U.S. - Mexico - Canada Agreement (USMCA) entered into force, strengthening the longstanding integrated trade relationship across North America. USMCA maintains the zero tariffs between the three countries that were in place under the North American Free Trade Agreement and provides new market access for a range of U.S. dairy and poultry products through tariff-rate quotas (TRQs).

On May 25, 2021, the Office of the U.S. Trade Representative requested a USMCA dispute settlement panel on Canada’s allocation of its dairy TRQs. On January 4, 2022, the panel’s Final Report was released to the public. The panel agreed with the United States that Canada is breaching its USMCA commitments by reserving most of the in-quota quantity in its dairy TRQs for the exclusive use of Canadian processors.

Several factors will influence U.S. agricultural exports to Canada in the coming year. U.S. agricultural exports would stand to benefit from continued economic recovery in Canada following the effects of 2 years of pandemic. Related uncertainties include whether consumers will return to pre-pandemic consumption patterns following COVID-19 and the possibility of continued high inflation. In addition, there is hope for supply chain normalization. In 2021, shipping container scarcity, weather events that damaged critical transportation networks, a shortage of truckers, and pandemic-related labor challenges together disrupted the movement of agricultural products. Canadian regulatory developments in a range of areas bear watching over the medium term as they may shape market opportunities and/or access for U.S. agricultural and food products.

In recent years, Canada has implemented free trade agreements with other agricultural exporting blocs: the eleven-nation Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Comprehensive Economic and Trade Agreement with the EU. Canada is in the process of implementing a Canada-United Kingdom Trade Continuity Agreement following the UK’s exit from the EU. In parallel, Canada and the UK are negotiating a comprehensive free trade agreement. Though Canada is a mature market with modest economic growth and low population growth, there remains significant export growth potential in Quebec, a regional economy the size of the Philippines, where U.S. products are underrepresented.